McDonald's stock hurtles lower afterhours on E. coli outbreak

- McDonald's stock shrinks as much as 10% after E. coli outbreak.

- The bacteria has caused one death and ten hospitalizations in Colorado and Nebraska.

- Burger chain is working with CDC and other government agencies to find source of outbreak.

- The popular Quarter Pounder sandwich is believed to be the culprit.

/stock-market-graph-gm532464153-55981218_XtraLarge.jpg)

McDonald’s (MCD) stock plunged as much as 10% afterhours on Tuesday when the Centers for Disease Control (CDC) said that the burger chain had caused an outbreak of E. coli in the middle of the country.

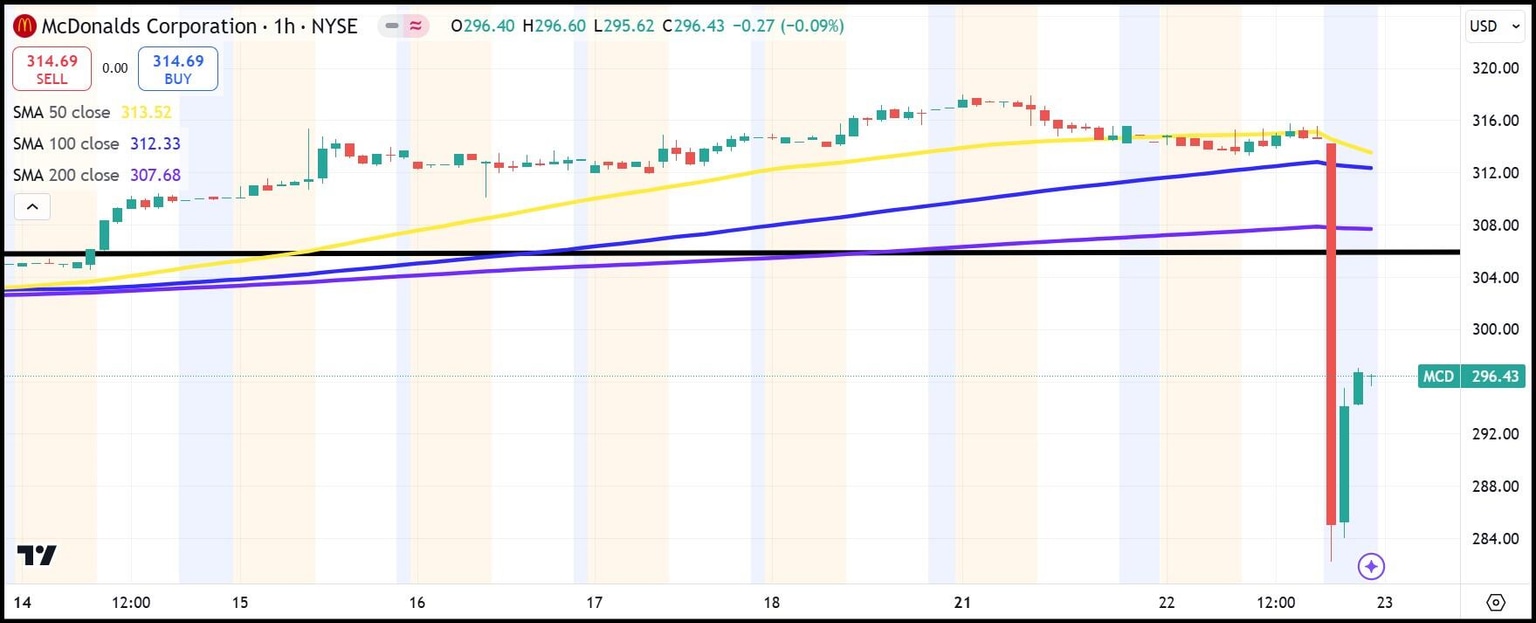

MCD stock dove from above $314 to the $280s but then recovered close to $296, down 5.8%, by the close of the afterhours trade.

The larger Dow Jones Industrial Average (DJIA) index, of which McDonald’s is a member, closed the regular session down ever so slightly, same as the S&P 500, while the NASDAQ advanced 0.18%.

McDonald’s stock news

The CDC says that about 10 people have been hospitalized so far and tested positive for E. coli, which is a bacteria that lives in the intestines of warm-blooded animals and humans. All of them have been connected to Quarter Pounders served by McDonald’s locations in Nebraska and Colorado.

So far, only one elderly individual has died from the bacteria outbreak, which often causes food poisoning.

The burger chain is working alongside the US Food & Drug Administration, the US Department of Agriculture, and the Food Safety & Inspection Service to determine as fast as possible which ingredient is making patrons sick. The company has already discontinued use of fresh slivered onions and Quarter Pounder beef patties in certain geographies in order to pinpoint the source of the outbreak.

Over the next few months, the news may cause worse profits at McDonald’s locations. But on hearing the news, the market immediately stoked the share prices of several competitors, including Shake Shack (SHAK) and Wendy’s (WEN).

McDonald's stock forecast

McDonald's shares dropped below a previous upward-sloping resistance level at $306. That's a bad sign as it took a long time to break above that level. MCD stock attempted it in May of 2023 and then again in January of this year. But it wasn't until mid-October that the area could be conquered.

If MCD can retake the $306 level in the next few weeks, that will be a bullish sign. Otherwise, expect McDonald's shares to search for support between the 100-day Simple Moving Average (SMA) near $277 and the 50-day SMA at $296.

MCD 1-hour stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.