Natural Gas Futures: Downside looks limited

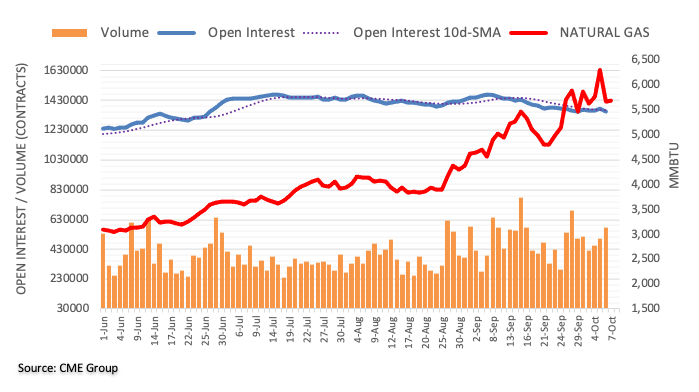

In light of advanced prints from CME Group for natural gas futures markets, open interest dropped by almost 25K contracts on Wednesday following two daily builds in a row. On the other hand, volume advanced for the third consecutive session, this time by around 70.5K contracts.

Natural Gas: Initial contention emerges around $5.60

Prices of natural gas dropped more than 10% on Wednesday soon after recording new 2021 highs near $6.50 per MMBtu. The sharp drop, however, was amidst shrinking open interest, hinting at the view that a sustainable downtrend remains out of favour for the time being. That said, the commodity faces some initial contention in the $5.65/60 band per MMBtu (mid-September tops).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.