Mexican Peso pulls back from highs on strong US employment data

- The Mexican Peso has retreated from two-week highs following upbeat US employment figures.

- Futures markets are now pricing bigger chances that the Fed will cut rates later in December.

- Technically, USD/MXN’s double top at 20.80 suggests the possibility of a deeper correction.

The Mexican Peso (MXN) is trading practically flat against the US Dollar following a whipsaw after the release of US employment data. The USD/MXN pair keeps looking for direction following a three-day sell-off that has pushed the pair to the resistance area above the 20.00 psychological level.

US Nonfarm Payrolls increased beyond expectations in November, according to data released on Friday, with wage pressures steady at relatively high levels. The Unemployment rate, however, has increased. This has increased hopes of further Federal Reserve (Fed) easing in December, which has kept the US Dollar from rallying higher.

Data released on Thursday showed that claims for unemployment benefits in the US increased beyond expectations last week. This, coupled with the lower-than-expected increase in the ADP private-employment gauge, has been weighing on the US Dollar across the board.

In Mexico, Banxico Deputy Governor Irene Espinosa warned against too-aggressive interest-rate cuts considering that an increase in the minimum wage will exert upside pressure on inflation. This has provided some support to the MXN.

Daily digest market movers: Mexican Peso rally stalls

- US Nonfarm payrolls increased by 227K in November, up from the upwardly revised 36K in the previous month and above market expectations of a 200K increment.

- Hourly wages increased at a steady 4% yearly pace, against expectations of a cooler 3.9% rate,. The Unemployment rate, however, has increased to 4.2% from the previous 4.1%.

- Data from the CME Group's Fed Watch Tool shows that chances of a 25 bps Fed cut in December, have increased to around 90% from below 70% before the data and about 60% earlier this week.

- According to a survey from Citi Mexico, most of the economists polled see the Mexican central bank cutting interest rates by 25 basis points in December, with GDP growing by 1.5% in 2024 and by 1% in 2025.

- Earlier this week, Federal Reserve (Fed) chairman, Jerome Powell, highlighted the stress of the US economy and reiterated that the bank should be cautious about rate cuts. These comments suggest that the bank’s easing cycle might target a higher terminal rate than previously anticipated.

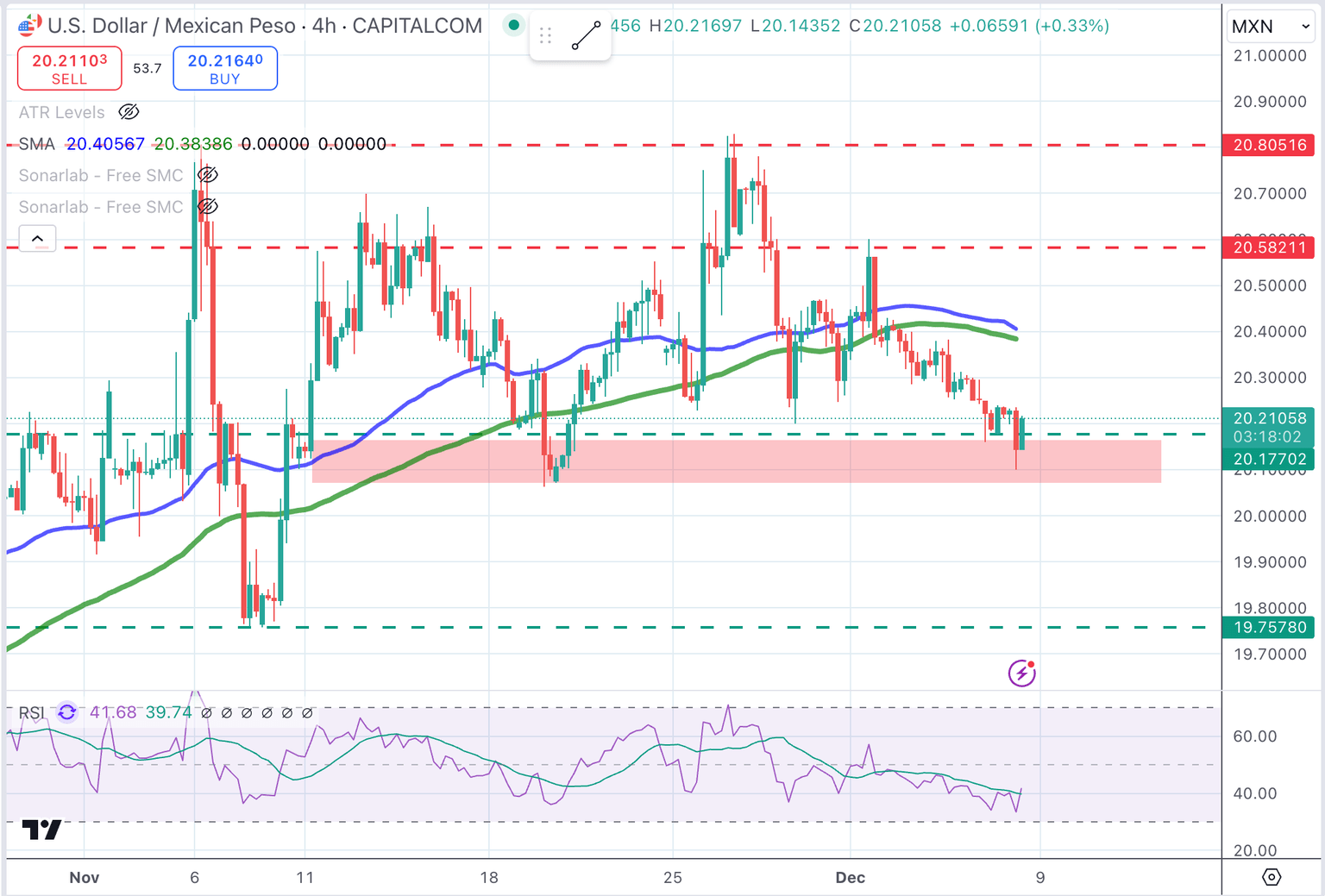

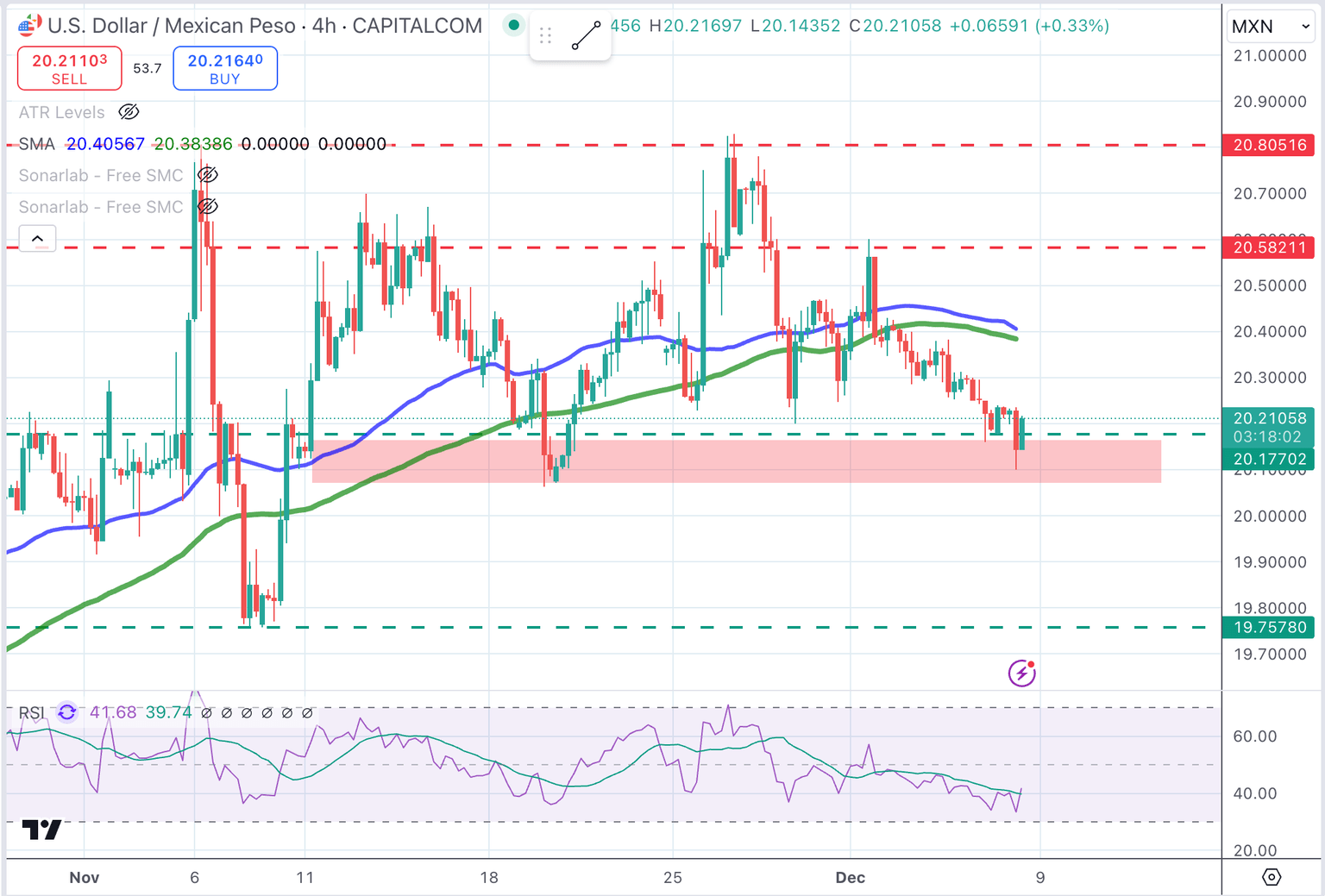

Mexican Peso technical outlook: USD/MXN tests support at 20.15

The immediate bias for USD/MXN is negative as it has retreated from the late November highs at around 20.80. However, the pair is also facing a strong support area between 20.05 and 20.15.

The 4-hour Relative Strength Index (RSI) is in bearish territory at around 38, and the double top at 20.80 suggests the possibility of a deeper correction.

Below the 20.00 psychological level, which is also the neckline of the mentioned double top, the next target would be November´s low at 19.75. Resistances are the December 2 high, at 20.60 and November’s peak, at 20.80.

USD/MXN 4-Hour Chart

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.