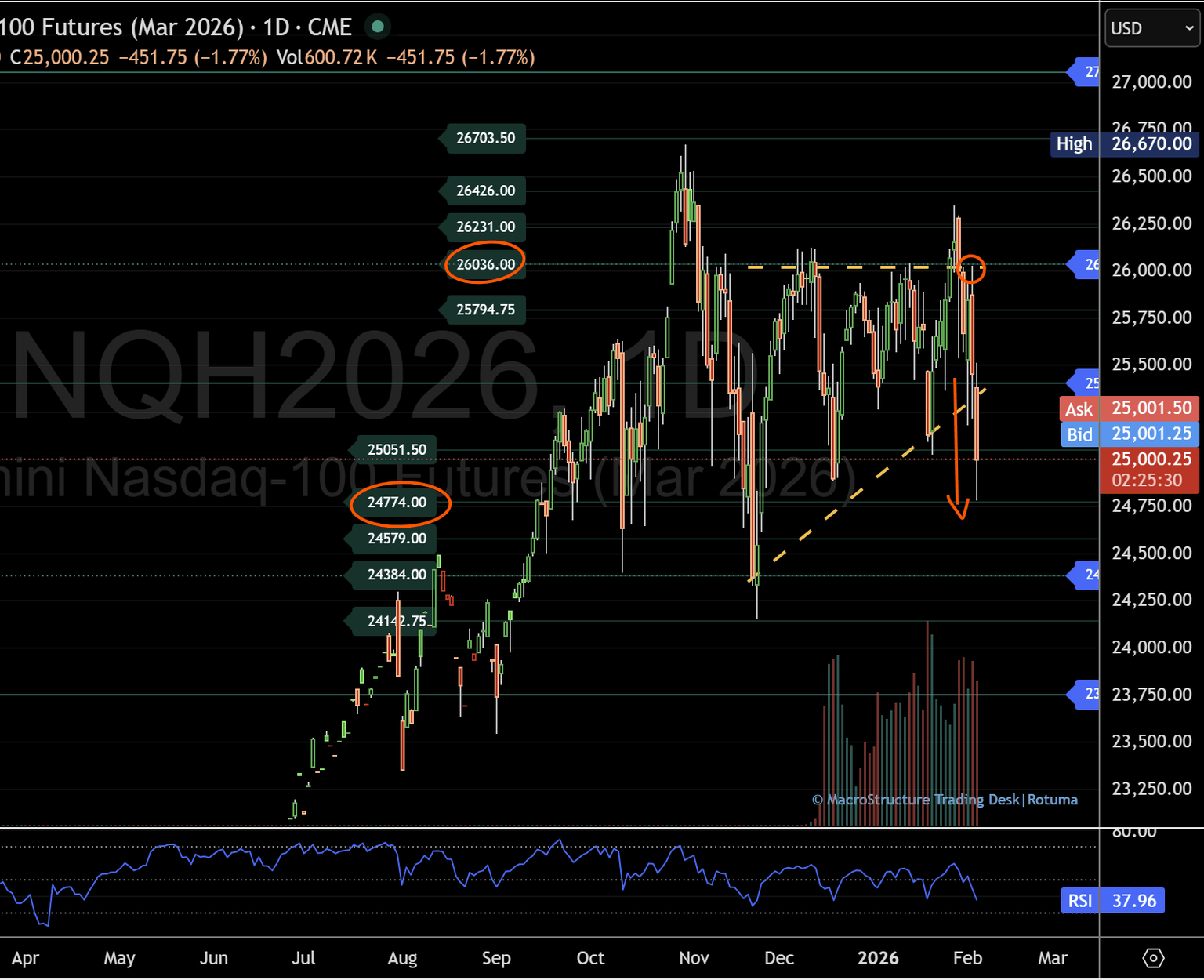

Nasdaq 100 futures slide after 26,036 rejection as 25,405 pivot breaks [Video]

![Nasdaq 100 futures slide after 26,036 rejection as 25,405 pivot breaks [Video]](https://editorial.fxsstatic.com/images/i/Equity-Index_Nasdaq-2_XtraLarge.jpg)

Price is leaning on the 25,051–24,774 support band; a reclaim of this level may reset the structure, while acceptance below 24,774 risks a deeper lower-structure rotation.

Nasdaq Futures desk report — Daily update

Continuation of the prior MacroStructure daily desk report | Structure unchanged since end-2025

Nasdaq futures rotated back into the lower structure after another failed upside attempt at 26,036 in yesterday’s session. Today’s selling pressure accelerated after an early rejection at the daily central pivot (25,405), triggering a sharp drop (over 2%) that pressed into 24,774.

From a structure-first standpoint, the message is clean: the market failed to sustain acceptance above the prior supply ceiling and is now testing whether the lower-structure support band can absorb liquidation. The breach of the long-term trendline adds weight to the idea that this is not just intraday noise — it’s a structural test of support, where response matters more than predictions.

What changed today

- 26,036 acted as the failed rotation point again.

- The early rejection at 25,405 (CP) set the tone and opened the door to fast downside continuation.

- Price is now effectively leaning on the key support band at 25,051–24,774.

This is still the same two-way framework we’ve been mapping since late-2025 — what’s changing is where price is accepted and where it’s being rejected.

Major structural references

- Failed rotation/supply reference: 26,036

- Daily central pivot (pressure point): 25,405

- Crucial support band (line in the sand): 25,051–24,774

- If weakness persists (lower structure base): 24,579 → 24,142

Scenario map

1) Stabilise and repair (support band holds)

If 25,051–24,774 continues to hold and price can reclaim 25,051, that would be an early sign the market is trying to rebuild value rather than continue liquidation. In that case, a retest of 25,405 becomes the natural next checkpoint — not as a “target,” but as the next decision node where the market must prove acceptance.

2) Breakdown and lower rotation (support band fails)

If 24,774 fails and price begins to accept below (not just wick through), the structure opens to a deeper rotation toward 24,579–24,142 — the lower boundary zone of the lower structure. This is where you’d expect stronger two-way trade and more meaningful response attempts, because it’s the next structural area with memory.

What I’m watching next

- Does price hold and build above the 25,051–24,774 band (stabilisation)?

- Or does it break and accept below 24,774 (deeper lower-structure rotation)?

- If we do bounce, does 25,405 reject again, or does it allow acceptance back into the middle of the range?

These desk updates document a structure-first process, observing how price accepts or rejects predefined levels over time. Coverage spans futures, commodities, forex, bonds, crypto, stocks, and indices, with structure providing context before direction. This observation is for informational purposes only and does not constitute financial advice.

Structure defines context; price reveals response.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.