MULN Stock Forecast: Mullen Automotive rises higher as Tesla earnings lifts EV sector

- NASDAQ: MULN gained 1.83% during Thursday’s trading session.

- Amazon begins delivering orders with its Rivian electric trucks.

- EV Stocks pop after Musk sees end to supply chain hell.

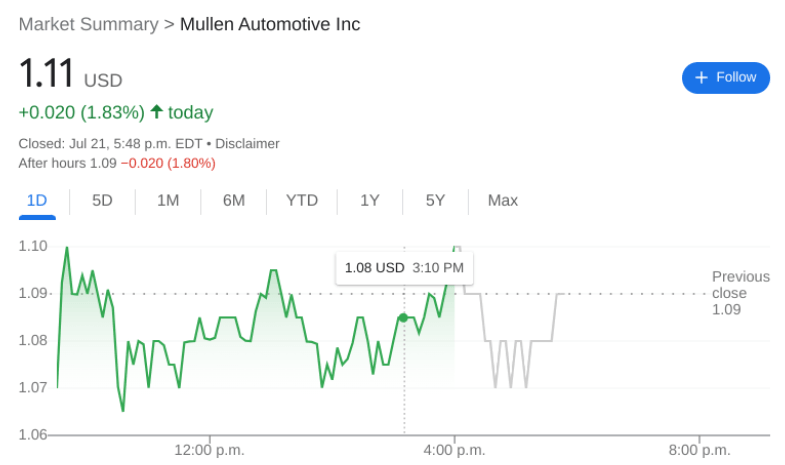

NASDAQ: MULN edged higher as the industry leader acted as the tide that lifted all other EV stocks on Thursday. Shares of MULN rose by 1.83% and closed the trading session at $1.11. Stocks rose higher again as the NASDAQ extended its streak to three straight days. Big tech stocks led the way during intraday trading, although some were falling sharply in after hours trading due to a disappointing earnings report from Snap (NYSE: SNAP). Overall, the Dow Jones gained 162 basis points, the S&P 500 added 0.99%, and the NASDAQ posted a gain of 1.36% during the session.

Stay up to speed with hot stocks' news!

The big news in the EV industry on Thursday was that eCommerce giant Amazon (NASDAQ:AMZN) has started to deliver orders with the new electric delivery vans from Rivian (NASDAQ: RIVN). The trucks have been spotted in several US cities, and Amazon has stated that it hopes to have them in over 100 different cities by the end of the year. The ultimate goal is to have 100,000 of these vans delivering packages by 2030, as Amazon moves to an all-electric delivery fleet. Amazon’s partners will also be moving to electric including DelPack Logistics which recently signed a deal with Mullen to provide up to 600 electric delivery trucks.

Mullen stock price

EV stocks were soaring on Thursday following the earnings report from Tesla (NASDAQ: TSLA) on Wednesday after the close. Shares of TSLA jumped by nearly 10% during the session, while other stocks like Rivian, Lucid (NASDAQ: LCID), and Nio (NYSE: NIO) were also trading higher. CEO Elon Musk revealed that EV demand remains high and that the company sees an end to the ‘supply chain hell’ that the industry has suffered from over the past couple of years.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet