NFLX: Found buyers from blue box area

in this article we will analyze our forecast for NFLX in the short term cycle. Since the short term peak of NFLX from 05.12.2023 to end wave 3 we have been expecting a pullback within wave 4 to take place. Here at Elliott Wave Forecast we have in place a system that allows us to measure an area in which we can expect a react to take place.

We call it equal legs area or blue box area as you might have seen within our charts. These areas provide us with at least an 85% chance of a minimum of 3 waves bounce or reaction to take place. We can use these areas to enter in the market with a defined entry, Stop Loss and exit strategy.

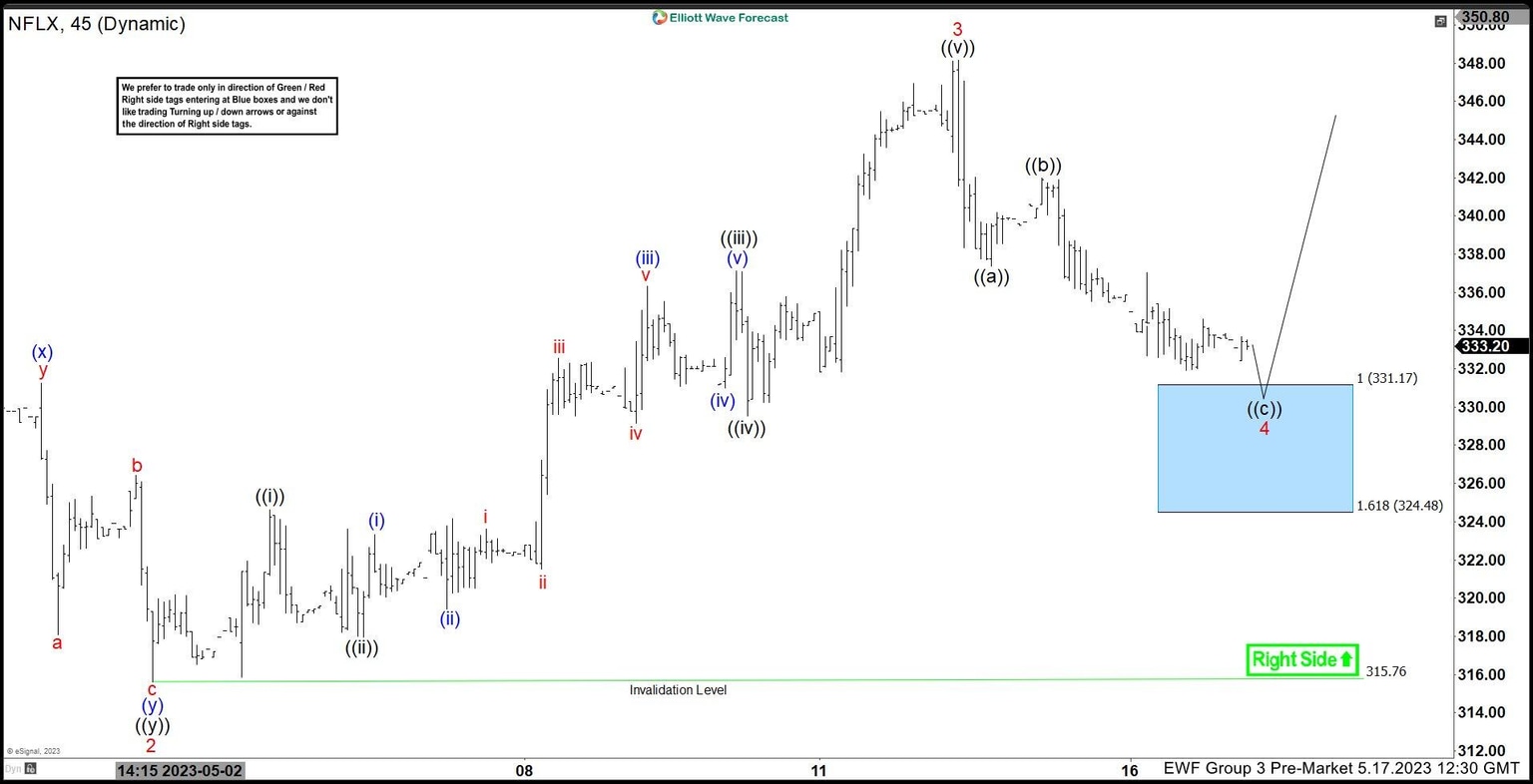

We teach how to use our system within our member’s area and live trading room. Once a member or in trial you will be able to gather more of that information under your disposal. Nevertheless, let’s have a look now on the 45 mins chart of NFLX as provided to members from 05.17.2023. We have been expecting little more downside to reach the blue box area before turning higher.

