Nasdaq surges as big tech recovers — Is a new all-time high coming?

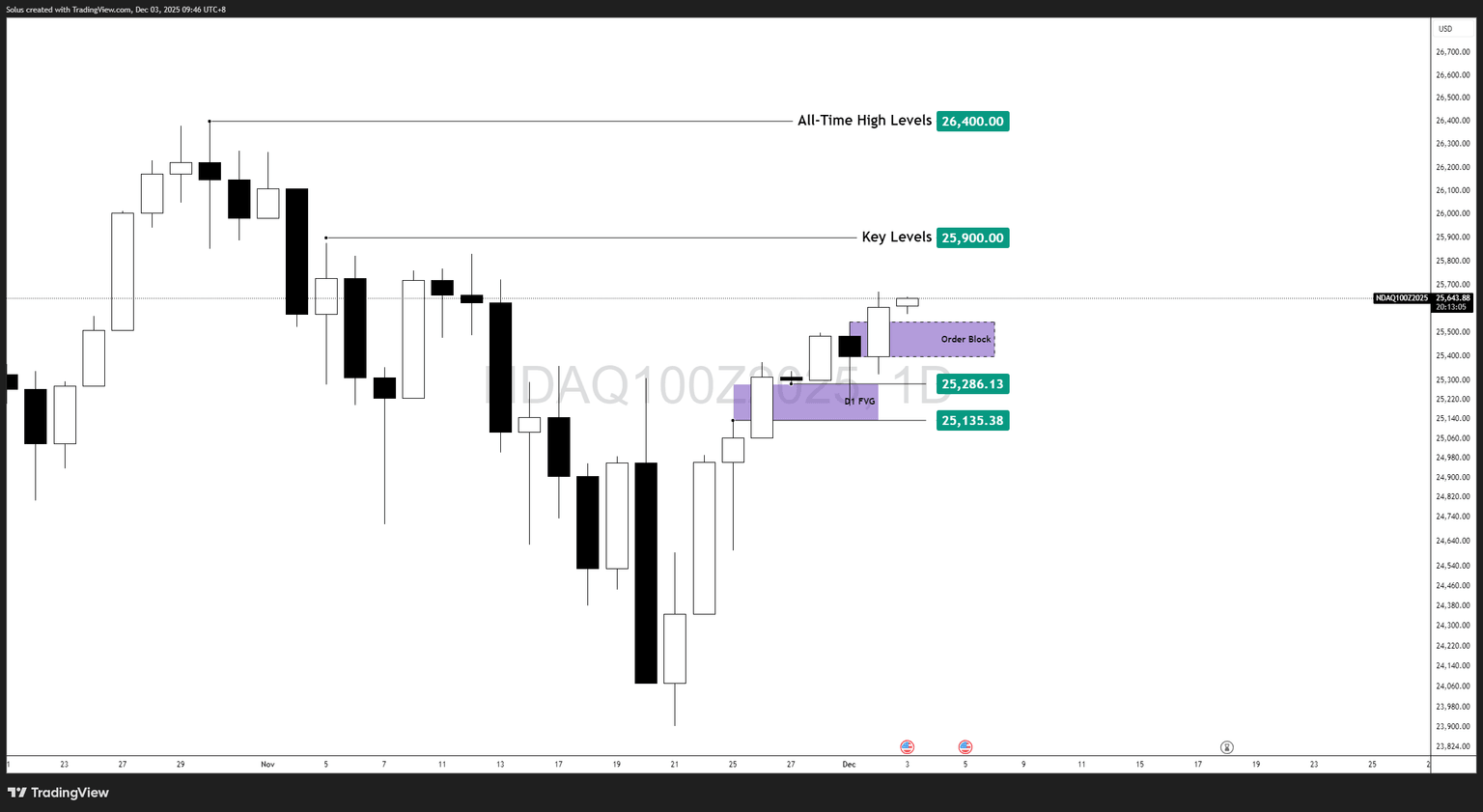

- Nasdaq rallies strongly after a clean rebound from the Daily Fair Value Gap, riding renewed Big Tech strength.

