XRP consolidates at $1.60 as sentiment weakens while ETF inflows return

- XRP consolidates around $1.60 on Wednesday as weak sentiment caps upside potential.

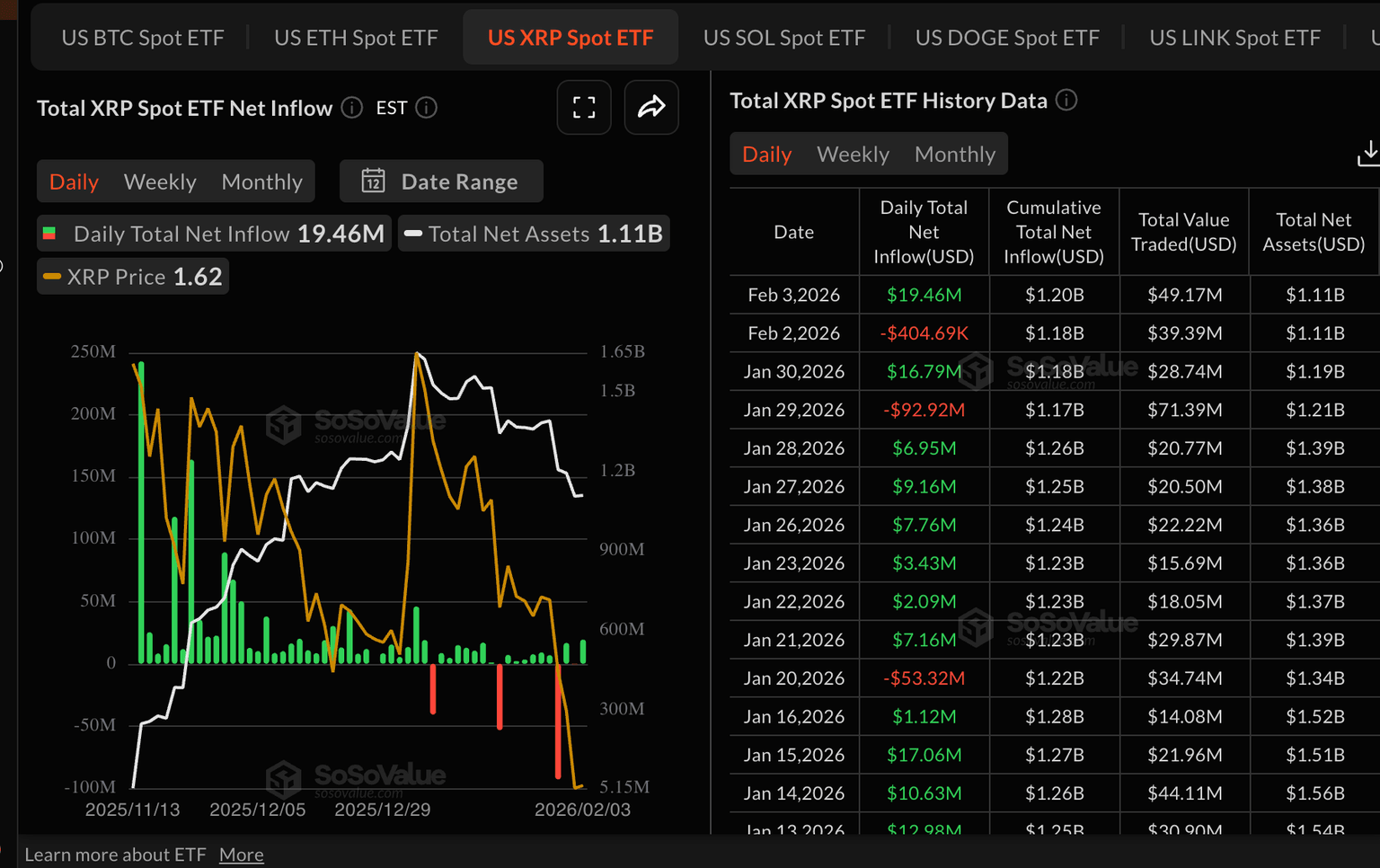

- XRP ETF inflows resume after a brief pause, signaling renewed institutional interest.

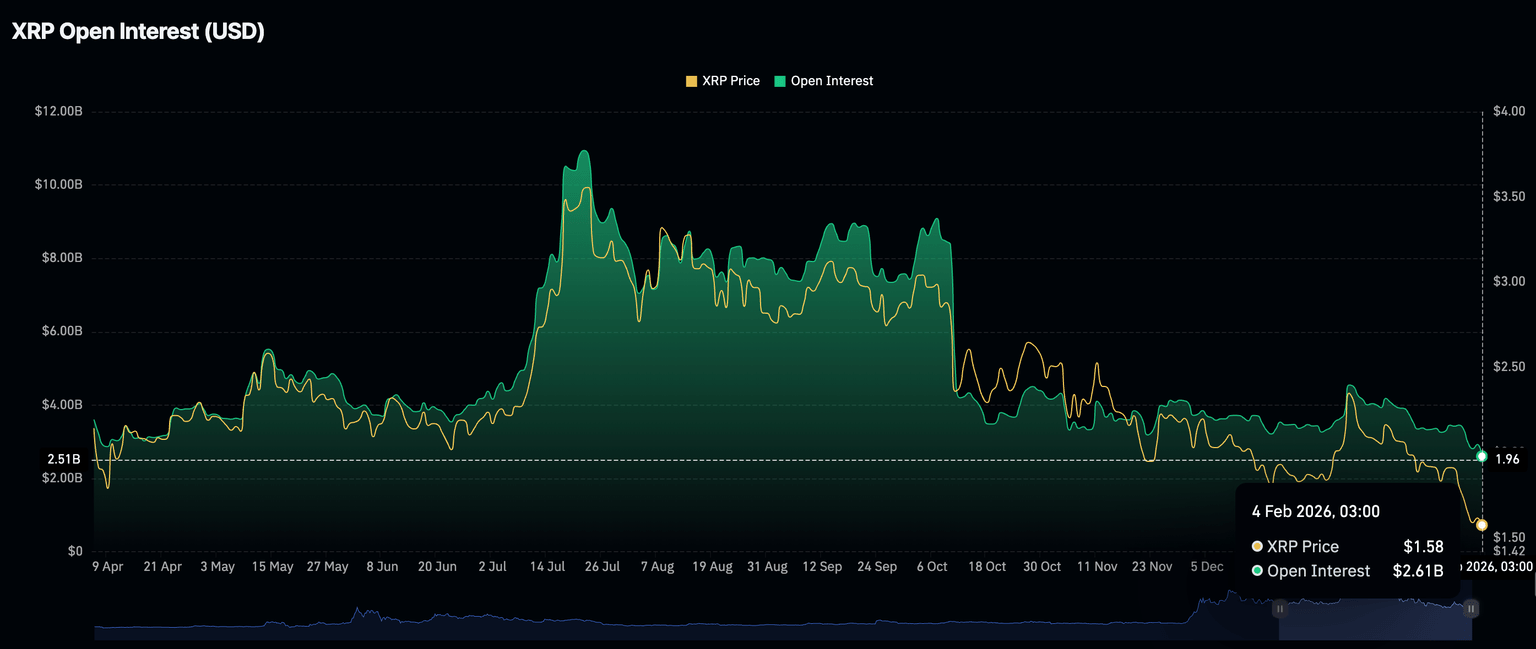

- The XRP derivatives market remains weak as traders close positions, driving futures open interest down to $2.61 billion.

Ripple (XRP) hovers around the $1.60 pivotal level at the time of writing on Wednesday, reflecting stable but weak sentiment across the crypto market. Intense volatility triggered a brief sell-off on Tuesday, driving the remittance token to pick up liquidity at $1.53 before recovering to the current level.

Inflows into spot Exchange-Traded Funds (ETFs) signal institutional interest. However, a weak derivatives market suggests that XRP may lack the required buying pressure to sustain recovery in the short to medium term.

XRP wobbles as retail escapes volatility

The XRP derivatives market weakens further as futures Open Interest (OI) drops to $2.61 billion on Wednesday from $2.93 billion the previous day. CoinGlass data shows that OI, which tracks the notional value of standing futures contracts, has continued to trend lower from $4.55 billion on January 6 and $8.36 billion on October 10, pointing to a sustained decline in retail interest in the token.

A persistent decline in OI adds to selling pressure, as traders increasingly close positions rather than open new ones. Conversely, OI expansion would support a bullish outlook in XRP amid improving market sentiment.

OI surged to a record $10.94 billion on July 22 after XRP hit a new all-time high at $3.66 on July 18, emphasising the need for steady retail interest.

US-listed XRP spot ETFs mirrored the volatility in the crypto market, attracting approximately $19 million in inflows on Tuesday after mild outflows of $405,000 on Monday. The resurgence points to renewed institutional interest, bringing the cumulative inflow to $1.2 billion and net assets under management to $1.11 billion.

Extending the inflow streak in the coming days could improve risk-on sentiment and increase the odds of XRP rising above key supply zones at $1.65 and $1.77.

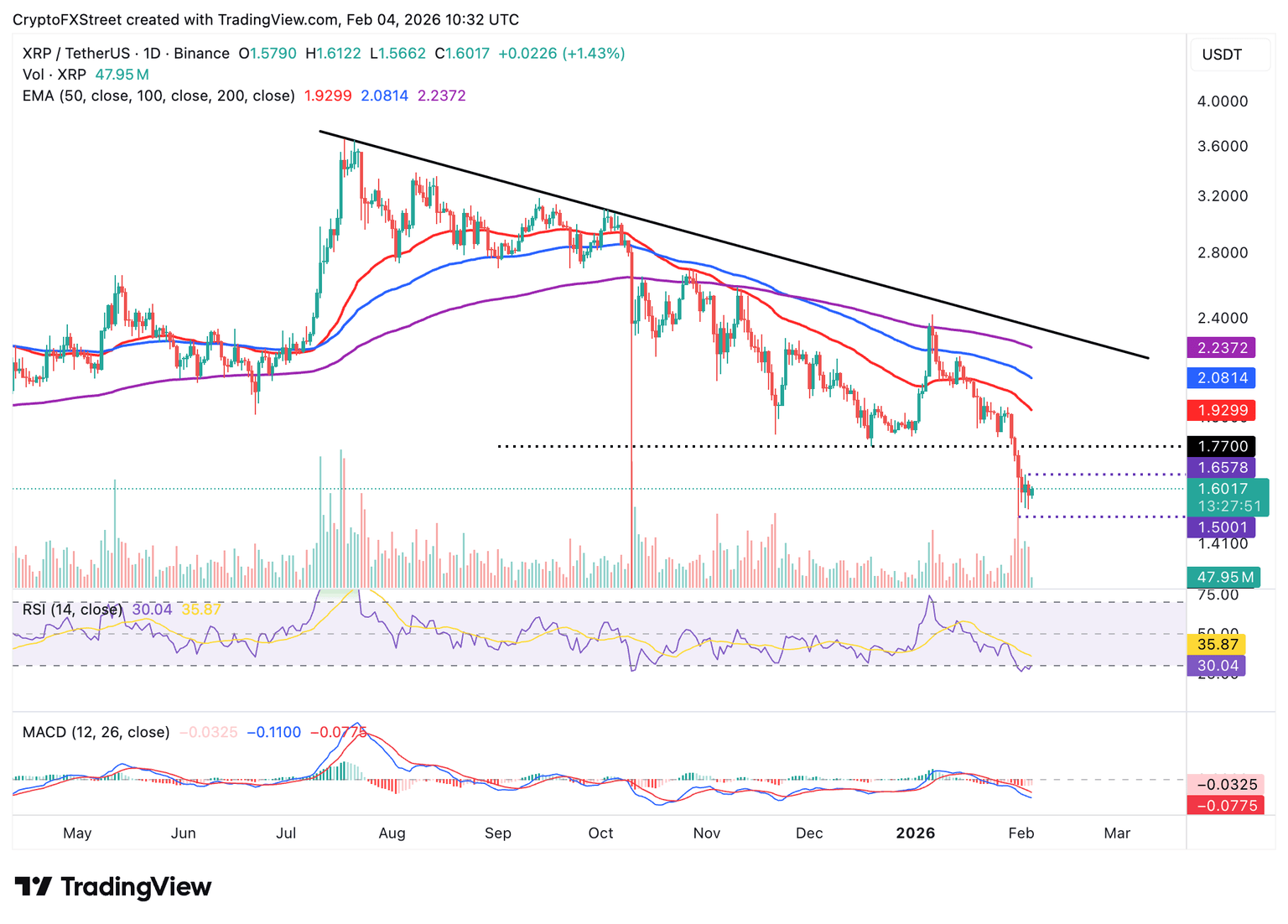

Technical outlook: XRP outlook hinges on key indicators

XRP exhibits subtle recovery signals as the Relative Strength Index (RSI) rises to 30, slightly above the oversold region, on the daily chart. A further increase in the RSI toward the midline would indicate that bearish momentum is easing and pave the way for a steady rebound.

Short-term targets include $1.66, tested on Monday, and $1.77, which was tested as support on December 19.

Still, XRP is not out of the woods yet, especially with the Moving Average Convergence Divergence (MACD) indicator extending its decline below the signal line on the same chart. Despite the histogram bars contracting, they remain below the zero line, a picture that may prompt investors to reduce risk exposure.

Closing below the pivotal $1.60 level may accelerate the downtrend to test Tuesday’s low at $1.53 and Saturday’s support at $1.50.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren