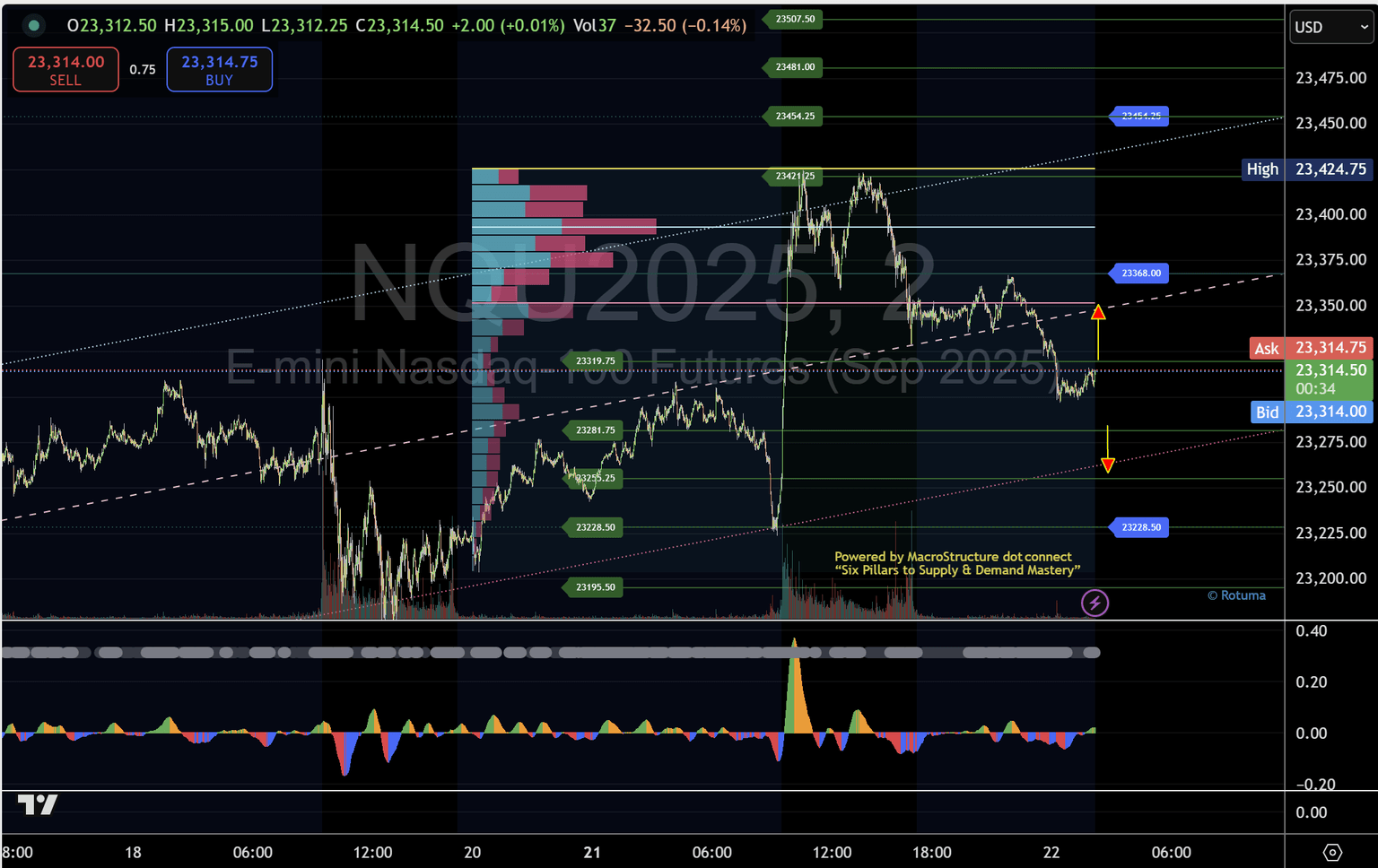

Nasdaq 100 futures London session playbook: Reclaim 23,319 to ignite the next leg higher

Bulls must establish a base above the 50% retracement at 23,319.75, while key micro pivots at 23,281, 23,255, and 23,228 offer clear bounce zones for tactical entries.

1. Session setup

-

Context: After yesterday's pullback off the 23,421.25 high, NQ futures have been grinding sideways, squeezed between Micro 5 (lower channel boundary) and Micro 4.

-

Objective: Identify the levels that will dictate direction in the London open—either a renewed bullish push or a measured retracement.

2. Key levels to watch

LevelDescription

23,319.75 - 50% retrace of yesterday's range – key bullish pivot.

23,350–23,368 - Value Area Low (~23,350) & mid-channel resistance at 23,368.

23,394 - Point of Control (POC) – major volume node.

23,421.25 - Yesterday's high – ultimate upside target.

23,281 - Micro 4 – first support on pullbacks.

23,255 - Micro 3 – secondary support.

23,228 - Micro 2 – last line of defence on deeper drops.

Nasdaq 100 Futures price chart courtesy of TradingView | Playbook by MacroStructure dot connect

3. Bullish playbook

-

Entry Trigger:

-

Clean reclaim and close above 23,319.75 on a 15‑minute chart.

-

Confirmation with rising volume or uptick in momentum oscillators.

-

-

Initial Target:

-

23,350–23,368 (Value Area Low & mid‑channel resistance).

-

-

Stretch Target:

-

23,394 (POC) – look for a brief stall or consolidation.

-

-

Aggressive Add‑On:

-

Break and retest of POC → target 23,421.25 (prior high).

-

-

Stop‑Loss:

-

Below 23,300 or just under the reclaim level to give room for noise.

-

4. Bearish/pullback playbook

-

Short Trigger:

-

Failure to hold 23,319.75, with a close below and fresh sellers stepping in.

-

-

Support Zones for Bounces:

-

23,281 (Micro 4)

-

23,255 (Micro 3)

-

23,228 (Micro 2) – key level; break here opens lower targets.

-

-

Primary Target on Break:

-

Drop below 23,228 → look for a move toward the lower trend‑channel boundary near 23,195–23,200.

-

-

Stop‑Loss:

-

Above 23,319.75, or above the breakdown candle high.

-

5. Trade execution and risk management

-

Timeframes: Use 5‑ and 15‑minute charts for entries, 1‑hour to monitor structure.

-

Position Sizing: Risk no more than 1–2% of account per trade.

-

Trailing Stops: Once in profit by 1R (risk), trail to breakeven or just behind next micro pivot.

-

News/Flow: Watch for London economic releases (e.g., UK CPI) that can spike volatility.

6. Pro tips for London session

-

Micro Pivot Confluence: The more pivots you see clustered (e.g., 23,281 & a trend‑line touch), the higher the probability of a clean bounce or break.

-

Volume Profile Insight: Notice how volume clusters around the POC—aggressive traders often defend or attack here.

-

Momentum Confirmation: A quick squeeze above/below key levels with matching momentum spike (e.g., via TTM Squeeze or MACD) adds conviction.

-

Scaling In/Out: Stagger entries at each micro level and scale out into areas of heavy volume (VAL, POC, prior high).

Powered by MacroStructure dot connect – "Six Pillars to Supply & Demand Mastery".

The information contained in this playbook is provided for educational and informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any financial instrument. Futures trading involves substantial risk and is not suitable for all investors. Past performance is not indicative of future results. Always conduct your own analysis, consider your risk tolerance, and consult with a licensed financial advisor before making any trading decisions. MacroStructure dot connect and its affiliates assume no liability for any losses incurred as a result of the use of this playbook.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.