- Institutional demand, tech-sector resilience, and a leadership surge from a major AI heavyweight push momentum higher.

- As long as the 4H Order Block holds, Nasdaq’s path toward 25,900 and potentially 26,400 (ATH) remains open.

Nasdaq extends its climb after a textbook daily FVG rebound

The Nasdaq’s recent upswing started precisely where high-timeframe buyers were expected to defend: the Daily Fair Value Gap. This demand pocket served as a springboard, kicking off a fresh bullish impulse that sent the index sharply higher.

Rather than breaking down, Nasdaq respected the inefficiency beautifully - a sign that institutions are still accumulating rather than distributing. The rebound was not a weak drift upward but a clear, impulsive reaction signaling renewed bullish control.

This type of HTF confirmation often precedes deeper continuation moves, especially when macro conditions and sector flows align.

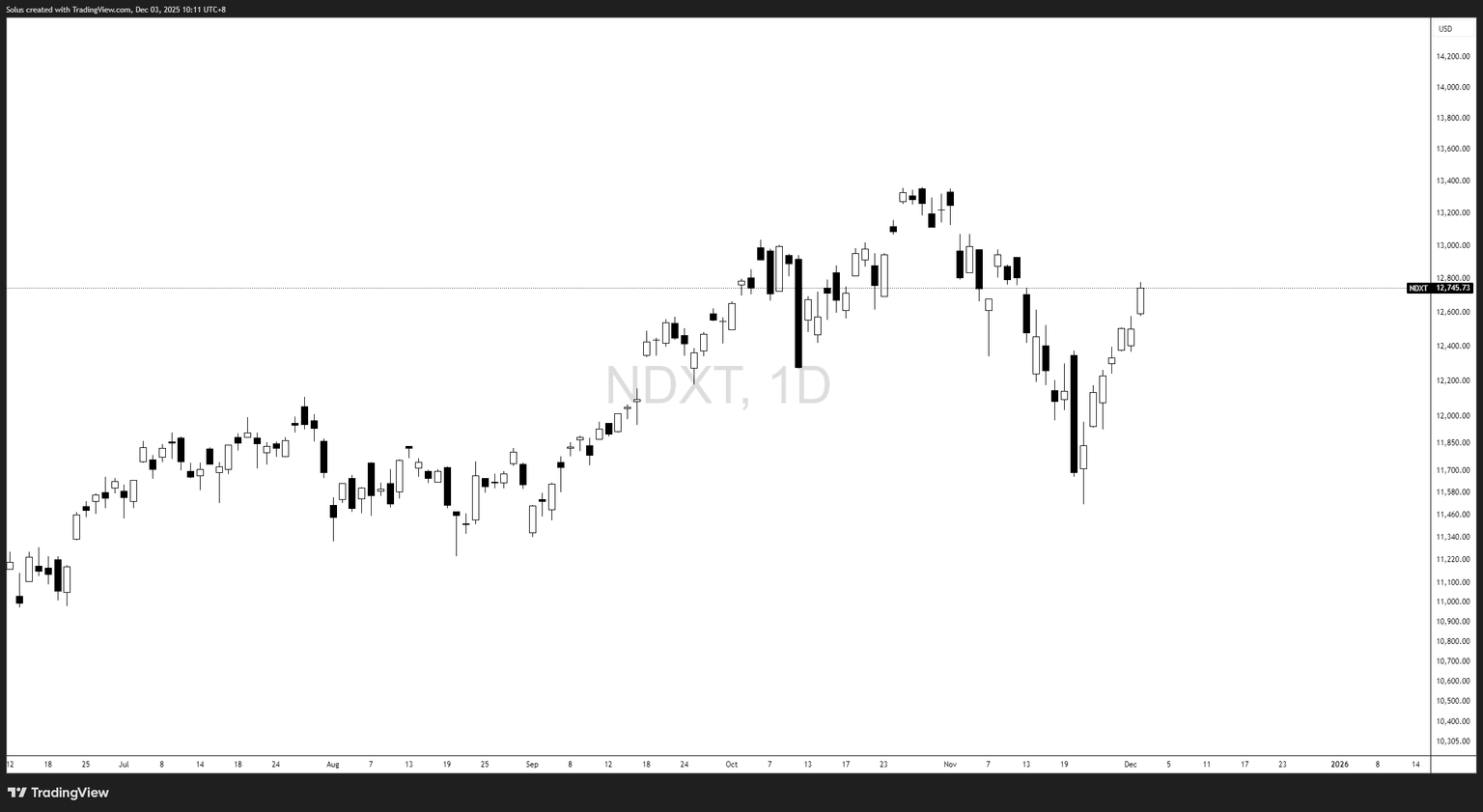

Big tech’s comeback is fueling the Nasdaq

Even outside technicals, Nasdaq’s strength is rooted in a broader narrative: large-cap tech is heating up again.

