Nikkei futures (NKD) looking to extend higher as an impulse [Video]

![Nikkei futures (NKD) looking to extend higher as an impulse [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Nikkei/nikkei-225-index-17329557_XtraLarge.jpg)

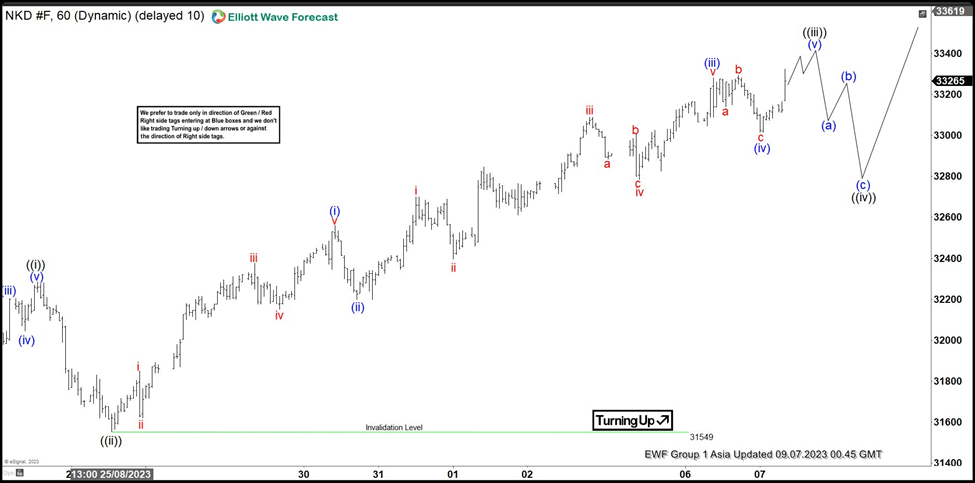

Short term Elliott Wave view in Nikkei Futures (NKD) suggests the Index rallies as a 5 waves impulse structure from August 18, 2023 low. Up from August 18, wave ((i)) ended at 32285 and pullback in wave ((ii)) ended at 31555 as the 1 hour chart below shows. Up from wave ((ii)), wave i ended at 31850 and dips in wave ii ended at 31620. Index resumed higher in wave (iii) towards 32375 and wave iv ended at 32150. Final leg wave v ended at 32560. This completed wave (i) in higher degree.

Pullback in wave (ii) ended at 32200 and the Index then resumed higher in wave (iii) towards 33280. Dips in wave (iv) ended at 33015 as expanded flat. Expect the Index to end wave (v) of ((iii)) soon. Afterwards, it should pullback in wave ((iv)) to correct cycle from August 25 low before the rally resumes. Typically wave ((iv)) should pullback somewhere around 23.6 – 38.2 Fibonacci retracement of wave ((iii)). Near term, as far as pivot at 31549 low stays intact, expect wave ((iv)) pullback to find support in 3, 7, 11 swing for more upside in wave ((v)).

Nikkei futures (NKD) 60 minutes Elliott Wave chart

Nikkei Elliott Wave video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com