Marriott International (MAR Stock) Q1 earning reports preview

Today, May 10, Marriott International – the largest US hospitality company, headquartered in Bethesda, Maryland, USA – is to announce its first quarterly report for 2021.

According to Zack’s investment research and based on nine analytical forecasts, the estimate consensus of earnings per share for the quarter is $0.03, while earnings per share for the same quarter of last year was $0.26.

Over the past two years, Marriott has achieved a victory in the earnings per share estimate 50% of the time, and also overturned revenue 25% of the time. In the past three months it has achieved four bullish reviews and 12 bearish reviews on the side. The preceding nine months of the past year saw no revenue assessment nor upward revision, but saw a decline in eight.

Technical analysis of Marriott International

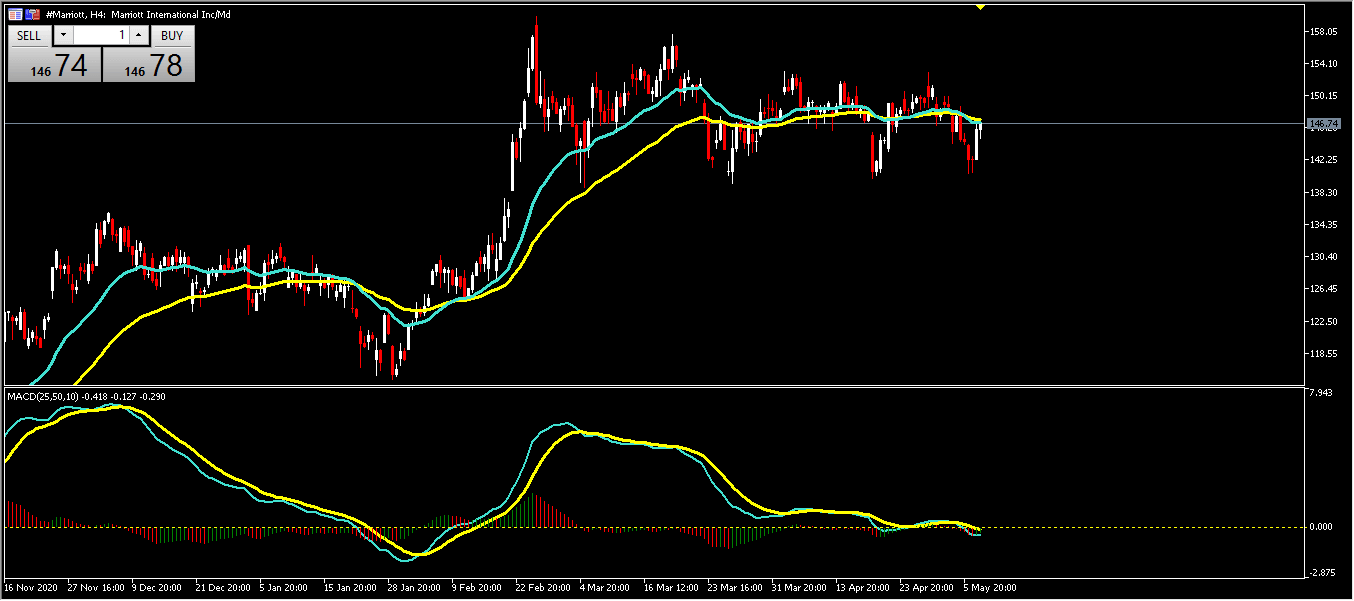

As shown by the above chart of the Marriott International stock price, on a four-hour timeframe, the price has risen tremendously since the beginning of 2021, from $115.90 per share to nearly $158.72 per share. Then it started moving in a sideways channel around $146.74 which was support and turned into resistance.

Many traders use the Relative Strength Index (RSI) to help make an appropriate decision: Should one continue or exit the trade? As shown in the previous figure for the share price on an hourly timeframe, the index was on the rise on May 7 until it reached 56.81.

The chart shows us the axes, resistance and support lines, and the main axis appears at approximately $142.00; resistance 1 is at $144.10, resistance 2 is at approximately $146.00, resistance 3 is at $147.85, while the support stands above $140.35.

The above chart indicates the movement of the stock price on the four-hour time frame of the green moving average lines of 25 and the yellow moving average 50, and that SMA 50 has broken and surpassed the moving average 20 at the beginning of last February, when the two lines began to converge. However, the MACD on the downside shows a slight increase in the 25-day moving average from the 50-day moving average.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.