MULN Stock Forecast: Mullen Automotive sinks further below $1.00 price level amidst market rally

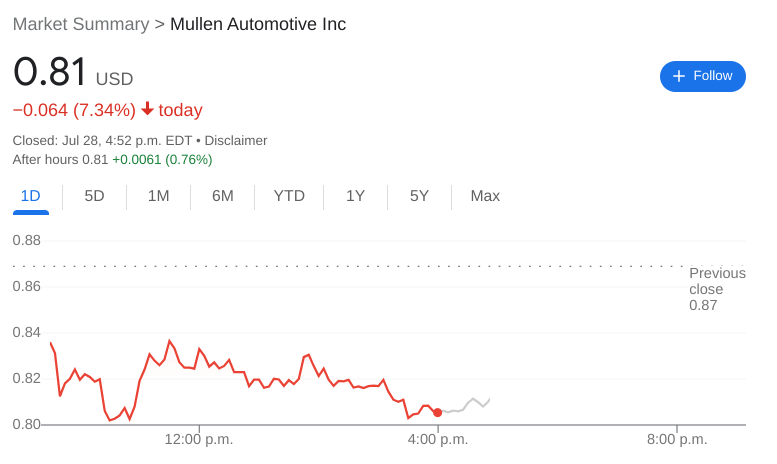

- NASDAQ:MULN fell by 7.34% during Thursday’s trading session.

- EV stocks rise as new legislation looks to boost clean energy companies.

- Canoo’s vans continue to gain popularity as NASA further tests its use cases.

NASDAQ:MULN extended its recent slump and fell even further below the $1.00 price level as the stock struggles to maintain its NASDAQ listing requirements. On Thursday, shares of MULN dropped by a further 7.34% and closed the trading session at $0.81. All three major indices rose for the second straight day as investors shrugged off the latest 75 basis point rate hike. Ahead of key earnings from Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) stocks rose higher into the closing bell. Overall, the Dow Jones added 332 basis points, the S&P 500 gained 1.21%, and the NASDAQ jumped higher by 1.08% during the session.

Stay up to speed with hot stocks' news!

Some good news for EV stocks today as a report out of Washington suggested that there is further funding on the way for clean energy companies. Tesla (NASDAQ:TSLA), Rivian (NASDAQ:RIVN), General Motors (NYSE:GM), and Ford (NYSE:F) all spiked higher. Rivian also benefited from the news that of the 6% of layoffs for the company, none will be coming from the manufacturing side of things. It looks like Rivian will be maintaining its production capacity while reducing its payroll from the corporate side of things.

Mullen stock price

Electric van maker, Canoo (NASDAQ:GOEV) continued to see interest in its popular lifestyle vans. After one round with NASA and testing with the US Army, NASA is testing their vans again to transport astronauts to the launch pad. Of course, Canoo’s biggest win is its contract with WalMart (NYSE:WMT) for up to 10,000 delivery vans. Shares of Canoo were down by 0.56% on Thursday.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet