Mexican Peso ends day with losses ahead of Banxico’s minutes

Most recent article: Mexican Peso surges ignoring dovish tilted Banxico’s minutes

- Mexican Peso slumps 0.94% as risk sentiment turns bearish on trade fears.

- US President Trump targets autos, pharma and computer chips with 25% tariffs.

- US Dollar Index hits four-day high as Fed signals caution on rate cuts.

- Banxico-Fed policy divergence favors further MXN weakness; traders eye Mexico Retail Sales, Banxico minutes.

The Mexican Peso lost ground and slumped to a two-day low against the Greenback on Wednesday as US President Donald Trump targeted tariffs on cars, pharmaceuticals and computer chips. Meanwhile, the Fed revealed its latest meeting minutes, which maintained the “status quo” but sponsored a leg up in the USD/MXN pair, which rises 0.94% and trades at 20.43.

The minutes showed that Fed officials judged the dual mandate risks to be roughly balanced, while “some participants cited potential changes in trade and immigration policy as having the potential to hinder the disinflation process.” Participants noted that some measures of inflation expectations “had increased recently.”

Market mood shifted negative amid a new round of Trump tariffs, which now include duties of around 25% on cars, pharmaceuticals and semiconductors. with an announcement as soon as April 2. This boosted the Greenback, which according to the US Dollar Index (DXY) hit a four-day peak of 107.32.

In the meantime, US housing data revealed earlier was mixed. Housing Starts plunged, while Building Permits maintained the “status quo.” Now eyes turn to the Minutes of the Federal Reserve’s (Fed) first monetary policy meeting of 2025.

The Fed turned more cautious after the latest inflation readings, suggesting that policy is not as restrictive as they thought. The rise of the Consumer Price Index (CPI) for five straight months might prevent the US central bank from cutting interest rates, at least for the first half of 2025.

Therefore, further USD/MXN upside is projected as monetary policy divergence between Banxico and the Fed favors further USD/MXN upside. The Fed is expected to keep rates steady, while Banxico is expected to cut rates again by 50 basis points at the next meeting.

Meanwhile, traders are eyeing the release of Mexico’s Retail Sales for December, which are expected to deteriorate on a monthly basis but improve despite contracting annually. After that, Banxico’s latest monetary policy minutes will be revealed.

Daily digest market movers: Mexican Peso treads water amid risk aversion

- Mexico’s Retail Sales in December are expected to show the economic slowdown. The final GDP reading for Q4 2024 is expected to show a contraction on a quarterly basis and is foreseen expanding annually.

- Meanwhile, investors await Banxico’s minutes, which will help them gather clues about the intention of reducing rates at a 50 basis point (bps) pace during the year.

- US Housing Starts in January dropped from 1.515 million to 1.366 million, or a 9.6% plunge, due to weather disruptions. At the same time, US Building Permits for the same period improved with figures rising from 1.482 million to 1.483 million, a 0.1% increase.

- San Francisco Fed President Mary Daly said, “Policy needs to remain restrictive until…I see that we are really continuing to make progress on inflation.”

- According to the December 2025 fed funds interest rate futures contract, the swaps market suggests that the Fed will reduce rates by 40 basis points toward year-end.

- Trade disputes between the US and Mexico remain in the boiler room. Although the countries found common ground previously, USD/MXN traders should know that there is a 30-day pause and that tensions could arise toward the end of February.

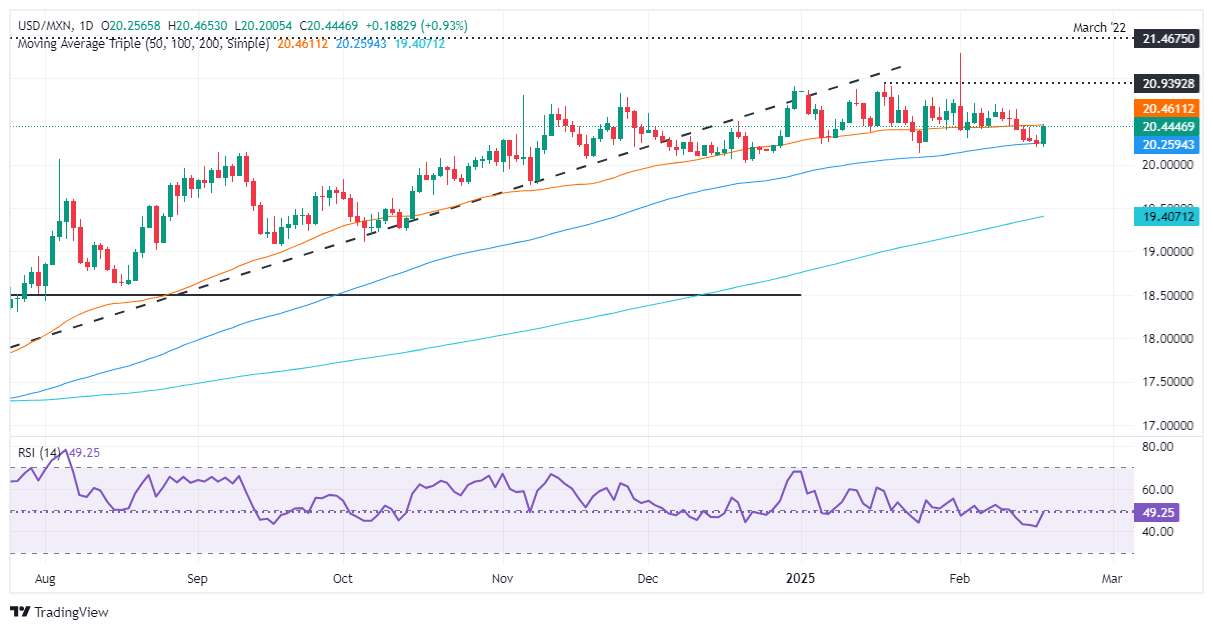

USD/MXN technical outlook: Mexican Peso plunges as USD/MXN rises toward 50-day SMA

The USD/MXN uptrend resumed as the exotic pair tested the 100-day Simple Moving Average (SMA) at 20.22 but failed to clear the latter. Momentum favors buyers in the short term due to the Relative Strength Index (RSI) being in bearish territory.

Therefore, bulls must clear the 50-day SMA at 20.57, before targeting the January 117 peak at 20.93. Once surpassed, traders could target the year-to-date (YTD) high at 21.28, ahead of challenging 21.46. Conversely, if USD/MXN drops beneath the 100-day SMA, look for a fall to test the 20.00 figure.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.