Mexican Peso weakens after Sheinbaum and Morena win substantial majority

- The Mexican Peso weakens after Claudia Sheinbaum wins the Mexican election and her party takes control of both houses.

- Given her strong majority Sheinbaum will have more freedom to enact ambitious spending programmes which is weighing on the Peso.

- Her plans to raise the minimum wage, however, are likely to drive growth and consumer spending keeping interest rates high which is MXN positive.

The Mexican Peso (MXN) weakens almost three percent in its key pairs on Monday following the news that Dr. Claudia Sheinbaum has won the Mexican presidential election whilst her Morena party have won comfortable majorities in both houses of the Mexican congress. Sheinbaum is expected to continue the legacy of her predecessor, mentor and fellow Morena party colleague, Andrés Manuel López Obrador.

USD/MXN is exchanging hands at 17.44 at the time of writing, EUR/MXN is trading at 18.93 and GBP/MXN at 22.21.

Mexican Peso weakens after Sheinbaum cruises to victory

The Mexican Peso is weakening on Monday after the news of Dr. Claudia Sheinbaum's victory in the Mexican presidential election. Analysts are putting the Peso's weakness down to the overwhelming size of Sheinbaum's victory. With clear majorities expected in both legislative houses she will have the liberty to enact whatever ambitious spending plans she wishes. This is leading to concerns about Mexico's future fiscal position and weighing on the currency.

“We women have landed in the presidency,” said Sheinbaum amid a roars of applause from supporters in Mexico City's Zocalo square, adding “We are going to govern for everyone.”

Whilst on the campaign trail, Sheinbaum often repeated she would continue with most of Obrador’s social policies, including his generous welfare programme. She has also pledged to increase the minimum wage by circa 11%.

"Sheinbaum has pledged to continue President Andrés Manuel López Obrador's agenda, but the prospect of no checks and balances has led to MXN weakness. With a supermajority in both houses of congress, Morena would be able to implement sweeping constitutional and economic reforms. Some of those, such as increased pension payouts and minimum wage hikes, could potentially lead to expensive social welfare spending," say analysts at Brown Brothers Harriman (BBH) in a note on Monday.

Despite fears her majority will lead to fiscal profligacy some argue the rise in wages is likely to boost consumer spending, a key driver of growth in recent quarters. This in turn is likely to keep interest rates high, supporting the Mexican Peso.

"We believe the fundamental backdrop remains positive for MXN. Mexico has one of the highest real interest rates within the EMFX universe, a stimulative fiscal stance, and boasts a favorable balance of payments backdrop (small current account deficit and large net FDI inflows)," adds BBH.

Greater discipline

Indeed, there are those who believe Sheinbaum may bring greater order and discipline to the office than Obrador, because of the new president's more quantitative and scientific background.

“She describes herself as someone who loves data, who makes decisions and implements policies based on data and that’s certainly in contrast to Lopez Obrador. She is someone who has an environmental science and engineering background. She has spoken about the need for Mexico to lead more in multilateral spaces on the climate emergency. She’s someone who, despite endorsing militarisation, did strengthen and take action on the civilian police in Mexico City as mayor here. So there’s reason to think that there could be some differences, but the jury is still out,” according to Stephanie Brewer, director for Mexico at the Washington Office of Latin America (WOLA).

Technical Analysis: USD/MXN breaks higher, extending uptrend

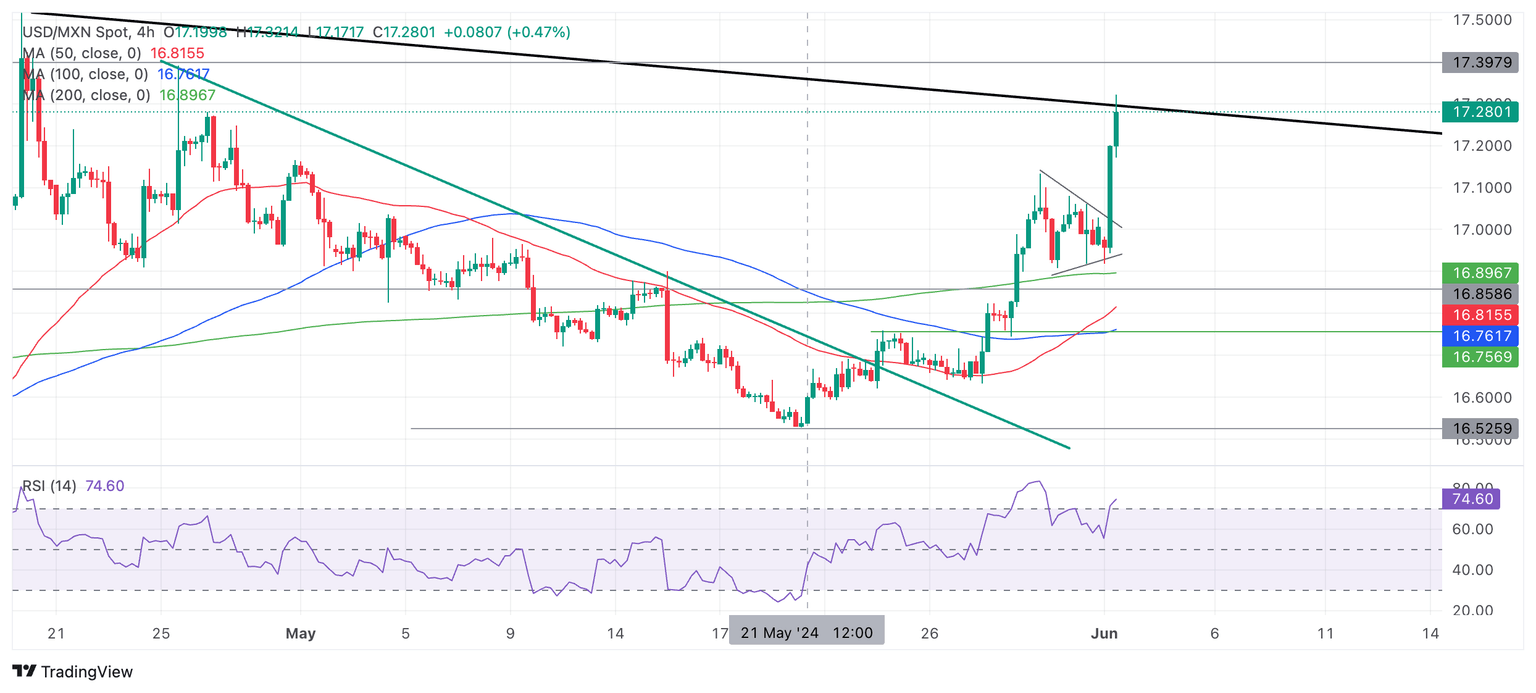

USD/MXN – or the number of Pesos that can be bought with one US Dollar – has broken out of a triangle price pattern that formed within a short-term uptrend and has surged higher.

USD/MXN 4-hour Chart

USD/MXN has now risen up and touched a major trendline (black) situated at around 17.25. Overall it is in a short-term uptrend and given “the trend is your friend”, the odds favor a continuation higher. A decisive break above the trendline would solidify the bullish case and indicate a bullish reversal in the medium-term time frame as well.

A decisive break would be one accompanied by a long green bar that closed near its high or three consecutive green bars in a row.

The Relative Strength Index (RSI) is overbought indicating the possibility of a pull-back evolving. It also indicates long-holders should not add to their positions. If the RSI exits overbought, returning to neutral, it will be a sign for short-term bulls to exit their longs. If a pull-back evolves, however, it is likely to only be a temporary correction before the overarching uptrend resumes and takes prices higher.

The long-term trend remains bearish, however, raising the risk of a reversal lower. However, there are no signs of this happening yet, so the uptrend is likely to continue.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.