NFLX 45 min chart pre market update 05.17.2023

As we can see the market was marginally above within blue box area of 331.17 – 324.48 and we have been expecting a dip to reach the area. We recommend members to always buy from the 100% extension area with a stop loss just below the 1.618 area. Fast forward, towards the post market update now from 05.19.2023, we will see that the market has already reacted higher and what we expect next.

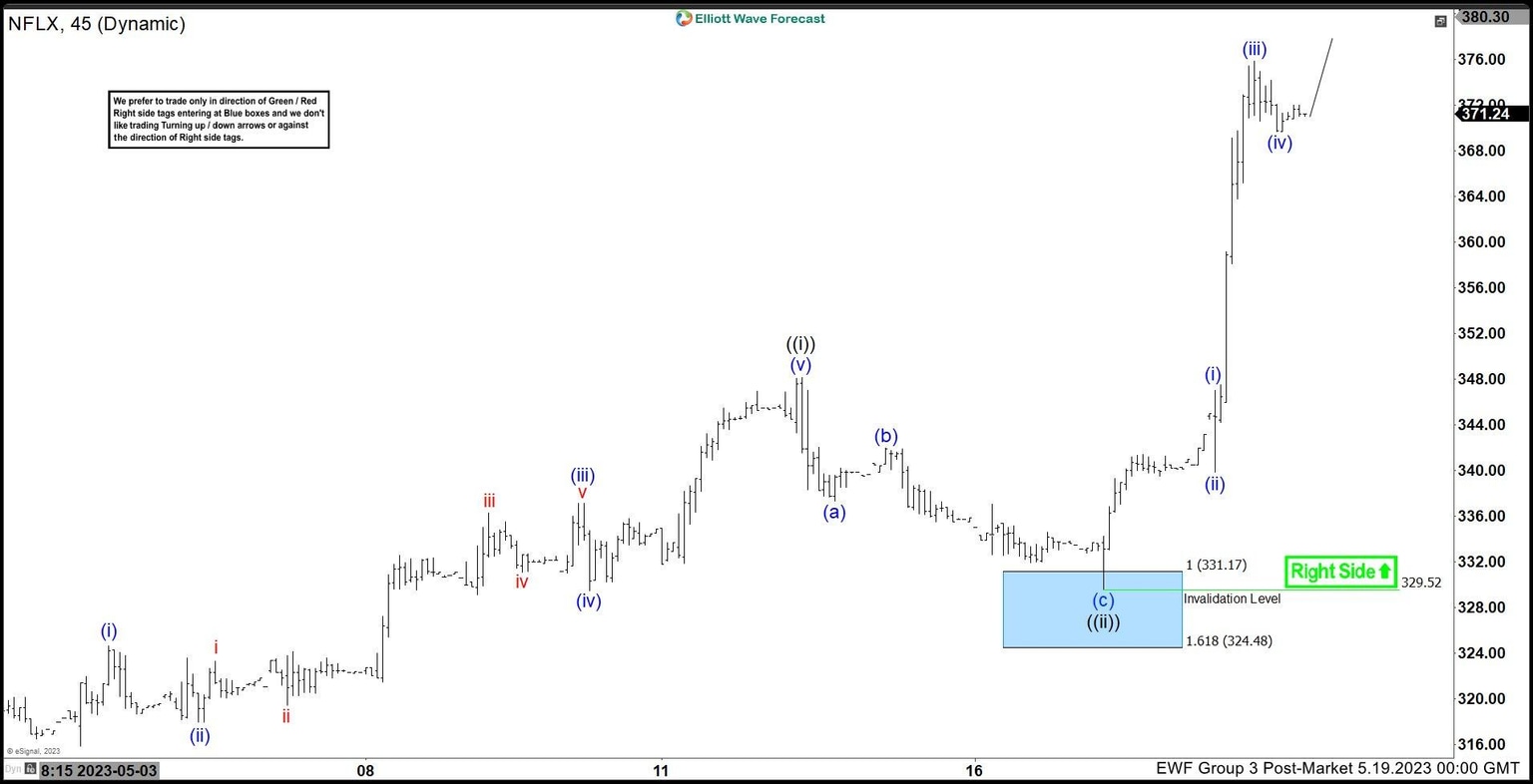

NFLX 45 min chart post market update 05.19.2023

A very clear reaction higher took place from 329.52 inside the blue box area. The reaction higher as an impulse within wave (iii) of ((iii)). After wave (iv) expecting one more high in (v) to end ((iii)) before a pullback in ((iv)). We have switched the view to the more aggressive one. You can learn more once become a member at Elliott Wave Forecast. Join us to learn the next trading opportunities in Netflix and other Stocks or ETFs. Belongs to our Group 3 of instruments.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com