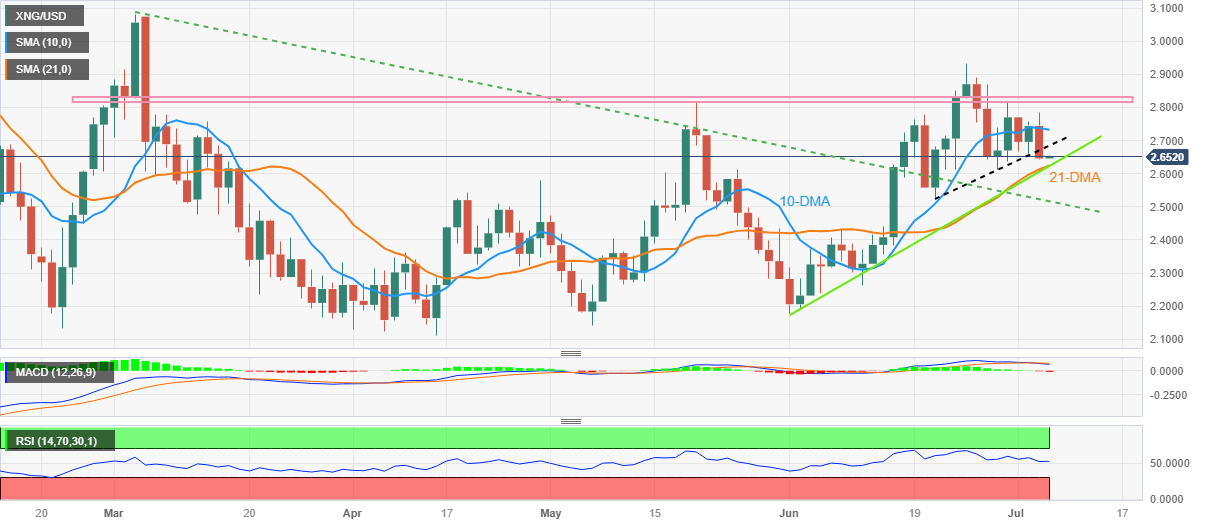

Natural Gas Price Analysis: XNG/USD bears need to break $2.62 for conviction

- Natural Gas Price stays depressed at weekly low after breaking fortnight-old support line.

- Convergence of 21-DMA, ascending trend line from early June challenges XNG/USD sellers.

- Bearish MACD signals, U-turn from 10-DMA and near 50.0 RSI suggest further downside of the Natural Gas Price.

- Multiple hurdles stand tall to challenge XNG/USD rebound.

Natural Gas Price (XNG/USD) remains pressured at a weekly low despite making rounds to $2.65 during the early hours of Thursday’s Asian session.

The XNG/USD Price refreshed its weekly bottom after breaking a two-week-old rising support line, now immediate resistance around $2.68. In doing so, the energy instrument not only reversed from the 10-DMA but also marked the biggest daily loss in a week.

In addition to the trend line break, the bearish MACD signal and the near 50.0 conditions of the RSI (14) line, also keep the Natural Gas bears hopeful.

However, a convergence of the 21-DMA and an upward-sloping trend line from June 01 challenges the XNG/USD bears around $2.62, a break of which won’t hesitate to drag the quote toward a four-month-old previous resistance line, close to $2.51 at the latest.

It should be noted that the Natural Gas bear’s dominance past $2.51 will offer a free hand to sellers trying to revisit the early June swing high of around $2.43.

Alternatively, an upside break of the support-turned-resistance line, near $2.68 by the press time, will need validation from the 10-DMA hurdle of around $2.73 to convince the Natural Gas buyers.

Even so, a horizontal area comprising multiple levels marked since early March, between $2.81 and $2.83, appears a tough nut to crack for the XNG/USD bulls before retaking control.

Natural Gas Price: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.