Mexican Peso crashes after Trump tariff threat

- The Mexican Peso declines steeply after Donald Trump says he will stop Mexican-made cars from entering the US.

- A critical report by the IMF about Mexico’s economic outlook further weighs.

- USD/MXN rallies strongly from its bedrock of support at the base of a rising channel.

The Mexican Peso (MXN) declines on Wednesday continuing its depreciation of the previous day when it lost an average of 1.5% in its most heavily traded pairs.

The Peso sold off after former US President Donald Trump said he would put tariffs of over “100%, 200% or even 300%” on Mexican cars entering the US to prevent a further erosion of the beleaguered US car industry by foreign competitors. This, along with a critical report about Mexico’s economy from the International Monetary Fund (IMF), contributed to the Peso’s steep sell-off.

Mexican Peso rolls off the back of the trailer during Trump interview

The Mexican Peso depreciated over 1.60% against the US Dollar (USD) on Tuesday after Donald Trump threatened to whack prohibitory tariffs on Mexican-made autos entering the US market.

“Mexico is a tremendous challenge for us,” said Trump in an interview with John Micklethwait, the Editor-in-Chief of Bloomberg News, “China is building massive auto plants in Mexico. And they are going to make those cars and then take those cars and sell them into the border – they are very near the border. And they are going to have all the advantages and none of the disadvantages. And that is going to be the end of Michigan, the end of South Carolina,” the former president said at the Chicago Economic Club.

Trump’s comments had all the more bite because, according to bookmakers he is now more likely to win the presidential election than Harris. According to OddsChecker Trump has an almost 58% probability of winning against Harris’ 42%.

That said, in the latest opinion polls, Vice-President Kamala Harris is still in the lead with 48.5% of the vote versus Trump’s 46.1%, according to FiveThirtyEight.

Mexican Peso hit by damaging IMF report

The Mexican Peso was further undermined after the release of an IMF report on the country, which highlighted a slowdown in activity and growth.

“Activity is decelerating. Despite an expansionary fiscal stance, growth is slowing to around 1.50% percent this year, partly due to binding capacity constraints and a tight monetary policy stance,” said the IMF report, adding, “Risks to growth are tilted to the downside while inflation risks remain on the upside.”

That said, the IMF saw inflation falling steadily to the Bank of Mexico’s (Banxico) 3.0% target in 2025.

Downside risks to the outlook came from weaker-than-expected growth in the US, an increase in global risk aversion, and the “unforeseen effects from recent institutional reforms”, said the IMF.

On the upside, the IMF highlighted Mexico’s unique nearshoring advantages given its proximity and current free-trade agreement with the US.

In relation to Mexico’s controversial new judicial reforms, which seek to have judges elected by popular vote rather than appointed, the IMF said these could “create important uncertainties about the effectiveness of contract enforcement and the predictability of the rule of law,” adding they were “a new source of uncertainty that may impinge upon private investment decisions.” However, overall, the IMF was optimistic about the new laws, saying, “Staff’s current baseline does not incorporate potential headwinds from these uncertainties.”

Technical Analysis: USD/MXN spikes from base of rising channel

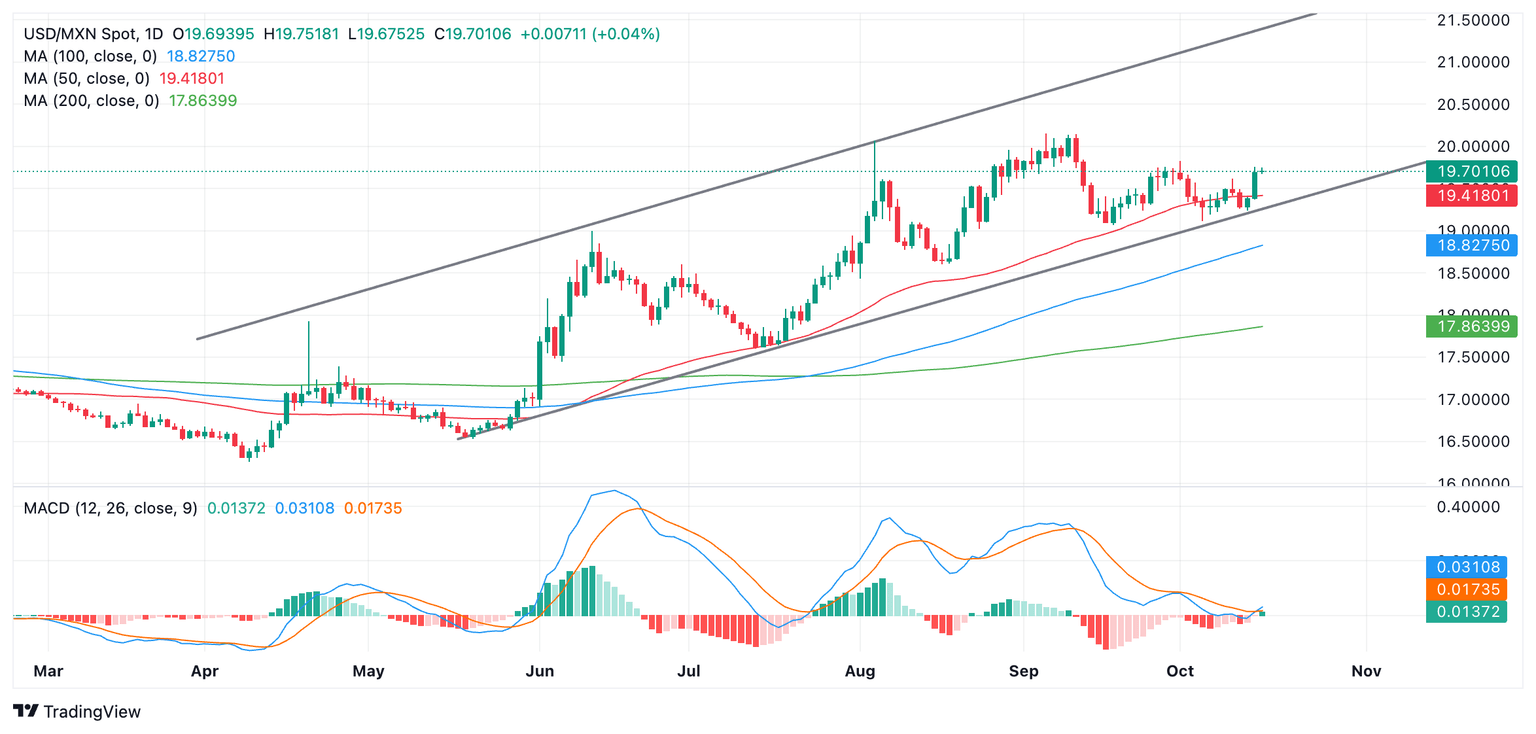

USD/MXN rallies from a strong belt of support at the base of a rising channel and the 50-day Simple Moving Average (SMA) situated at 19.42.

USD/MXN Daily Chart

USD/MXN is now probably in a short-term uptrend, and given the technical analysis principle that “the trend is your friend,” this favors a continuation higher.

The next target is at 19.83 (October 1 high), and a break above that would probably lead to a move up to 20.10 and the vicinity of the September 10 high.

The Moving Average Convergence Divergence (MACD) (blue) line has broken above its (red) signal line, further indicating a bullish bias.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.