Japanese Yen bears seem non-committed amid reviving BoJ rate hike bets

- The Japanese Yen struggles to capitalize on modest Asian session gains against the rebounding USD.

- Hawkish June BoJ meeting Minutes reaffirmed rate hike bets and should limit the JPY downside.

- Rising September Fed rate cut bets could act as a headwind for the USD and cap the USD/JPY pair.

The Japanese Yen (JPY) remains on the back foot against a broadly rebounding US Dollar (USD) and assists the USD/JPY pair to hold steady above the 147.00 mark heading into the European session on Tuesday. Investors remain concerned that domestic political uncertainty could complicate the Bank of Japan's (BoJ) policy normalization path. This, along with the prevalent risk-on environment, turns out to be a key factor undermining the JPY's safe-haven status.

Meanwhile, the June BoJ meeting Minutes reaffirmed market bets for an imminent interest rate hike by the year-end. Moreover, an upward revision of Japan's Services PMI holds back the JPY bears from placing aggressive bets. The USD, on the other hand, might struggle to capitalize on its intraday move up amid expectations that the Federal Reserve (Fed) will cut rates in September. This could cap the USD/JPY pair's intraday bounce from a nearly two-week low.

Japanese Yen bulls not ready to give up yet despite positive risk tone

- The Bank of Japan, in the Minutes of the June meeting released this Tuesday, reiterated that it will hike interest rates further if growth and inflation continue to advance in line with its estimates. The minutes also revealed that most BoJ members supported keeping interest rates unchanged for the time being amid heightened uncertainty over US trade tariffs.

- The S&P Global Japan Services PMI rose to 53.6 in July 2025, slightly above the flash estimate of 53.5 and up from 51.7 in the previous month, marking the fourth straight month of expansion and the fastest pace since February. Moreover, the composite PMI rose slightly to 51.6 last month, marking the strongest overall business activity growth since February.

- The ruling Liberal Democratic Party’s loss in the July 20 polls fueled concerns about Japan's fiscal health amid calls from the opposition to boost spending and cut taxes. This suggests that prospects for BoJ rate hikes could be delayed further. Moreover, BoJ Governor Kazuo Ueda last week downplayed inflation risks and signaled continued policy patience.

- Asian equity markets take cues from the overnight sharp rebound on Wall Street and scale higher during the Asian session on Tuesday. This, in turn, undermines demand for traditional safe-haven assets and contributes to capping the Japanese Yen. The US Dollar, on the other hand, gains some positive traction and further offers some support to the USD/JPY pair.

- Any meaningful USD appreciation seems elusive in the wake of the growing acceptance that the Federal Reserve will resume its rate-cutting cycle in September. The bets were lifted by Friday's weaker-than-expected US Nonfarm Payrolls report, which pointed to a cooling labor market. Moreover, concerns about the Fed's independence warrant caution for the USD bulls.

- US President Donald Trump ordered the firing of the head of the Bureau of Labor Statistics hours after the dismal employment details. Moreover, Fed Governor Adriana Kugler resigned from her position on the central bank’s board. This comes amid relentless political pressure on Fed Chair Jerome Powell to lower borrowing costs and should keep a lid on the USD.

- Meanwhile, the CME Group's FedWatch Tool implies over 80% chance of a Fed rate cut in September and around 65 basis points of easing by the end of this year. This keeps US Treasury bond yields depressed and weighs on the USD, which, in turn, might act as a headwind for the USD/JPY pair and warrant some caution before positioning for any meaningful recovery.

- Traders now look forward to the release of the US ISM Services PMI for a fresh impetus later during the North American session. Apart from this, comments from influential FOMC members will play a key role in driving the USD demand. This, along with the broader risk sentiment, should produce short-term trading opportunities around the USD/JPY pair.