A leading stock is pulling the tech sector upward

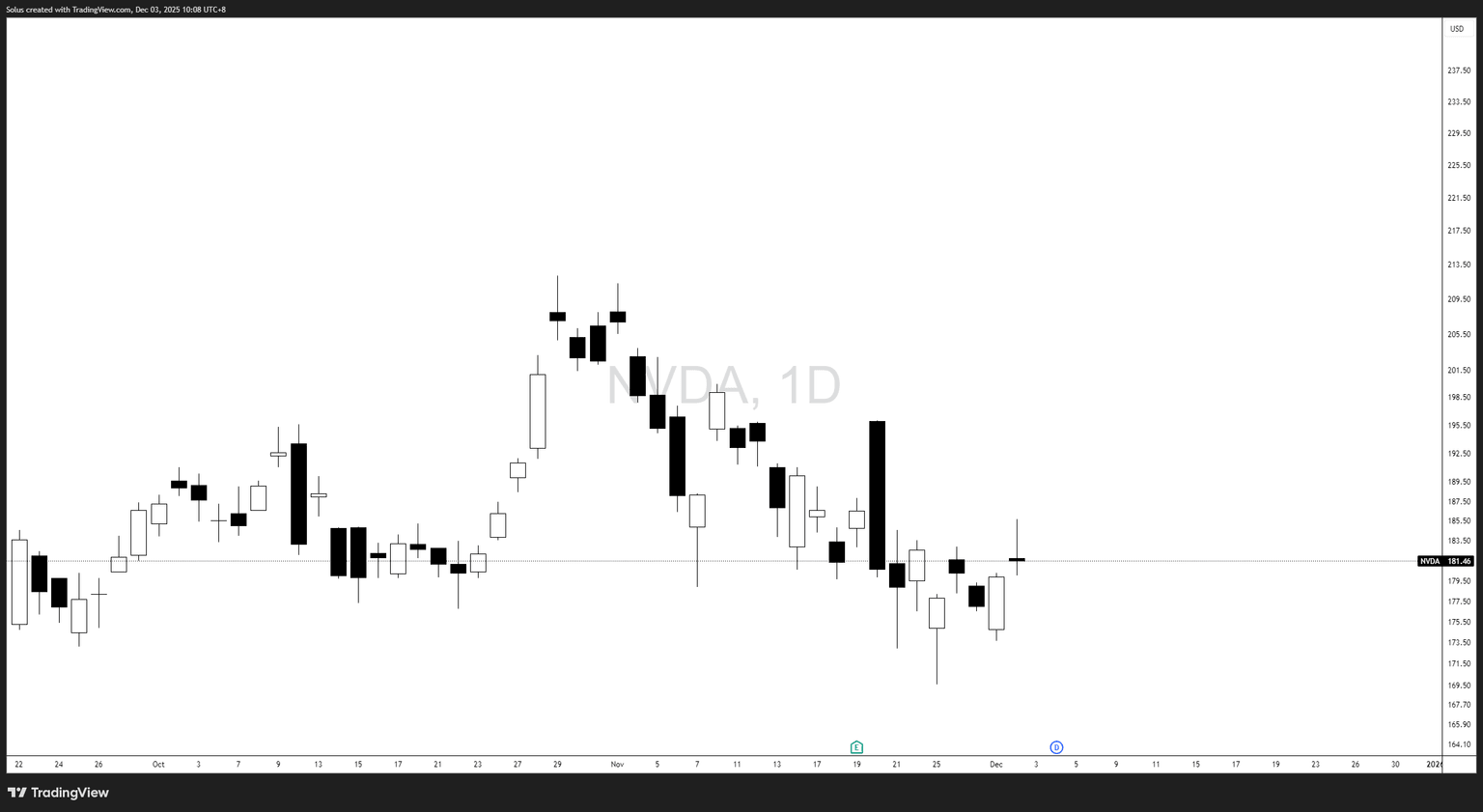

Among the giants, NVIDIA has been the clear standout. Its recent resurgence - driven by AI demand, stronger-than-expected data center revenue, and bullish forward guidance - has re-ignited the entire technology sector.

NVIDIA’s aggressive rebound has:

- boosted risk sentiment in semiconductors,

- pulled AI-related names back into momentum,

- and renewed confidence in the sustainability of the broader tech rally.

When a major sector leader fires up, money follows - and indices like the Nasdaq benefit almost immediately. This leadership rotation is one of the strongest signals that the rally isn't built on weak footing.

Risk-on tone is returning - And it’s lifting the Nasdaq

The broader macro landscape is shifting toward “risk-on,” anchored by four fundamental drivers:

- Expectations of easing financial conditions in the coming months

- Heavy institutional flows back into growth and innovation sectors

- Strong earnings and AI-driven guidance from top tech names

- Stabilizing yields that reduce pressure on long-duration tech valuations

Together, these create a supportive environment where pullbacks are absorbed quickly - exactly what we’ve seen this week.

Is a new all-time high now in play?

With the index pushing closer to the 25,900 key level, the market is now staring at a familiar ceiling. A decisive break above this structure turns the spotlight directly onto the all-time high at 26,400.

Is it coming?

Momentum, fundamentals, and sector rotation all suggest the probability is rising - but not confirmed until 25,900 is cleared.

Until then, we treat 25,900 as the final resistance before a true breakout attempt.

