Newmont Mining (NEM) Elliott Wave outlook: Impulsive rally building momentum

Newmont Mining (NEM) is the world’s largest gold producer, with a diversified portfolio of mines and projects spanning North America, South America, Australia, and Africa. Founded in 1921 and headquartered in Denver, Colorado, the company plays a central role in the global precious metals market, offering investors exposure to gold and other resources through its scale, operational expertise, and long-standing industry presence. This article looks at the Elliott Wave Outlook for the stock.

Newmont monthly Elliott Wave chart

Newmont Mining (NEM) is in the midst of a strong bullish advance, highlighted by its monthly Elliott Wave structure. The chart points toward a breakout that should carry the stock to new record highs. Back in September 2000, NEM completed wave ((II)) of the Grand Super Cycle at $12.75, laying the foundation for a powerful nested impulse. From there, wave (I) climbed to $62.72 before wave (II) retraced to $15.39. The current wave (III) is unfolding, with wave I peaking at $86.37 and wave II correcting down to $29.42. Provided the stock holds above the $15.39 threshold, the upward trajectory remains intact, suggesting further strength ahead.

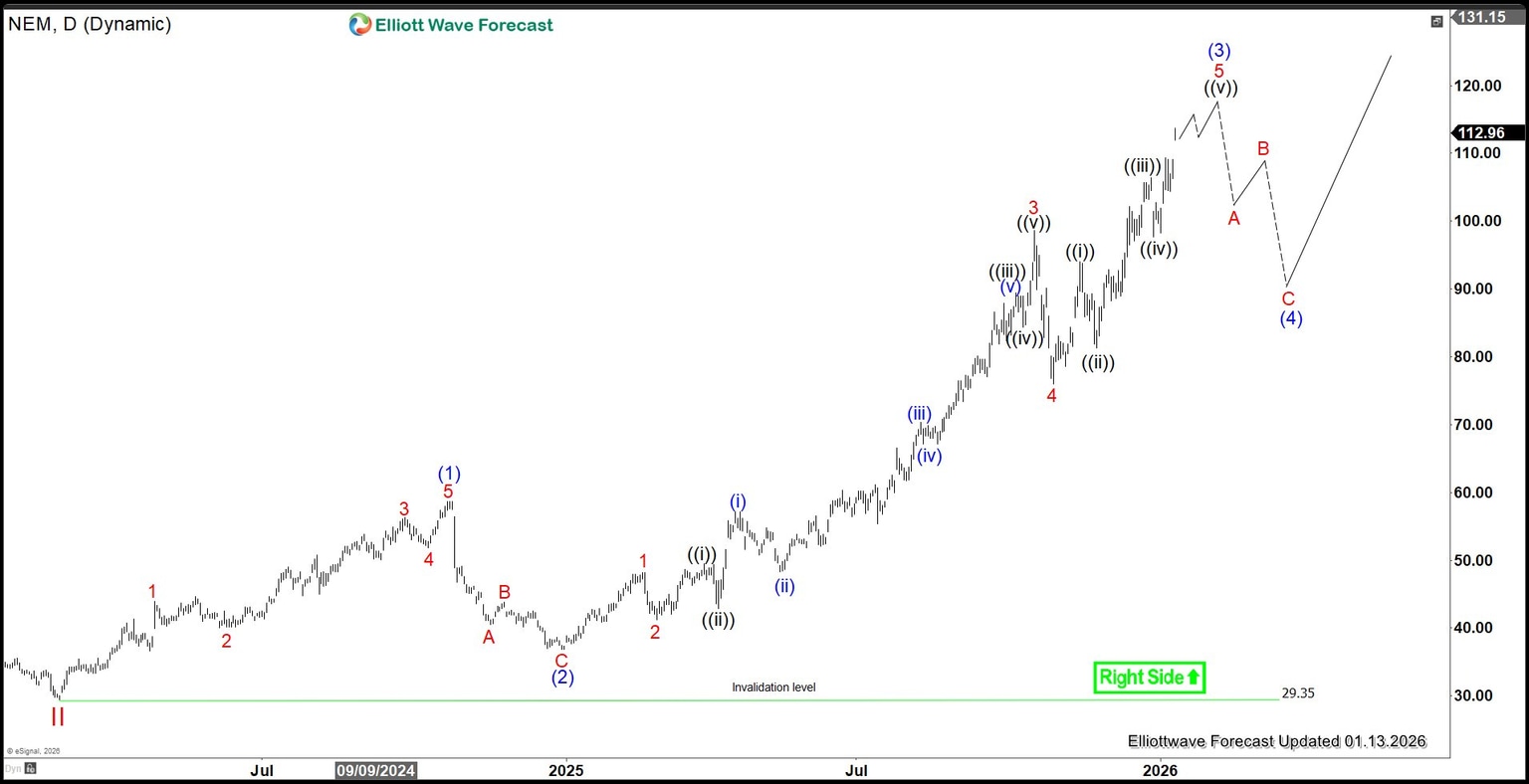

Newmont daily Elliott Wave chart

The daily Elliott Wave outlook for Newmont Mining (NEM) highlights a clear sequence in its price action. After completing the wave II correction at $29.03, the stock has shifted into wave III, marking a renewed bullish phase. From that low, wave (1) carried prices up to $58.72, before wave (2) pulled back to $36.86. Wave (3) is now unfolding and appears close to completion. Wave (4) consolidation should happen soon before the next leg higher. As long as the $29.03 support remains intact, NEM retains strong potential to extend its advance within wave III.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com