MULN Stock Forecast: Mullen Automotive retreats during a mixed session for EV Stocks

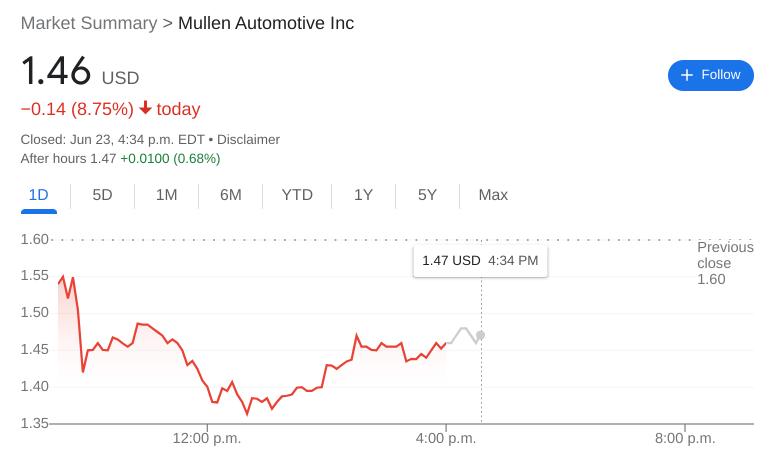

- NASDAQ:MULN fell by 8.75% during Thursday’s trading session.

- Mullen issues another business update to shareholders.

- EV stocks are mixed as Tesla falls while others rise higher.

NASDAQ:MULN snapped its recent winning streak even as the company continues to churn out positive updates for its shareholders. On Thursday, shares of MULN dropped lower by 8.75% and closed the trading session at $1.46. Stocks rebounded from Wednesday as all three major indices rallied higher into the close. As June comes to a close, investors are looking to the second half of the year for better results, as the first half was amongst the worst starts to a year in history. The Dow Jones added 194 basis points, the S&P 500 gained 0.95%, and the NASDAQ rose by 1.62% during the session.

Stay up to speed with hot stocks' news!

Mullen issued yet another business update to its shareholders, as the company outlined the recent advances it has made. Specifically, Mullen mentioned the addition of its stock to the Russell 2000 and 3000 indices, its results from the solid-state battery testing, and the launch of its Strikingly Different US tour to promote its FIVE crossover EV model. The company did not mention anything about the SPAC merger vote that was held on Thursday, so an official announcement about those results will likely be provided in the next week or so.

Mullen stock price

It was a fairly mixed session for EV stocks, although the late hour push managed to put most companies into the green for the day. Tesla (NASDAQ:TSLA) traded lower after comments from Elon Musk about the amount of money the new GigaFactories were burning through. In the green were stocks like Nio (NYSE:NIO), Lucid (NASDAQ:LCID), and Rivian (NASDAQ:RIVN). Lucid led the way with a 7.04% gain for the day.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet