Natural Gas jumps to session's high after US Opening Bell

- Natural Gas price rallies on Monday despite bearish headlines.

- US Gas storages are near full with California already ahead of next heating season.

- The US Dollar Index fully recovers from early decline after Yen intervention.

Natural Gas (XNG/USD) prices are ticking up above $2 on Monday, showing a distorted picture of fundamentals against correlations. Fundamentally, Gas prices are expected to retreat a little with news that points to higher supply and lower demand, a textbook combination for lower prices. On the demand side, Europe is about to face a warm weather front, slashing the demand for Gas in the continent. Adding to this, more supply is likely coming online as the US Freeport Liquified Natural Gas (LNG) plant overcomes some of its technical problems, which have weighed on production for the last few months.

Meanwhile, the US Dollar Index (DXY) is erasing

Natural Gas is trading at $2.06 per MMBtu at the time of writing.

Natural Gas news and market movers: Ahead of plan

- Gas reservoirs in California are almost full ahead of schedule in restocking for the next heating season.

- Bloomberg reports that The Freeport LNG export plant in Texas has restarted one of its production trains, according to traders in the commodity.

- BP has signed a deal with Korea Gas Corporation to deliver 9.8 million tons of LNG over 11 years.

- European Natural Gas prices are extending their decline as a warmer weather front moves in for this week and the next.

- German Gas storages are still at 67% full, while reserves for overall Europe are at 62%.

- BloombergNEF has released its estimate delivery table for US Natural Gas imports. The table points to a net export for all major ports in the US, confirming that the US is still a net-exporter of LNG.

Natural Gas Technical Analysis: Who wants to buy?

Natural Gas is bound to ease a little with flows from the US Freeport plant coming back online, adding to US export volumes, which were tighter these past few weeks. Meanwhile, Europe will see its reserves holding up this week with a warm front coming in. This should at least open some room for a bit of easing in Gas prices, which is already taking place in the European Gas market, while the US market needs to catch up.

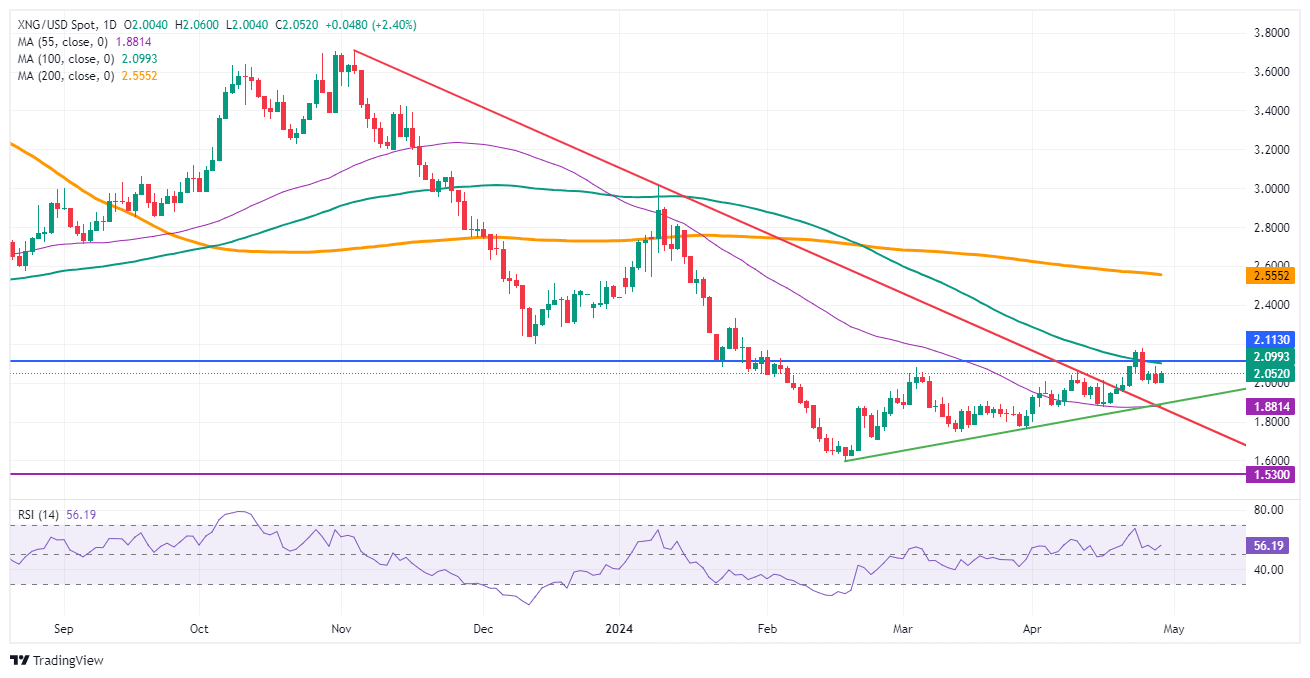

On the upside, the blue line at $2.11, the 2023 low, and the 100-day Simple Moving Average (SMA) at $2.10 are acting as a resistance. Further up, the next level to watch is the January 25 high at $2.33.

On the other side, the $2.00 handle has worked as nearby support for now. Further down, a trifecta of support is formed at $1.88, with the ascending and descending trend lines crossing and the 55-day SMA. Should that level break, expect a quick downward movement to the year-to-date low at $1.60.

Natural Gas: Daily Chart

Natural Gas FAQs

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.