Natural Gas Futures: Rally remains unabated

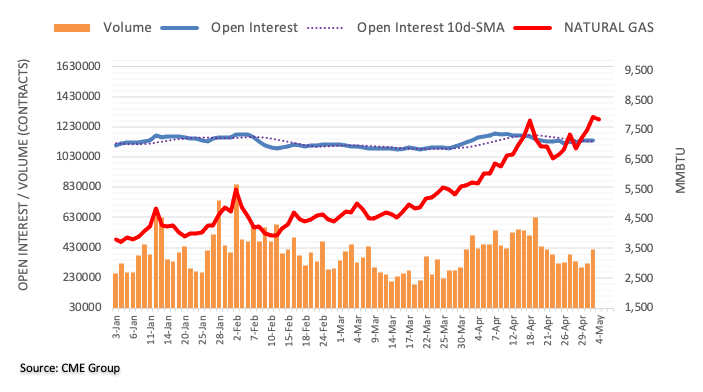

Considering preliminary figures from CME Group for natural gas futures markets, open interest rose by more than 1K contracts on Tuesday, while volume followed suit and rose for the second straight session, this time by around 91.2K contracts.

Natural Gas remains focused on $8.30

Prices of natural gas edged higher and clinched new 13-year highs past the $8.00 mark per MMBtu on Tuesday, although they closed below this level. The move was against the backdrop of increasing open interest and volume, allowing for the continuation of the uptrend in the very near term and with the next target at the $8.30 region, or September 2018 highs.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.