Mexican Peso strengthens on positive market sentiment

- The Mexican Peso rises as sentiment improves due to gains for tech giants and the easing of real-estate regulations in China.

- Microsoft and Alphabet stock prices soared at the end of last week, lifting the whole market higher.

- Speculation of the Chinese authorities easing property market regulations helps soothe investor fears, further supporting sentiment.

The Mexican Peso (MXN) trades higher against its key counterparts on Monday morning on the back of a wave of positive market sentiment. Asian stock indices noted gains at the end of their session, with Hong Kong’s Hang Seng Index up 1.6% and China’s Shanghai Composite closing up 0.79%.

USD/MXN is trading down 0.45% at 17.08, EUR/MXN is down over 0.28% at 18.29 and GBP/MXN is down at 21.41, at the time of publication during the US session.

Mexican Peso rises on wave of positive risk sentiment

The Mexican Peso makes gains at the start of the week as risk sentiment turns positive on speculation the Chinese Communist Party Central Committee's Political Bureau will meet in late April to discuss loosening property policies, according to Reuters.

Market sentiment is being further buoyed by the strong gains seen in US stocks on Friday as a result of expectation-beating first quarter results from Alphabet (GOOG) and Microsoft (MSFT).

On the data front, the Mexican labor market showed resilience after the release of the Unemployment Rate, which came in lower-than-expected at 2.3% in March from 2.5% previously, according to figures from INEGI. Analysts had been expecting a lesser decline to 2.4%.

Balance of Trade data, released at the same time, showed a higher-than-expected surplus of $2.098 billion in March from $1.195B in the same month of the previous year, and February’s 0.585B deficit, according to data from INEGI. The result was above expectations of a 0.700B surplus.

The data is more likely than not to lead the Banxico to delay further interest-rate cuts. The central bank reduced interest rates from 11.25% to 11.00% at its March meeting, however, it said future cuts would be data dependent. Maintaining higher interest rates for longer is likely to support the Mexican Peso going forward as higher interest rates attract more capital inflows.

Technical Analysis: USD/MXN extends sideways trend

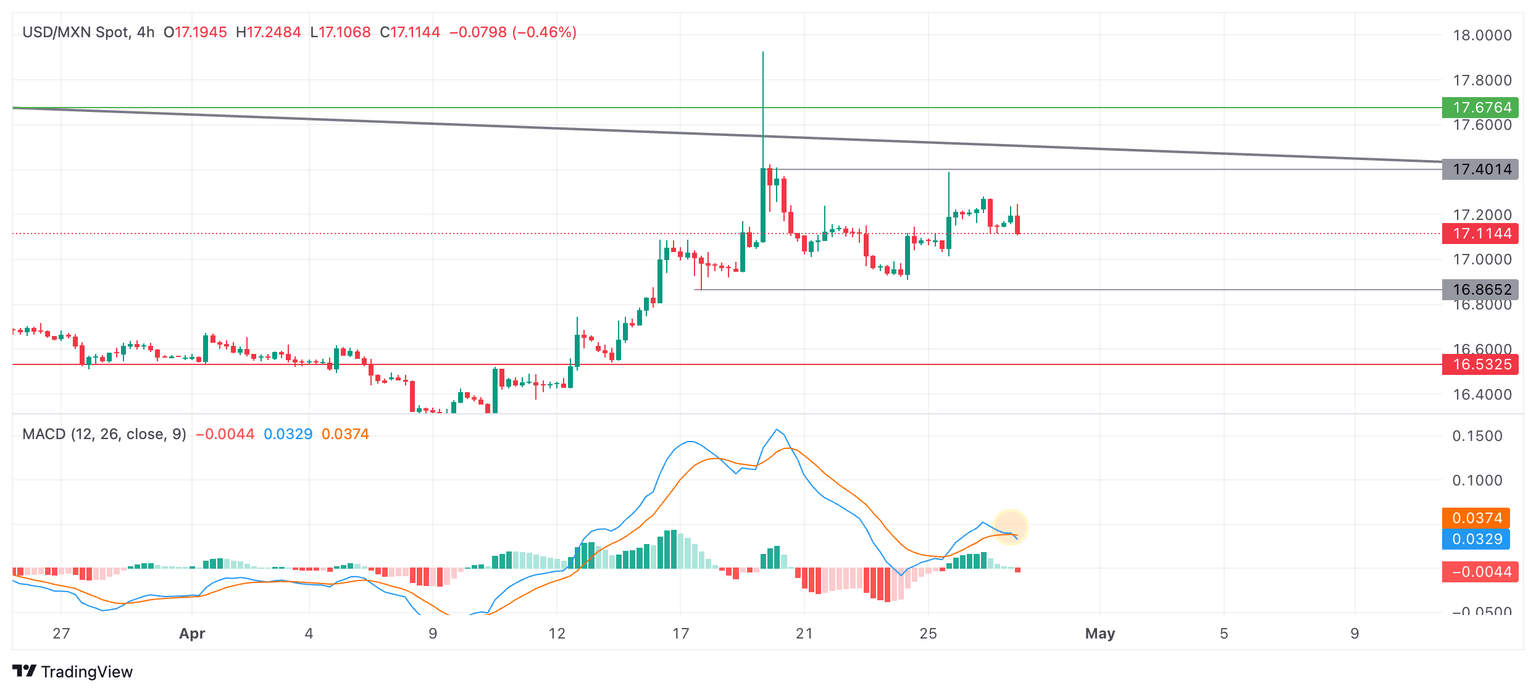

USD/MXN extends its sideways trend over the short-term horizon as it continues to seesaw between tepid gains and losses between range lows in the 16.80s and highs in the 17.40s.

USD/MXN 4-hour Chart

The Moving Average Convergence/ Divergence (MACD) momentum indicator has just crossed below its signal line, giving a sell signal and indicating the likelihood that USD/MXN will continue falling to the range floor. The signal is enhanced by the fact that MACD is more reliable in sideways market conditions.

A decisive breakout of the range, either below the range floor at 16.86 or range ceiling at 17.40, would change the directional bias of the pair.

A break below the floor could see further downside to a target at 16.50, followed by the April 9 low at 16.26.

On the other side, a breakout higher would activate an upside target first at 17.67, piercing a long-term trendline and then possibly reaching a further target at around 18.15.

A decisive break would be one characterized by a longer-than-average green or red daily candlestick that pierces above or below the range high or low, and that closes near its high or low for the period; or three green/red candlesticks in a row that pierce above/below the respective levels.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.