Mexican Peso edges higher on improving risk appetite

- The Mexican Peso rises in its key pairs as investor risk appetite improves.

- China, Japan and South Korea reopen free-trade talks, tech stocks rally.

- Speculation of Banxico cutting interest rates in June is high, according to a leading poll.

The Mexican Peso (MXN) is rising in its key pairs due to strong investor risk appetite on Monday, which favors the Mexican Peso and commodity-linked currencies.

During the Asian session, stocks rose, with the Shanghai Composite clocking up gains of 1.14%; the Nikkei rising 0.61%, and Australia’s ASX200 up 0.83%. Optimism from the restarting of free-trade negotiations between China, Japan and South Korea – after they stalled in 2019 – and advances in technology stocks, were seen as factors supporting sentiment.

USD/MXN is exchanging hands at 16.68 at the time of writing, EUR/MXN is trading at 18.09 and GBP/MXN at 21.25.

Mexican Peso rises despite Citibanamex survey

The Mexican Peso recovers despite high expectations Banxico will lower interest rates this summer. A poll of economists held by Mexico’s second-largest bank, Citibanamex, showed that the majority of respondents estimated the Bank of Mexico (Banxico) will cut interest rates from 11.00% to 10.75% at its June 27 meeting. Lower interest rates are negative for a currency since they attract less foreign capital inflows.

The survey followed Banxico’s unanimous decision to keep interest rates unchanged at its May meeting.

Banxico’s May meeting Minutes showed policymakers championing a broad range of views, making it difficult to determine the future trajectory of Banxico’s policy rate. Stubborn services-sector inflation, however, appears to be a key factor holding Banxico back from planning further cuts.

The US Federal Reserve (Fed) is expected to further delay its first interest-rate cut after strong US economic data. The preliminary Purchasing Manager Index (PMI) data for May roundly beat expectations – especially in the services sector, which is also inflationary in the US. The odds of the Fed cutting in September are now at 49.4%, according to the CME FedWatch tool, which bases its calculations on interest-rate futures.

In Europe, meanwhile, European Central Bank (ECB) officials have all but committed to a June interest-rate cut although most policymakers appear to favor a data-dependent approach after that.

In the UK, the latest inflation data showed inflation cooling to 2.3%. However, this was not as low as expected. UK Retail Sales and data for April was weak although Consumer Confidence improved. Speculation remains high that the Bank of England (BoE) will cut interest rates in June as inflation declines closer to the BoE’s 2.0% target.

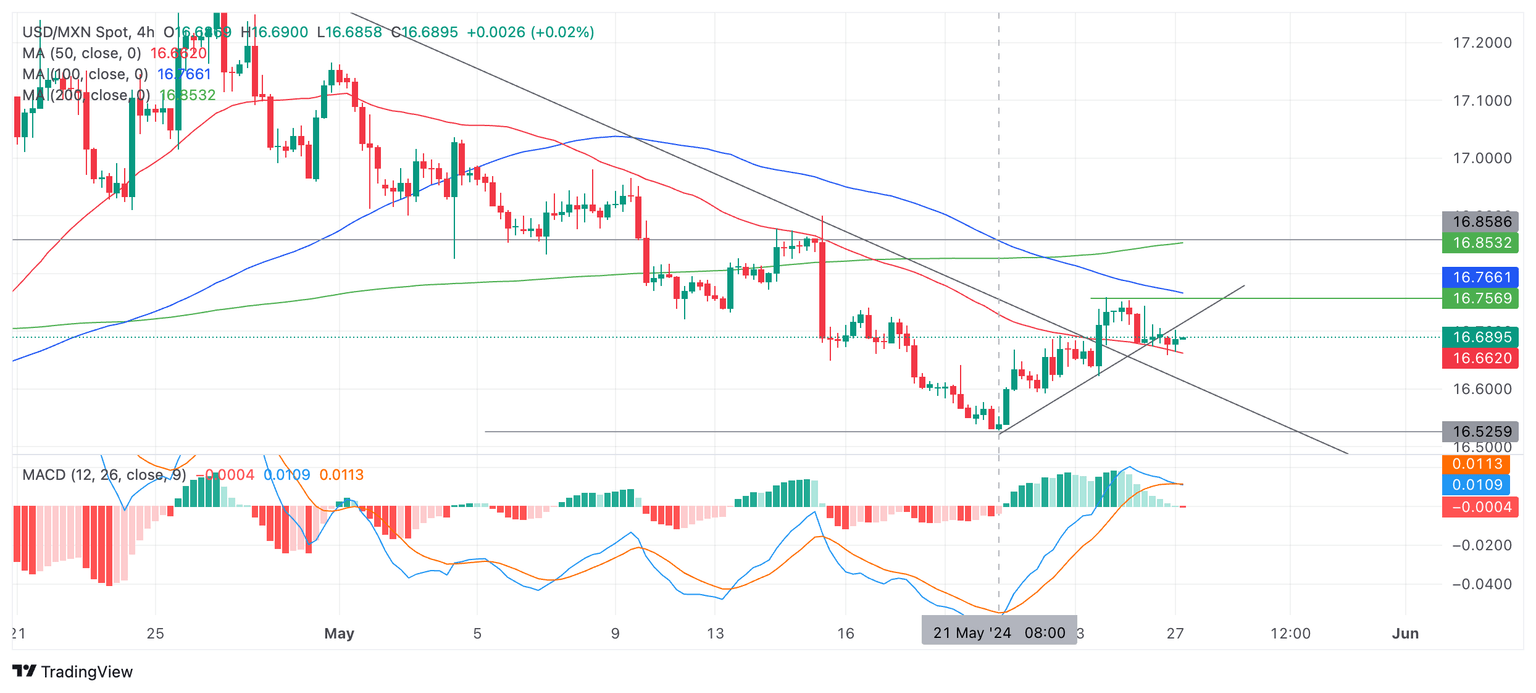

Technical Analysis: USD/MXN pulls back after tracking higher

USD/MXN – or the number of Pesos that can be bought with one US Dollar – has weakened a little since peaking on May 23, and has broken below the grey trendline of the recovery from the May 21 low. This has weakened the outlook somewhat, however, the new short-term uptrend remains intact and still favors longs over shorts.

USD/MXN 4-hour Chart

A break above the 16.76 (May 23 high) would probably confirm a continuation of the young uptrend to a possible target at the previous range lows around 16.85.

The Moving Average Convergence Divergence (MACD) indicator has crossed below its signal line, giving a sell signal and possibly indicating further weakness. A break below the swing low at 16.62 could indicate further weakness to the low of May 21 at 16.52.

Given the medium and long-term trends are bearish there also remains a risk of the pair continuing lower due to longer-term currents.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.