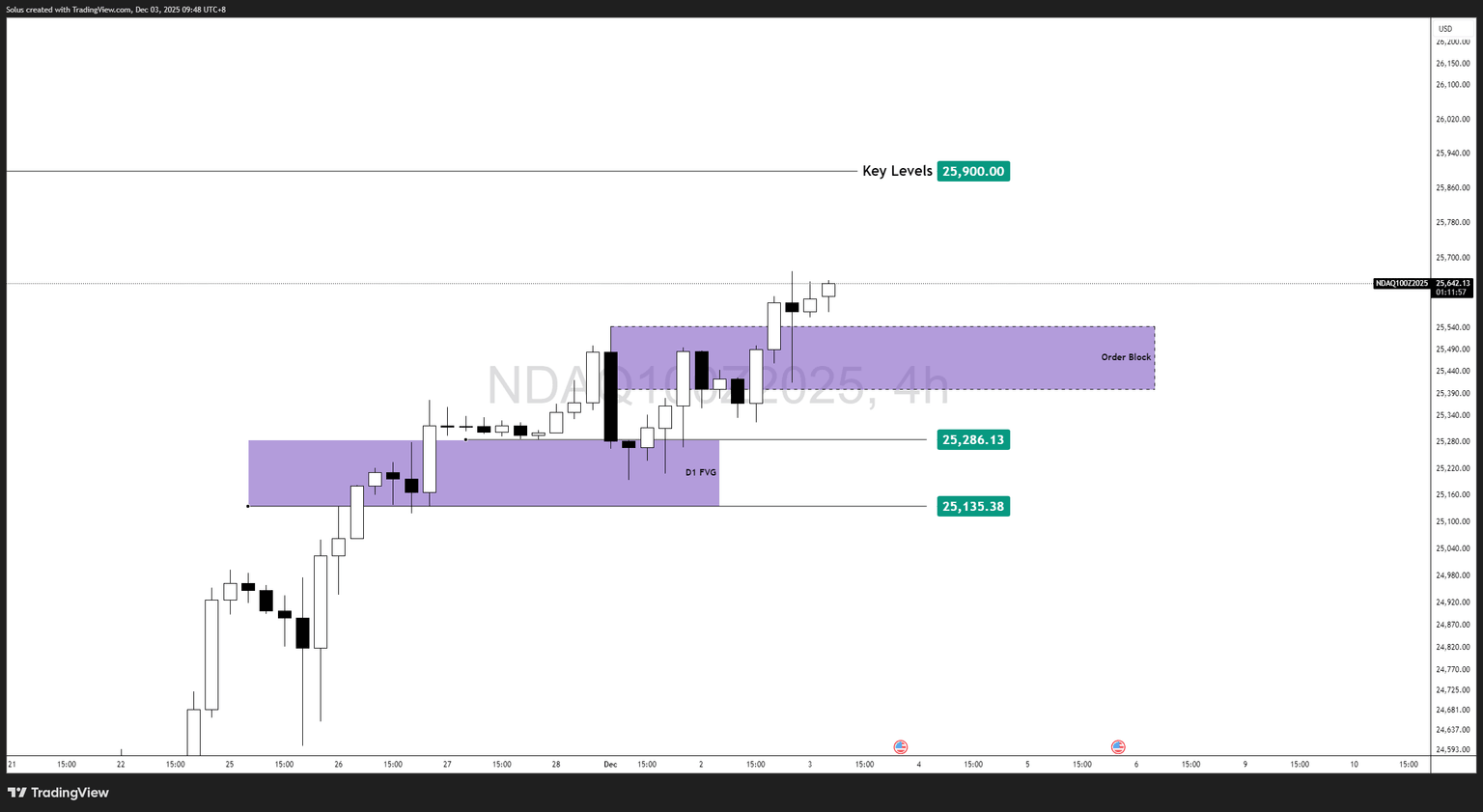

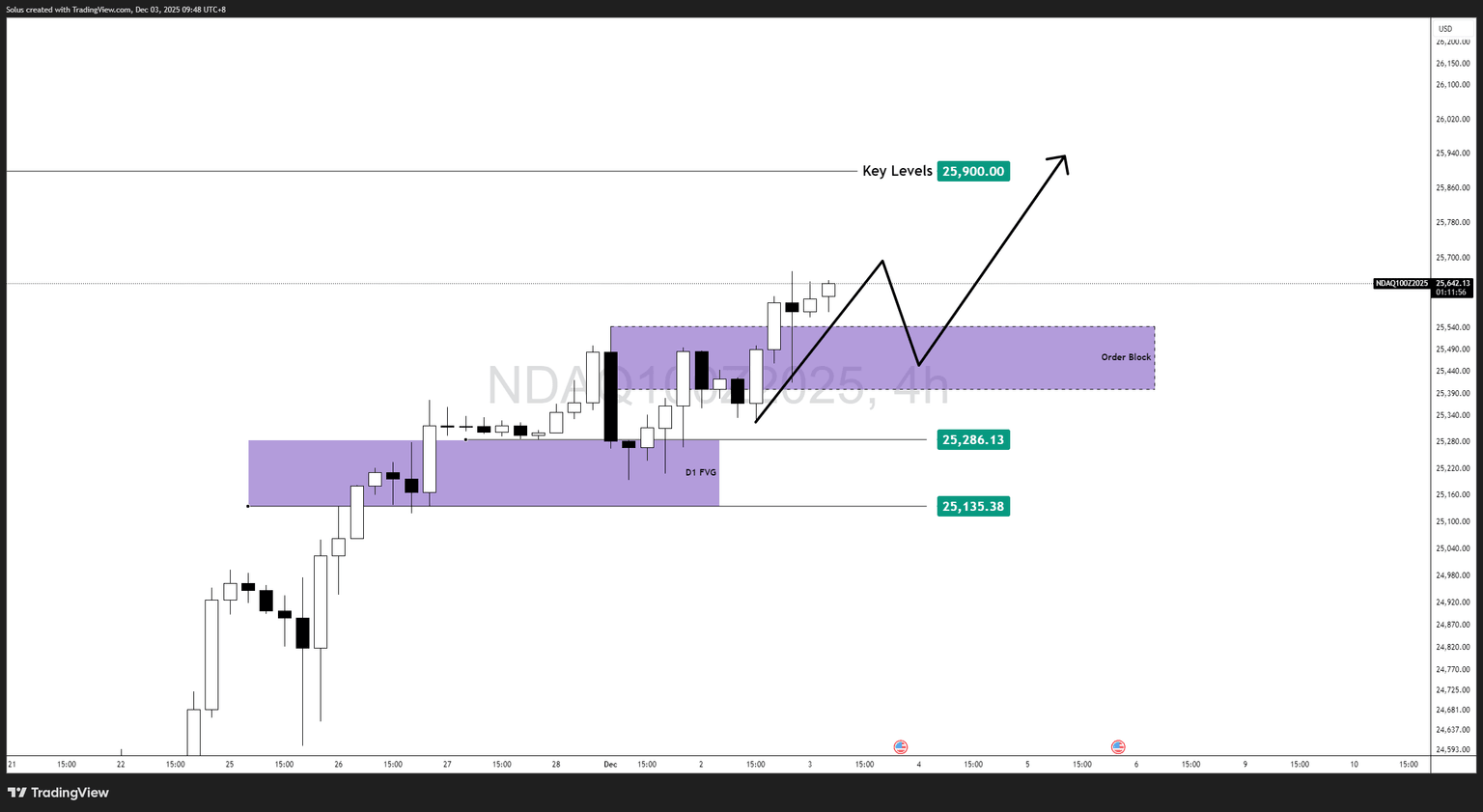

Technical outlook (4H chart)

The 4H structure remains classically bullish:

- Price rebounded from the Daily FVG, confirming HTF demand.

- The current pullback sits above a 4H Order Block between 25,380–25,430.

- Market continues printing higher highs and higher lows, showing clean continuation order flow.

Price action is still in expansion mode, with the 4H OB acting as the most important short-term support.

Bullish scenario: Respect the OB → break 25,900 → target ATH

The bullish outlook remains intact if:

- Pullbacks continue to hold the 4H OB

- Buyers push past 25,900

- Momentum expands into the remaining inefficiencies above

A breakout above 25,900 opens the next phase of upside targets:

- 26,100 (first liquidity pocket)

- 26,400 (all-time high)

- 26,550+ (post-breakout overshoot)

This aligns with your 4H projection: a corrective dip into demand followed by a clean continuation.

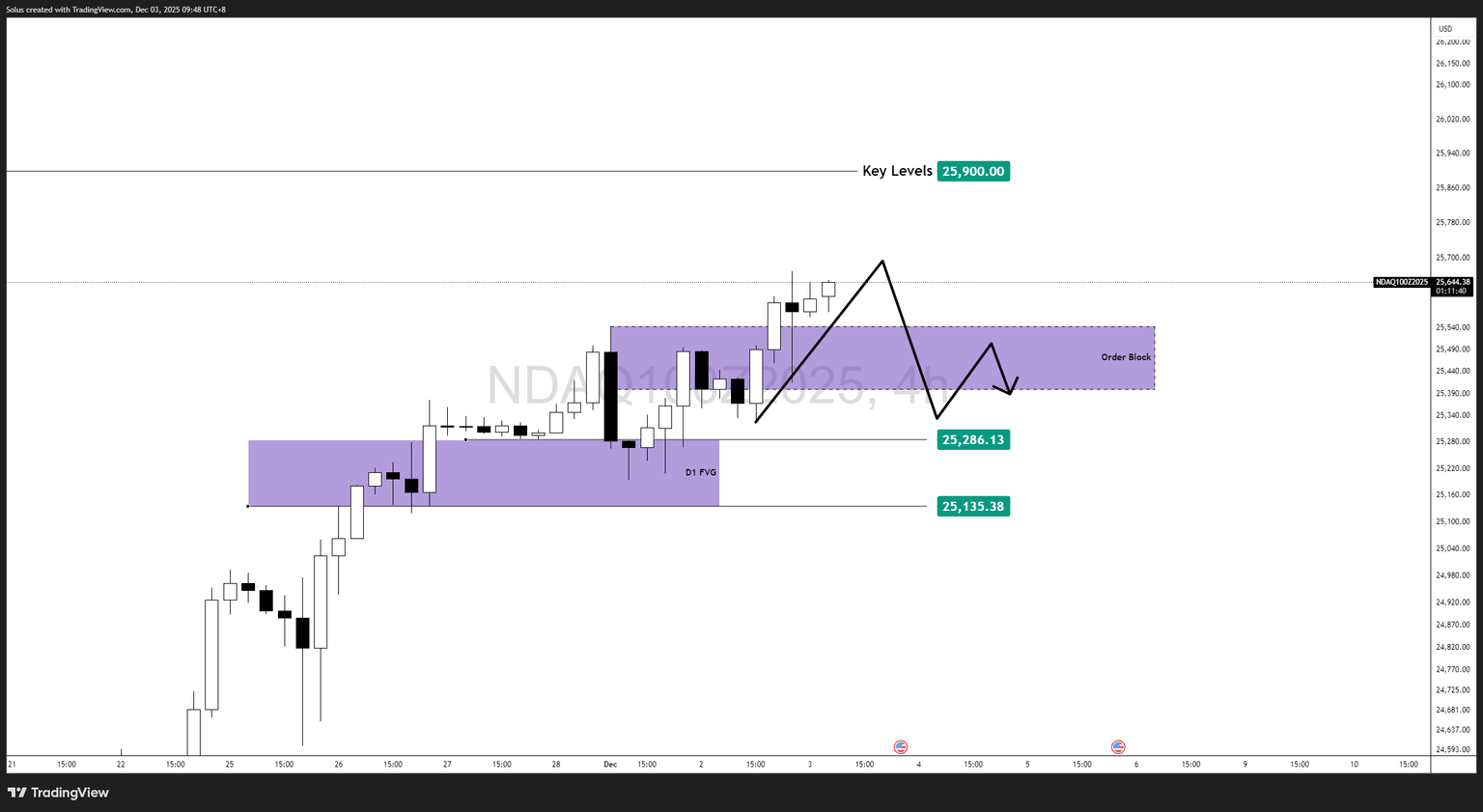

Bearish scenario: OB breakdown → Revisit lower FVG zones

A shift to a bearish tone would require:

- A decisive breakdown of the 4H Order Block

- A close below 25,286 (structural invalidation point)

- A failure to maintain order flow above Daily FVG boundaries

Downside targets:

- 25,286 (mid-term liquidity magnet)

- 25,135 (remaining Daily FVG portion)

- 24,900 zone (deeper correction if sentiment weakens)

A rejection from 25,900 combined with OB failure could signal a short-term top.

Final thoughts

The Nasdaq’s recovery from the Daily FVG is not a random bounce - it’s a confluence of institutional demand, improving macro sentiment, and powerful leadership from major tech players like NVIDIA.

All eyes now turn to 25,900.

Break it - and the path toward a new all-time high opens wide.

Hold below - and we remain in a premium distribution zone.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.