Mexican Peso falls against the Greenback despite US Sentiment miss

- US consumer sentiment falls short, but inflation expectations jump, lifting the Greenback

- Diverging policy paths: Banxico begins easing while the Fed may stay on hold longer.

- USD/MXN holds above 19.50 as markets reassess rate outlook and inflation risks.

The Mexican peso (MXN) is trading lower against the US dollar (USD) on Friday, extending losses following Thursday’s rate cut by the Bank of Mexico (Banxico), which had been widely anticipated. At the time of writing, USD/MXN is trading near 19.551, up 0.30% on the day, as the pair stabilizes during the US session. Trade-related uncertainty and diverging central bank outlooks remain dominant forces behind the pair’s direction.

US consumer data sparks Dollar rebound

A key catalyst for Friday’s move was the release of the University of Michigan’s preliminary consumer data for May.

The headline Consumer Sentiment Index dropped to 50.8, well below the forecast of 53.4 and down from 52.2 previously, while the Consumer Expectations Index slipped to 46.5, also missing expectations. However, the real surprise came from inflation expectations: the 1-year outlook surged to 7.3% from 6.5%, and the 5-year expectation rose to 4.6% from 4.4%.

These sharp increases suggest US consumers expect inflation to remain elevated, complicating the Federal Reserve’s (Fed) efforts to ease policy in the near term. Markets reacted by pricing in a more cautious Fed stance, which lifted demand for the USD and pressured Emerging Market (EM) currencies like the Mexican Peso.

Fed walks a tightrope amid mixed signals

The Fed has adopted a cautious stance in light of softening economic signals and persistent supply-side uncertainty. Speaking after the release of Thursday’s April data, Fed Chair Jerome Powell addressed the twin themes of slowing momentum and inflation risks.

The Producer Price Index (PPI) unexpectedly declined by 0.5% compared with the previous month –its steepest drop since 2009 –while retail sales rose by only 0.1%, suggesting subdued consumer demand.

During his opening speech at the Second Thomas Laubach Research Conference on Thursday, Powell noted, “The economy may be entering a period marked by more frequent and persistent supply shocks,” while adding that the central bank remains “attentive to signs of cooling demand” and that “inflation is moving in the right direction, though the path forward remains uncertain.”

While these developments may delay any shift toward policy easing, they also underscore the delicate balancing act the Fed faces as it monitors inflation and growth risks simultaneously.

Mexico's aggressive rate cuts underscore domestic slowdown

On the other side of the policy spectrum, Banxico delivered a 50 basis-point rate cut on Thursday as expected, lowering its benchmark interest rate to 8.5% in a unanimous decision. The move extended its easing cycle for a seventh straight meeting as the central bank seeks to stimulate a sluggish domestic economy. In its post-meeting statement, Banxico stated that:

“The Board estimates that looking ahead, it could continue calibrating the monetary policy stance and consider adjusting it in similar magnitudes. It anticipates that the inflationary environment will allow to continue the rate cutting cycle, albeit maintaining a restrictive stance.”

With Banxico signaling more easing and the Federal Reserve maintaining a cautious but steady tone, the policy divergence continues to favor the US Dollar. Still, USD/MXN remains vulnerable to headline-driven risk shifts, and the University of Michigan sentiment data could inject additional volatility. Trade policy developments and inflation expectations will also remain key drivers in shaping the near-term path for the Peso.

Mexican Peso daily digest: Banxico warns about trade risks to the economy

- The Banxico lowered its benchmark interest rate by 50 basis points to 8.5%. In the statement, the bank signaled that further similar cuts could be considered going forward.

- Banxico warned about the effects of the current trade standoff with the United States on the country’s economy. “The environment of uncertainty and trade tensions poses significant downward risks,” the bank said in its statement.

- Rising US-Mexico trade tensions threaten Mexico’s export-reliant economy, where over 80% of exports go to the US. Tariffs on goods such as steel and aluminium could disrupt supply chains, dampen investor sentiment, and weigh on growth.

- Concerns about the economic downturn have weighed in on Banxico. While inflation has picked up in recent months to 3.93% in April, the bank still expects inflation to return to its 3% target in the third quarter of 2026.

- The US has imposed 25% tariffs on certain Mexican imports not covered by the USMCA, citing security and drug enforcement concerns, adding further uncertainty to bilateral trade relations.

- According to Reuters, Mexico’s Economy Minister has proposed an early review of the USMCA, ahead of the 2026 timeline, to reassure investors and preserve the framework underpinning over $1.5 trillion in annual North American trade.

- The US economy contracted at an annualized rate of 0.3% in Q1, marking the first decline since 2022. This unexpected downturn was primarily driven by a surge in imports as businesses and consumers accelerated purchases ahead of new tariffs introduced by the Trump administration.

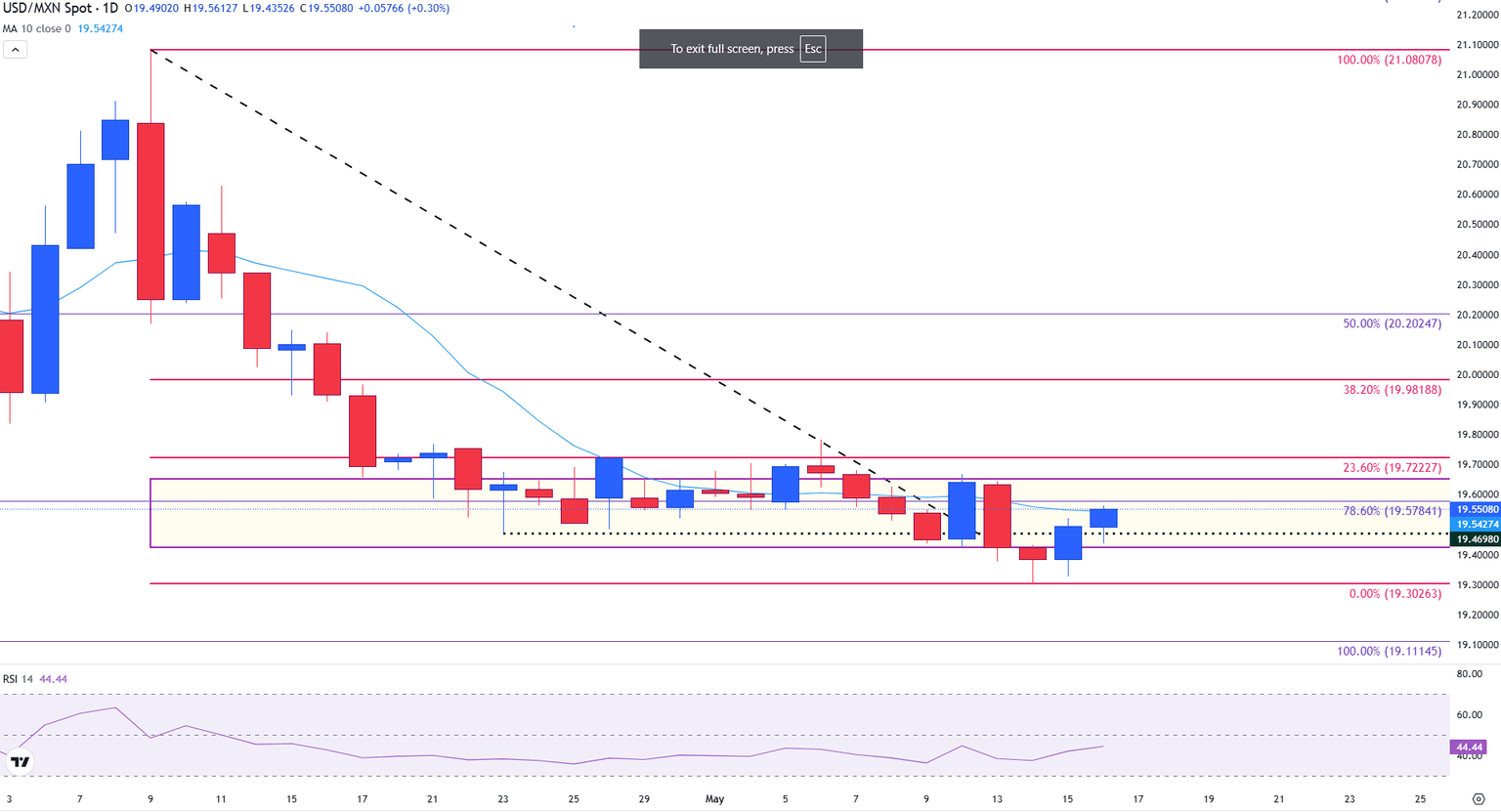

Technical Analysis: USD/MXN bearish consolidation signals further weakness

USD/MXN continues to face downside pressure, trading just above the 19.50 mark after slipping below the 78.6% Fibonacci retracement of the October–February rally at 19.57.

Although the pair has managed to stay above the psychological 19.50 level, it remains capped by resistance near the 10-day Simple Moving Average (SMA), currently at 19.53. This area continues to act as dynamic resistance, preventing a sustained recovery and reinforcing the bearish technical outlook.

Price action remains confined within a consolidation range highlighted in the yellow box, but repeated failures to break higher—and the broader downtrend—suggest that a bearish continuation is still the most likely scenario. The Relative Strength Index (RSI) hovers near 40, indicating moderate bearish momentum with room for further downside before oversold conditions are reached.

The next key support lies at the October low near 19.11, which may serve as a medium-term target if sellers maintain control. A decisive break below that level would expose the psychological 19.00 barrier, opening the door to deeper losses.

USD/MXN daily chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.