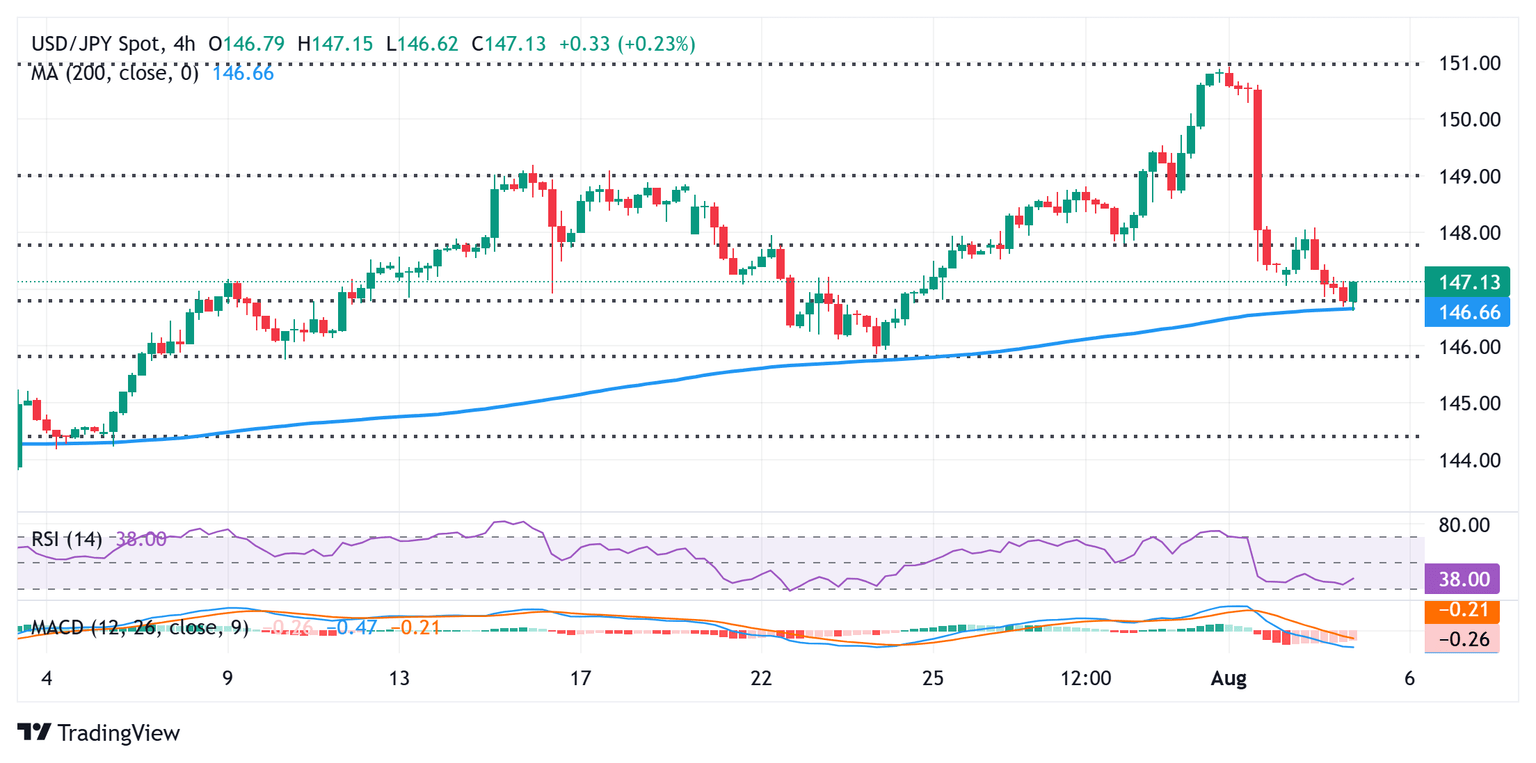

USD/JPY is more likely to face immediate hurdle and remain capped near the 147.35 region

From a technical perspective, spot prices showed some resilience below the 50% retracement level of the rally from the July swing low, and the subsequent move back above the 147.00 mark warrants caution for the USD/JPY bears. Meanwhile, neutral oscillators on the daily chart suggest that any further recovery is more likely to confront an immediate hurdle near the 147.35 area ahead of the 147.75 region, or the 38.2% Fibonacci retracement level and the 148.00 round figure. A sustained strength beyond the latter will suggest that the USD/JPY pair has formed a near-term bottom and shift the bias in favor of bullish traders.

On the flip side, the 50% retracement level, around the 146.85 region, now seems to act as an immediate support. Some follow-through selling below the Asian session low, around the 146.60 area, could make the USD/JPY pair vulnerable to accelerate the fall towards the 146.00 mark. The downward trajectory could extend further and eventually drag spot prices to the 145.85 zone, or the 61.8% Fibo. retracement level.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.17% | 0.00% | 0.01% | 0.03% | 0.06% | 0.27% | 0.28% | |

| EUR | -0.17% | -0.16% | -0.12% | -0.13% | -0.19% | 0.04% | 0.12% | |

| GBP | -0.01% | 0.16% | -0.02% | 0.03% | -0.02% | 0.19% | 0.15% | |

| JPY | -0.01% | 0.12% | 0.02% | 0.04% | 0.14% | 0.24% | 0.27% | |

| CAD | -0.03% | 0.13% | -0.03% | -0.04% | -0.03% | 0.16% | 0.12% | |

| AUD | -0.06% | 0.19% | 0.02% | -0.14% | 0.03% | 0.25% | 0.18% | |

| NZD | -0.27% | -0.04% | -0.19% | -0.24% | -0.16% | -0.25% | 0.03% | |

| CHF | -0.28% | -0.12% | -0.15% | -0.27% | -0.12% | -0.18% | -0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.