Nikkei Futures (NKD) reach historic highs, extending bullish rally [Video]

![Nikkei Futures (NKD) reach historic highs, extending bullish rally [Video]](https://editorial.fxsstatic.com/images/i/Equity-Index_NIKKEI-2_XtraLarge.jpg)

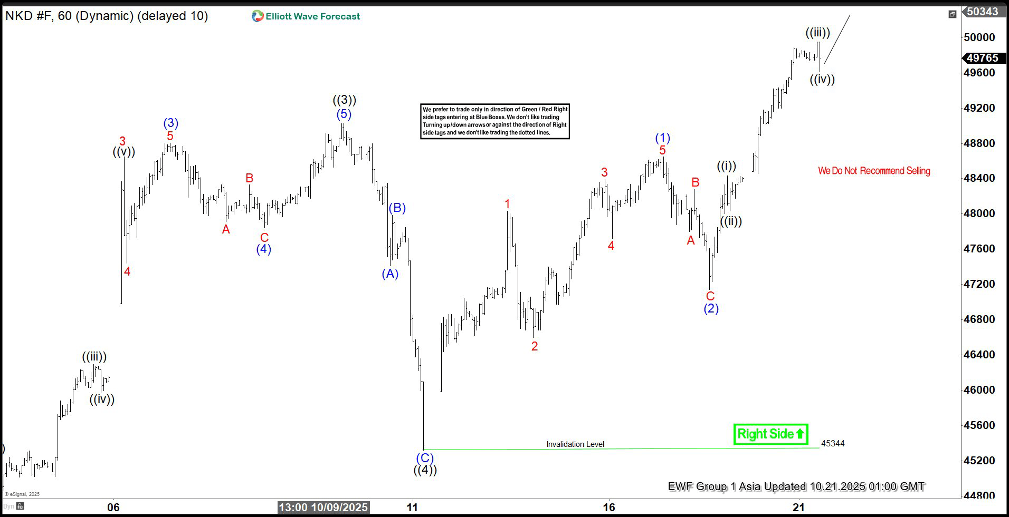

The short-term Elliott Wave analysis for Nikkei Futures (NKD) indicates a robust bullish trend, with the Index recently achieving a new all-time high. The rally to 49,030 marked the completion of wave ((3)), followed by a pullback to 45,344, which concluded wave ((4)). The internal structure of wave ((4)) developed as a zigzag Elliott Wave pattern. From the peak of wave ((3)), wave (A) declined to 47,410, followed by a wave (B) rally to 47,985. The Index then extended lower in wave (C), reaching 45,344, finalizing wave ((4)) in the larger degree.

The Index has since resumed its upward trajectory in wave ((5)). From the wave ((4)) low, wave 1 advanced to 48,030, with a subsequent wave 2 pullback concluding at 46,600. The Index then surged in wave 3 to 48,390, followed by a wave 4 dip to 47,720. The final leg, wave 5, reached 48,650, completing wave (1). A corrective wave (2) followed, ending at 47,145 in a zigzag structure. The Index has now resumed its ascent within wave (3). In the near term, as long as the pivot low at 45,344 holds, expect pullbacks to attract buyers in 3, 7, or 11 swings, supporting further upside in the Nikkei Futures.

Nikkei (NKD) latest 1-hour Elliott Wave chart from 10.21.2025

NKD Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com