Mexican Peso retreats further after mixed US data

- The Mexican peso pulls away from the 20.00 level with the US Dollar steady near two-week highs.

- US Weekly Jobless Claims increased beyond expectations with Producer Prices underscoring the higher inflationary trends.

- Technically, the USD/MXN pair remains bearish, with upside attempts limited at 20.30.

The Mexican Peso (MXN) extends losses against the US Dollar (USD) on Thursday, pulling away from the key 20.00 level. The pair has failed to draw support from the mixed US economic figures with US Weekly Jobless Claims disappointing and November's Producer Price Index (PPI) accelerating beyond expectations. A deeper-than-expected deterioration of Mexico’s Industrial Output seen earlier today is weighing on the MXN.

The USD has been drawing some support from higher US Treasury yields, which have rallied for the last three days with investors paring back hopes of monetary easing for 2025. The strong US macroeconomic data and the outlook of higher inflationary pressures from Donald Trump’s policies are likely to limit the US central bank’s leeway to lower borrowing costs.

Earlier this week, softer-than-expected Mexican Consumer Prices Index data, coupled with a deteriorated Consumer Confidence index, has bolstered the case for a 25 bps cut by the Bank of Mexico next week.

Daily digest market movers: Weak Mexican data and higher US yields weigh on the MXN

- US Initial Jobless Claims increased by 242K in the first week of December against expectations of a moderate decline, to 220K in the first week of December. The previous week's reading has been upwardly revised to 225K from the previously estimated 224K.

- At the same time, data from the Bureau of Labor Statistics revealed a 0.4% increase in November's Producer Prices, twice as much as the 0.2% increment forecasted by the experts, following a 0.3% rise in October. Year-on-year, the PPI increased 3% against expectations of a steady 2.6% increase from October.

- The Core PPI eased to 0.2% on the month from 0.3% in October, while the yearly inflation accelerated at a 3.4% rate, beyond the consensus of 3.2%, from 3.1% in October.

- In Mexico the Industrial Production contracted by 1.2% in November, beyond market expectations of a 0.2% decline. Year-on-year, the Industrial Output declined 2.2% instead of the 0.6% expected. Data released in October showed a 0.6% monthly increase and a 0.4% decline in the previous 12 months.

- On Wednesday, US Consumer Price Index (CPI) figures revealed that inflation accelerated to 0.3% in November and to 2.7% on the year as expected, posting its largest increase in seven months.

- Futures markets, however, are now nearly fully pricing a 25 bps cut by the Fed next week. The CME Fed Watch tool shows a 98% chance of such a scenario, up from 85% earlier this week.

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

USD EUR GBP JPY CAD AUD NZD CHF USD 0.58% -0.03% 1.55% -0.04% -0.25% 0.74% 0.86% EUR -0.58% -0.59% 1.09% -0.54% -0.74% 0.24% 0.37% GBP 0.03% 0.59% 1.51% 0.05% -0.15% 0.84% 0.95% JPY -1.55% -1.09% -1.51% -1.61% -1.70% -0.93% -0.61% CAD 0.04% 0.54% -0.05% 1.61% -0.16% 0.79% 0.90% AUD 0.25% 0.74% 0.15% 1.70% 0.16% 0.99% 1.15% NZD -0.74% -0.24% -0.84% 0.93% -0.79% -0.99% 0.10% CHF -0.86% -0.37% -0.95% 0.61% -0.90% -1.15% -0.10% The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

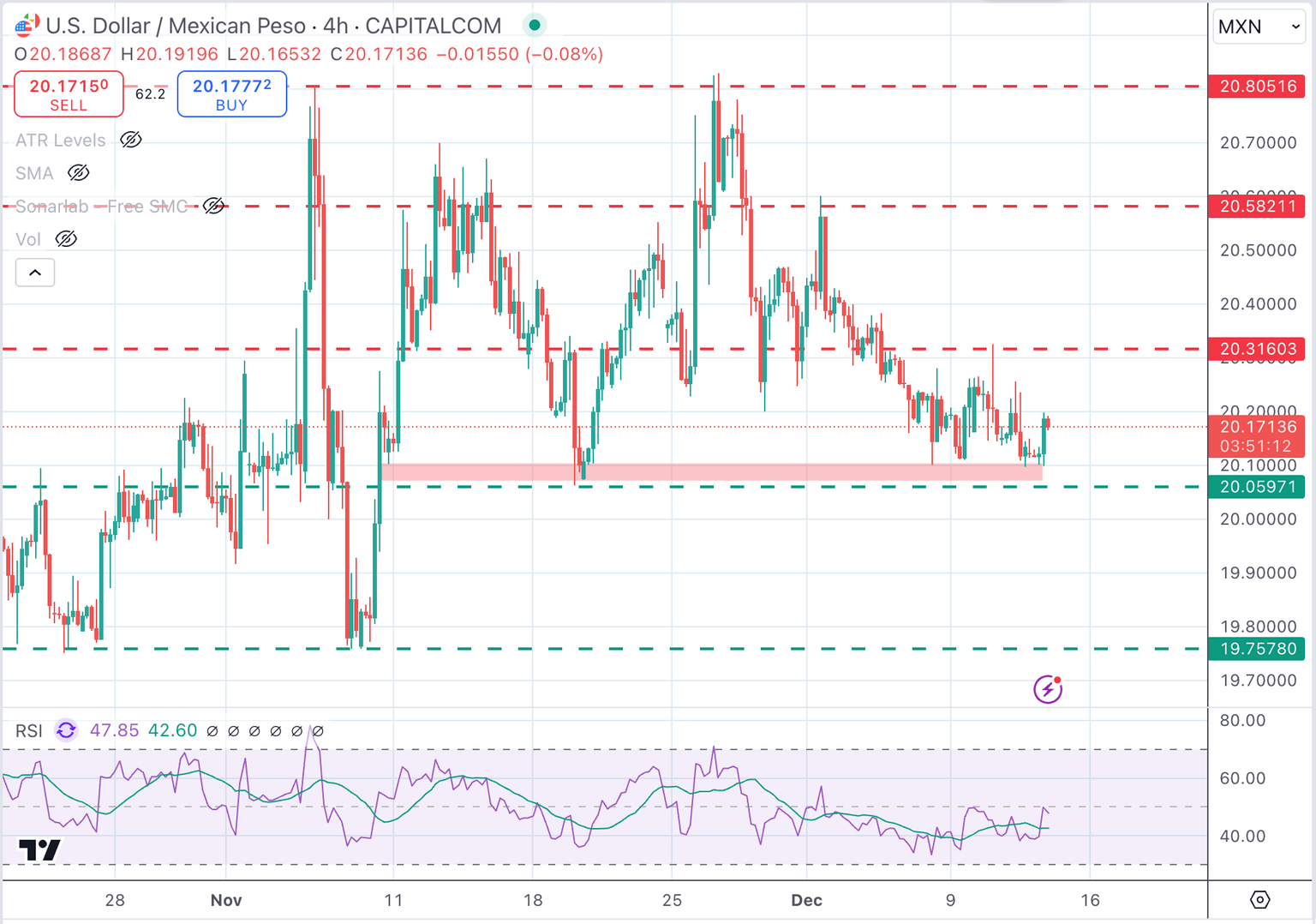

Mexican Peso technical outlook: USD/MXN remains supported above 20.00 key level

The USD/MXN pair remains steady above the 20.00 support area, with the December 5 high at the 20.30 area capping upside attempts. The pair is trading practically flat, awaiting US data.

The short-term bias remains bearish as a double top at 20.80 suggests the possibility of a deeper correction. The 20.00 psychological level is a key support. Below here the target is November’s low at 19.75.

On the upside, the December 5 high at 20.30 is holding upside attempts ahead of the December 2 high at 20.60 and November’s peak at around 20.80.

USD/MXN 4-Hour Chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.