LCID Stock News: Lucid Motors drops as Morgan Stanley hits the brakes

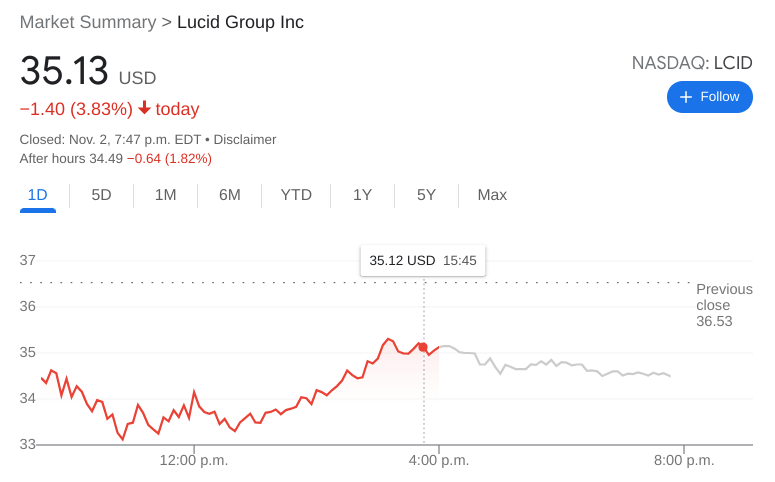

- NASDAQ:LCID fell by 3.83% during Tuesday’s trading session.

- Lucid bear Adam Jonas stands by his $12 price target for Lucid.

- Tesla tumbles on uncertainty surrounding Hertz deal from Musk.

NASDAQ:LCID has been stuck in reverse since the calendar flipped over from October to November. Shares of the red-hot electric vehicle maker have cooled since the company announced its inaugural deliveries would hit customers at the end of October. On Tuesday, Lucid’s stock fel a further 3.83% and closed the trading session at $35.13. Lucid’s stock has been on fire over the past month, gaining over 45% as retail investors piled in. Lucid once again lagged the broader markets as the NASDAQ, S&P 500, and Dow Jones all hit new all-time highs and closed in the green for the second straight session to start the month.

Stay up to speed with hot stocks' news!

Morgan Stanley analyst Adam Jonas has been a long-time bear of Lucid’s stock. On Tuesday, Jonas reiterated his stance on the stock, citing that a majority of the price action over the past month has been a result of retail investors buying up shares rather than institutions. Jonas stood by his incredibly bearish $12.00 price target for Lucid, which represents a near 70% downside from Tuesday’s closing price. Jonas continues to warn investors that Lucid has a long way to go before it can even be compared to the EV industry leader Tesla (NASDAQ:TSLA).

Lucid group stock price

Speaking of Tesla, shares of the company also cooled off on Tuesday as the stock fell by 3.03% to close the day at $1,171.97. Tesla CEO Elon Musk announced that despite the high flying stock, a deal with rental company Hertz has yet to be reached. On the other hand, Hertz has already reported that Tesla vehicle deliveries have already started. The confusion in the story caused some uncertainty for investors, and the stock was sold off as some decided to take their recent profits off the table.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet