Mexican Peso recovers after four-day decline on Trump tariff fears

- The Mexican Peso rebounds but struggles to recover recent losses despite higher-than-expected economic growth in Q3.

- Technical trend-following and the threat of a Trump victory is probably a factor weighing on the Peso as polls show a close race.

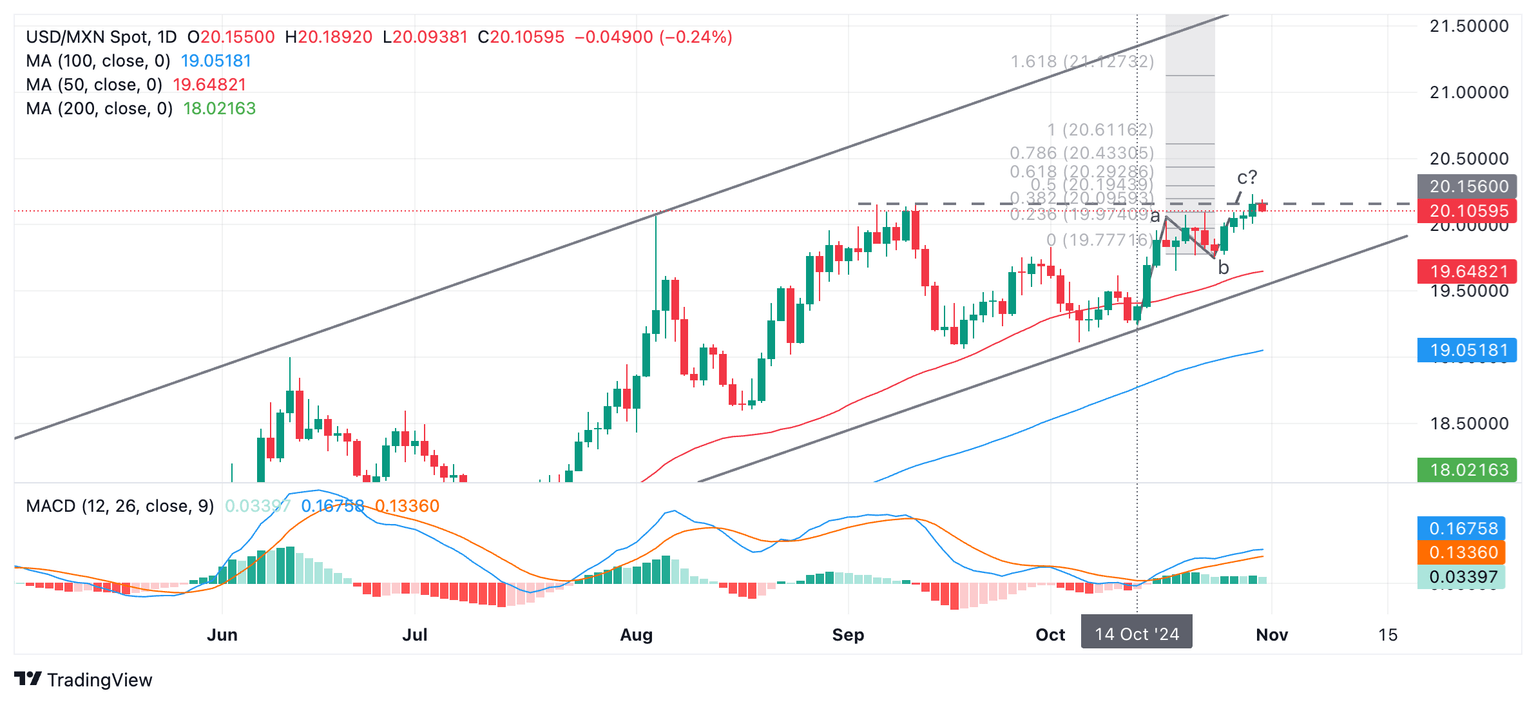

- USD/MXN continues unfolding a bullish ‘abc’ pattern.

The Mexican Peso (MXN) recovers in its key pairs – USD/MXN, EUR/MXN and GBP/MXN – on Thursday after weakening for four days running. The continuation lower comes despite a slight improvement in Mexican fundamentals as technical traders ride the Peso’s downtrend.

Mexican Peso struggles as US presidential election draws to a close

The Mexican Peso’s broad weakness could be attributed to the continuing high odds of former President Donald Trump winning the US presidential election on November 5 given his promise to place high tariffs on Mexican imports. In addition, Trump’s preference for lowering taxes despite a rising US debt pile could also potentially lead to higher US Treasury yields and boost the US Dollar (USD), directly impacting USD/MXN.

The election model on polling website FiveThirtyEight gives Trump a 52% chance of winning versus Vice President Kamala Harris’ 48%. Betting website OddsChecker offers fractional odds of 11/18 (or 62.1%) for a Trump win against 28/17 (or 37.8%) for a Kamala Harris victory. The latest opinion polls, however, still place Harris marginally in the lead with 48.1% for the Democrat nominee versus 46.7% for the Republican.

The direct negative impact of a Trump victory on Mexico might be ameliorated, however, by the reality of modern trade between the countries. US, Mexican and Canadian supply chains and economic ecosystems are now intertwined due to three decades of free trade agreements, Mexican imported goods are actually often composed of an amalgam of the three country’s components so tariffs would harm the US as much as Mexico.

Mexican Growth in Q3 beats estimates

The latest macroeconomic figures, meanwhile, offered some relief to the Peso but not enough to push back the tide. Mexican Gross Domestic Product (GDP) growth came out at 1.5% YoY in Q3, beating estimates of 1.2% but below the 2.1% registered in Q2, according to The Instituto Nacional de Estadistica Geografia e Informatica (INEGI). This follows 1.5% growth In Q1.

The Q3 result was exactly in line with the estimates of the International Monetary Fund (IMF), which downgraded its forecasts for Mexican economic growth by 1.5% for 2024.

On a quarterly basis, Mexican GDP rose by 1.0% QoQ, beating estimates of a 0.8% expansion and the previous quarter’s 0.2% increase.

The growth was broad-based and a positive development, however, it would not “preclude another rate cut in November” from the Bank of Mexico (Banxico), according to Kimberley Sperrfechter, Emerging Markets Economist at London-based advisory service Capital Economics. A cut to Mexico’s relatively attractive 10.50% base interest rate would attract less foreign capital inflows, pressuring the Peso lower.

“We still think the conditions are currently in place for Banxico to press ahead with another interest rate cut at its November meeting. But a lot will depend on the outcome of the US election. A Trump victory – and higher US Treasury yields and a stronger Dollar – would probably prompt Banxico to halt,” said Sperrfechter in a note.

Technical Analysis: USD/MXN extends C wave of bullish pattern

USD/MXN continues unfolding a leg higher, probably the “c wave” of a bullish “abc” pattern, which began at the October 14 swing low.

Wave c will probably reach the Fibonacci 61.8% of the length of wave “a”, giving an upside target of 20.29.

USD/MXN Daily Chart

USD/MXN is probably in an uptrend on a short, medium and long-term basis and is trading in a rising channel. Given the technical dictum “the trend is your friend,” the odds favor a continuation higher.

The original break above 19.83 (October 1 high) already confirmed a move up, with a target in the vicinity of the September 10 high at 20.13, which has now been met.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.