Morgan Stanley (MS Stock) – Looking to buy the dips

Morgan Stanley has been considerably been climbing for the past decade without any financial crashes and economical issues affecting it to a point that it has interferred within it’s bullish cycle. We have been eyeing this up recently, considering all stocks and indices have been correcting – this gave us a good opportunity to eye up Morgan Stanley as it may continue to appreciate within the near term future.

Weekly timeframe 22nd April 2022

On a weekly timeframe we are currently within wave II of (III) to the upside. We believe alongside other stocks such as Bank of American, S&P500, it will form a new low within the corrective cyce of wave II. From the completion of that corrective cycle we can expect Morgan Stanley entering into wave III of (III). This is subject to price not breaching through 27.38 invalidation level at the extreme of wave (II).

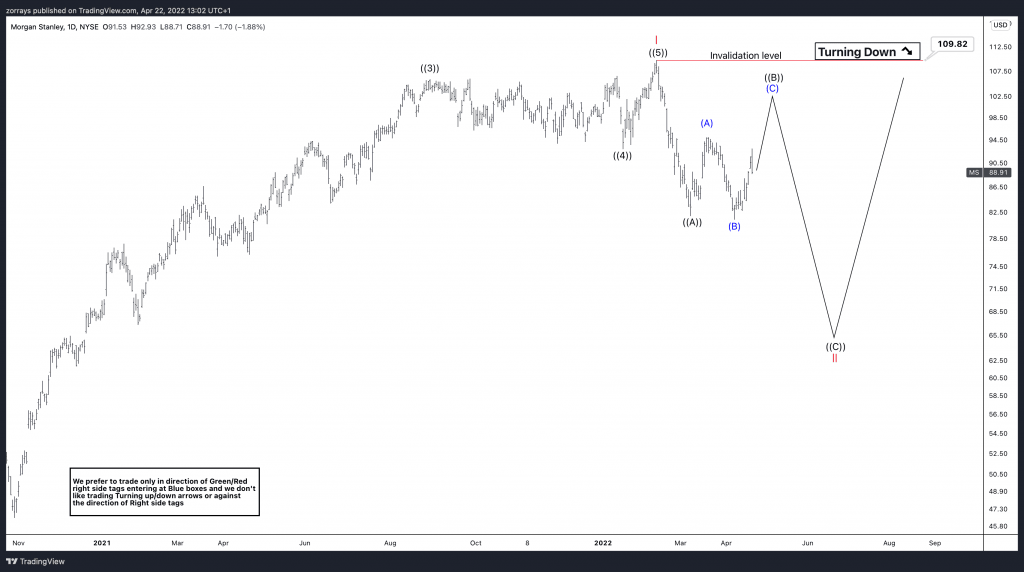

Daily timeframe 22nd April 2022

Now looking at wave II a bit more closer. We are currently in sub-wave ((B)). It seems like ((B)) is unfolding as an expanded flat. Therefore we can expect wave (C) to unfold in a 5 wave sequence prior to ((C)) of II will be in play. Once ((B)) is done, we would want to breach wave ((A)) against ((B)) to measure our entry point of wave ((C)) based on equality. We would then like to see the breach of 109.82 – extreme of wave I to determine that price is currently in the next impulse wave, III.

I will be keeping a closer look on this and keep our audience up to date when we have a buy range determined.

We pride ourselves to providing real-time analysis on asset classes such as FX, commodities, stocks, ETFs and Indices. To get an exclusive deep dive into our content, we suggest signing up to our 14 day trail! Our strategy has been proven successful within the professional world of trading.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com