Microstrategy Stock News and Forecast: MSTR earnings preview

- Microstrategy to release earnings after the close on Tuesday.

- MSTR stock has slumped in line with Bitcoin this year.

- MSTR shares are down by over 32% so far in 2022.

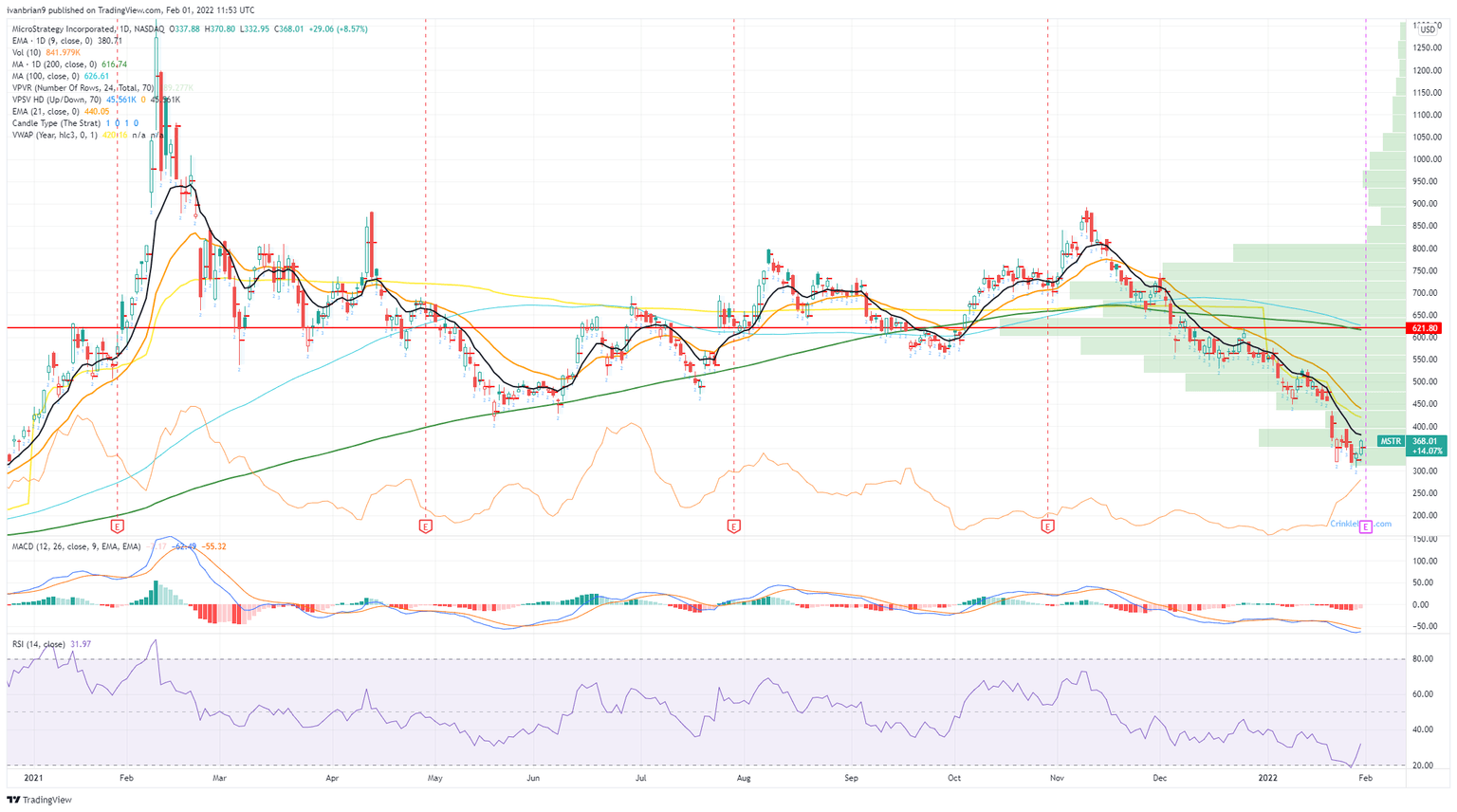

Microstrategy (MSTR) reports earnings after the close on Tuesday in what is sure to provide some volatility to the stock. Bitcoin has struggled through the start of the year, and this has had an obvious knock-on effect on the crypto sector. Microstrategy stock had been falling before the New Year and finds itself down over 50% in the last three months alone and just over 32% so far for 2022. After topping out at $1,315 back in February of last year in the meme stock craze, the stock fell back to $450 before again spiking in late November to just under $900. However, since then it has been a steady decline. MSTR stock closed Monday at $368, and that was after an 8% rise.

Microstrategy Stock News

Bitcoin is down nearly 40% in the last three months, so the performance of MSTR stock does not exactly come as a surprise. Microstrategy is a tech company involved in business intelligence software, but it has come to be synonymous with crypto currency due to its CEO Michael Saylor being a strong and vociferous proponent of Bitcoin.

Microstrategy holds a significant amount of Bitcoin, and some of the purchases of it have been funded through debt. The company raised $600 million in February 2021 via convertible notes to buy Bitcoin. Back in July CEO Michael Saylor said in an interview with CNBC, “We’ve got $2.2 billion of debt, and we pay about 1.5% interest, and we have a very long time horizon,” Saylor said on “Squawk on the Street.”

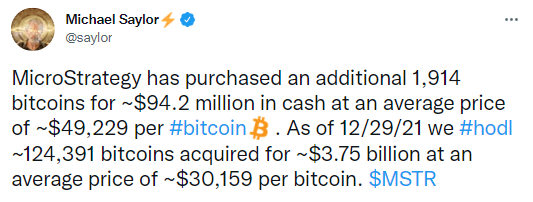

“Our point of view is being a leveraged, Bitcoin-long company is a good thing for our shareholders.” At the end of 2021, MSTR held 124,391 bitcoins bought at an approximate average price of $30,159 per coin, according to a tweet from CEO Michael Saylor.

The SEC recently rejected the accounting method used and said in a filing, "We note your response to prior comment 5 and we object to your adjustment for Bitcoin impairment charges in your non-GAAP measures,” the filing said. “Please revise to remove this adjustment in future filings.

The earnings are expected to drop after the close today. Earnings per share (EPS) is expected at $1.49, and revenues are expected to reach $133.2 million.

Microstrategy Stock Forecast

The downtrend is well-established, and really this is a proxy for Bitcoin. Risk appetites are waning despite this recent recovery, and growth and tech stocks are suffering. Add Bitcoin into the mix, and you have a potent combination. This will rocket as it has in the past when or if risk appetites return to last year's elevated levels. We doubt that mania will return fully, but Bitcoin has many more influences and is showing some strong correlation with gold as an anti-inflation hedge.

Microstrategy (MSTR) chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.