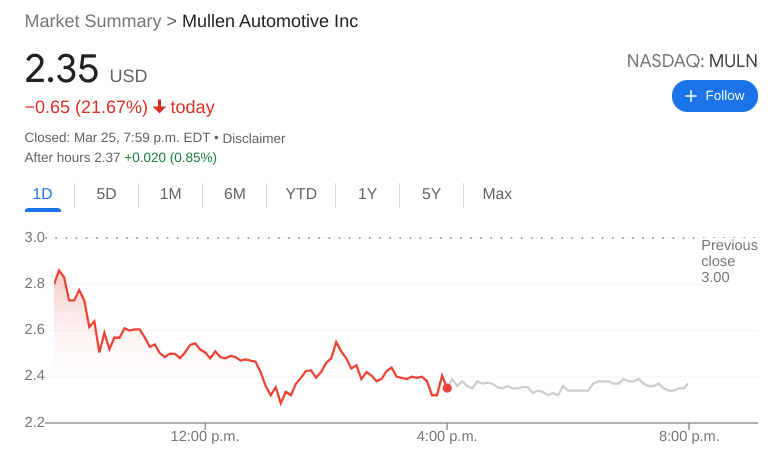

MULN Stock News: Mullen Automotive tumbles for weekly loss of 33%

- NASDAQ:MULN fell by 21.67% during Friday’s trading session.

- The gap between Tesla and EV startups like Mullen just got wider.

- EV stocks fall to close the week as growth stocks cool off.

NASDAQ:MULN had a bearish close to the week as the EV stock tumbled during Friday’s session. Shares of MULN plummeted by 21.67% and closed the trading week at $2.35. After gaining more than 100% during last week’s trading, shares fell by 33% this week. The stock has recently been a trending ticker on Reddit and Twitter, with the volatility and massive swings characteristic in meme stock behavior. Mullen Automotive fell on a day where the NASDAQ snapped its recent hot streak, as the tech-heavy index fell by 0.16%. Despite this, all three major indices closed the week higher for the second straight week, as investors have mostly shrugged off the rise in interest rates and ongoing crisis in Ukraine.

Stay up to speed with hot stocks' news!

The CarBuzz article that first brought Mullen Automotive back into the spotlight referred to the company as a potential major competitor to Tesla (NASDAQ:TSLA). Given the fact that Mullen does not expect its vehicles to be on the market until 2024, Tesla’s recent advancements have only widened the gap between it and the rest of the market. With the Berlin GigaFactory now open and the Austin GigaFactory opening imminently, Tesla is establishing a global supply chain that most automakers simply cannot compete with. At this point, it seems unlikely Mullen will pose any threat to Tesla when its vehicles are ready.

MULN stock forecast

It was a sea of red for the electric vehicle sector on Friday as nearly every EV maker was trading lower to close the week. Tesla saw its eight-day win streak snapped, while Chinese EV maker Nio (NYSE:NIO) tumbled after providing weak guidance despite beating estimates for its fourth quarter and full year performance. Lucid (NASDAQ:LCID), Rivian (NASDAQ:RIVN), and XPeng (NYSE:XPEV) all closed the week lower as well.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet