Mexican Peso tumbles on trade war fears, US high yields boost USD

- Mexican Peso weakens as Trump eyes copper tariffs, trade tensions escalate

- USD/MXN climbs past 20.50 as US Treasury yields rebound.

- US Treasury Secretary Bessent warns of economic fragility and supports tariffs as a revenue source.

- Mexico’s Balance of Trade and jobs data are in focus amid rising trade policy uncertainty.

The Mexican Peso (MXN) begins Wednesday's session on the backfoot against the US Dollar (USD) as US Treasury bond yields recover, underpinning the Greenback. The United States (US), imposing tariffs on its allies and adversaries, continued to grab the headlines, while US Treasury Secretary Scott Bessent noted the economy is “fragile.” At the time of writing, the USD/MXN pair trades at 20.51, up 0.24%.

A possible trade war spurred by US President Donald Trump keeps the Mexican Peso heavy. He had set his sights on copper and directed the Commerce Department to examine copper tariffs, with Mexico being one of the country's top importers. Meanwhile, US Treasury Secretary Bessent echoed some of his comments, saying that tariffs would be a source of revenue for the government.

Bessent warned that the economy is more fragile than economic indicators suggest, mentioning interest rate volatility, stickier inflation and reliance on government-sponsored job growth.

In the meantime, an absent economic docket in Mexico keeps USD/MXN traders leaning on dynamics linked to trade policies between the US and Mexico. Mexico’s Secretary of Commerce, Marcelo Ebrard, said that his first meeting with his counterpart, Howard Lutnick, was used to set the ground and establish general ideas about the importance of trade between both countries.

This week, Mexico’s docket will feature the Balance of Trade data for January alongside jobs data.

Daily digest market movers: Mexican Peso weakens ahead of Trump’s 30-day tariff deadline

- The Balance of Trade in Mexico is expected to show a deficit of $-3.8 billion, down from a surplus of $2.567 billion in December.

- Mexico’s Unemployment Rate in January is projected to rise three-tenths from 2.4% to 2.7%.

- Mexico’s February mid-month core inflation increased from 3.61% to 3.63% YoY. Headline prices rose by 3.74% YoY, as expected by analysts.

- Washington is pushing the Mexican government to levy tariffs on Chinese imports to the country.

- The swaps markets hint that the Federal Reserve might ease policy by 58 basis points, up from last week's 40 bps in 2025, via data from the Chicago Board of Trade (CBOT).

- Trade disputes between the US and Mexico remain front and center. Although the countries found common ground previously, USD/MXN traders should know that the 30-day pause is about to end, and tensions could trigger volatility in the pair during the rest of the week.

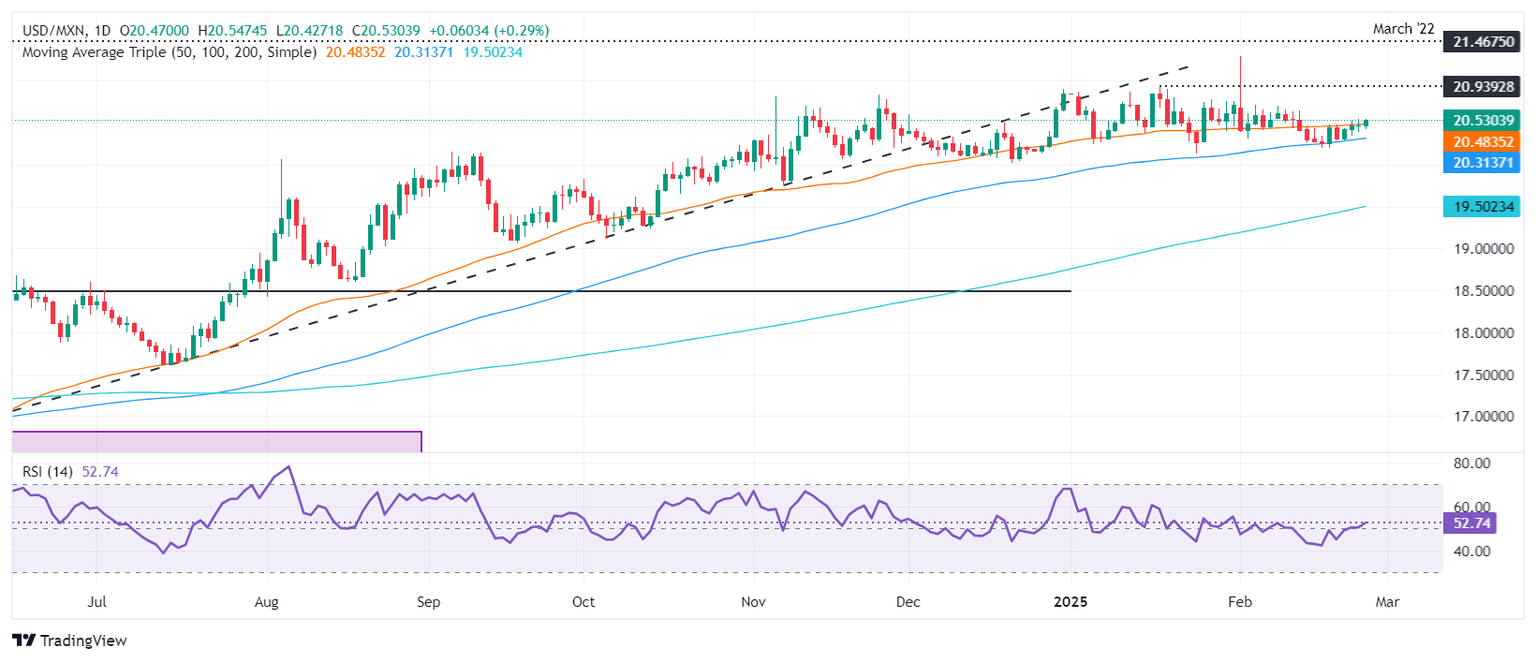

USD/MXN technical outlook: Mexican Peso drops as USD/MXN hurdles 50-day SMA

USD/MXN remains upward biased, and once it surpasses the 50-day Simple Moving Average (SMA) at 20.45, the path toward clearing 20.50 is on the cards. The Relative Strength Index (RSI), above 50, hit its highest peak in February, an indication that momentum favors buyers. They must clear the January 17 high of 20.93, followed by 21.00 and the year-to-date (YTD) high of 21.28.

Conversely, if USD/MXN struggles at the 50-day SMA, it could drop to the 100-day SMA at 20.24. On further weakness, the pair might surpass that dynamic support and head towards the 20.00 figure.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.