LCID Stock News: Lucid Group Inc continues momentum despite EV stock weakness

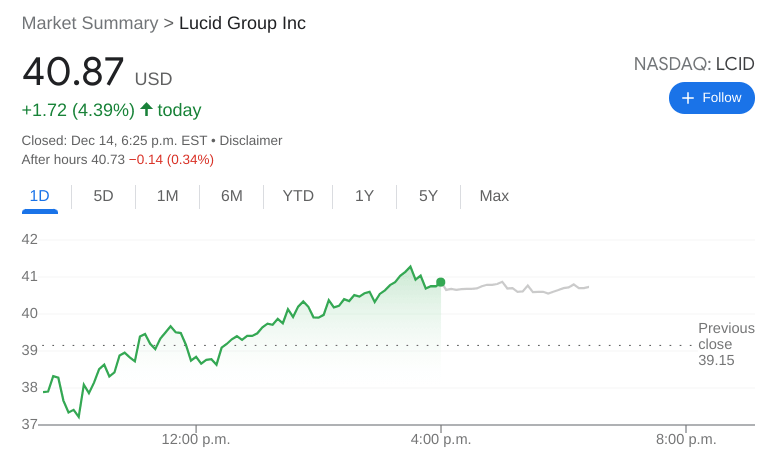

- NASDAQ:LCID gained 4.39% during Tuesday’s trading session.

- Lucid is trying to gain back momentum amidst recent headlines.

- Tesla falls yet again as Elon Musk continues to sell shares.

NASDAQ:LCID rode higher against the stream of red on Tuesday, as the EV stock shrugged off recent negativity for its second straight positive day. Shares of LCID gained 4.39% on Tuesday, and closed the trading session at $40.87. Growth stock valuations continued to get slashed as the NASDAQ index took another beating, this time dropping by 1.14% The Dow Jones and the S&P 500 also fell, as investors remained on edge ahead of the much anticipated Federal Reserve decision on removing easing policies on Wednesday. It is anticipated that the Fed will begin a transition away from these policies, even as the Omicron variant makes its way across the country.

Stay up to speed with hot stocks' news!

Last week was not the best week for Lucid investors, but the company is trying to win back public sentiment and get back on track. First, Lucid announced it was being investigated by the SEC over its merger with Churchill Capital. Then, Lucid announced after-hours that it is issuing a $1.75 billion debt offering to raise capital. Both of these headlines caused a panicked sell-off of Lucid’s stock. On Monday, it was announced that Lucid would be joining the exclusive NASDAQ-100 index, which shows that perhaps investors were overthinking the two negative headlines from the week before.

Lucid Motors stock price

Lucid’s chief rival Tesla (NASDAQ:TSLA) fell once again on Tuesday, as CEO Elon Musk continues to sell shares of his own company. While Musk has already sold in the neighborhood of $10-12 billion in stock, many believe this will continue until his goal of 10% is reached. This could mean a further $5 billion in shares by the end of the year. Tesla also announced it would be accepting the meme cryptocurrency DogeCoin to pay for some merchandise it would sell at its online store. The result was a surge in the price of DogeCoin amidst the ongoing cryptocurrency sell off.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet