Japanese Yen traders seem reluctant amid BoJ uncertainty; a softer USD caps USD/JPY

- The Japanese Yen lacks a firm intraday direction amid the holiday-thinned liquidity on Monday.

- The uncertainty over the timing of the next BoJ rate hike keeps the JPY bulls on the defensive.

- Rising Fed rate cut bets undermine the USD and act as a headwind for the USD/JPY pair.

The Japanese Yen (JPY) seesaws between tepid gains/minor losses against its American counterpart through the early European session on Monday amid mixed fundamental cues. The prevalent risk-on environment, along with the uncertainty over the likely timing of the next interest rate hike by the Bank of Japan (BoJ), is seen undermining the safe-haven JPY. However, the divergent BoJ-Federal Reserve (Fed) policy expectations hold back the JPY bears from placing aggressive bets.

Investors seem convinced that the BoJ will raise interest rates by the end of this year. In contrast, the US central bank is expected to resume its rate-cutting cycle in September. This keeps the US Dollar (USD) depressed near a two-week low touched on Friday and acts as a tailwind for the lower-yielding JPY. Apart from this, nervousness ahead of the US-Russia bilateral talks on Ukraine offers some support to the JPY and contributes to keeping the USD/JPY pair below the 147.75-147.80 hurdle.

Japanese Yen extends the range play as receding safe-haven demand offsets BoJ rate hike bets

- The Japanese Yen consolidates in a range during the Asian session on Monday amid the uncertainty over the likely timing of the next interest rate hike by the Bank of Japan (BoJ). In fact, the central bank left the door open for further policy normalization at the end of the July policy meeting. However, BoJ's Summary of Opinions showed on Friday that policymakers remain worried about the potential negative impact of higher US tariffs on the domestic economy, tempering expectations for an immediate rate hike.

- Major Asian indices, along with US equity futures, crept higher at the start of a new week. This turns out to be another factor undermining the safe-haven JPY. Investors, however, remain on edge amid the looming US tariff deadline on China, due to expire on Tuesday. Meanwhile, US President Donald Trump and Russian leader Vladimir Putin will meet in Alaska on Friday to discuss Ukraine. This might further contribute to keeping a lid on the market optimism and hold back traders from placing aggressive directional bets.

- The US Dollar attracts fresh sellers and erases a major part of Friday's modest recovery gains amid rising bets for more interest rate cuts by the Federal Reserve. The expectations were reaffirmed by Fed Governor Michelle Bowman's dovish remarks on Saturday, saying that three interest rate cuts will likely be appropriate this year. Bowman added that the apparent weakening in the labor market outweighs the risks of higher inflation to come. Traders are currently pricing in a nearly 90% chance of a rate cut in September.

- There isn't any relevant market-moving economic data due for release from the US on Monday, leaving the USD at the mercy of comments from influential FOMC members. The focus, meanwhile, will remain glued to the latest US consumer inflation figures on Tuesday. Apart from this, the preliminary Q2 GDP print from Japan and the US Producer Price Index on Thursday could provide a fresh impetus to the USD/JPY pair. The mixed fundamental backdrop, however, warrants caution before positioning for a firm near-term direction.

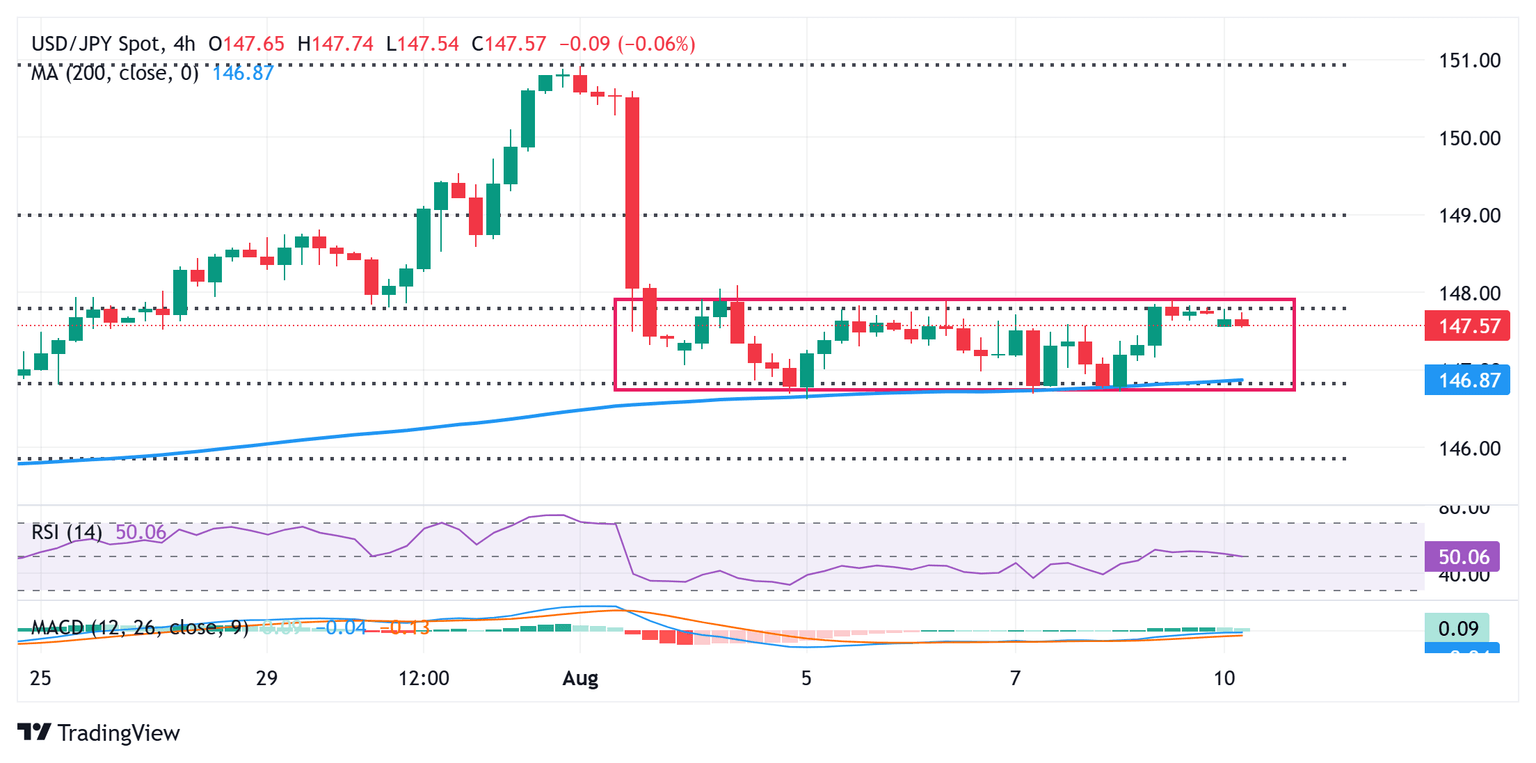

USD/JPY bulls await move and acceptance above the 147.75-147.80 hurdle before placing fresh bets

Spot prices remain confined in a familiar range held over the past week or so, forming a rectangle pattern and pointing to a consolidation phase amid neutral technical indicators on hourly/daily charts. Hence, it will be prudent to wait for a sustained move and acceptance above the 147.75-147.80 barrier, representing the 38.2% Fibonacci retracement level of the upswing in July, before positioning for any further gains. Some follow-through buying beyond the 148.00 mark would be seen as a key trigger for bulls and lift the USD/JPY pair to the 148.45-148.50 region. The momentum could extend further towards the 23.6% Fibo. retracement level, just ahead of the 149.00 mark.

On the flip side, the 147.00 round figure now seems to protect the immediate downside ahead of the 146.80-146.75 confluence – comprising the 200-period Simple Moving Average (SMA) on the 4-hour and the 50% Fibo. retracement level. A convincing break below should pave the way for deeper losses and drag the USD/JPY pair to sub-146.00 levels, or the 61.8% Fibo. retracement level. Spot prices could extend the slide further and eventually drop to the 145.00 psychological mark.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.10% | -0.10% | 0.04% | 0.10% | 0.10% | 0.28% | -0.17% | |

| EUR | 0.10% | 0.00% | 0.15% | 0.21% | 0.21% | 0.34% | -0.06% | |

| GBP | 0.10% | -0.01% | 0.10% | 0.21% | 0.20% | 0.33% | -0.07% | |

| JPY | -0.04% | -0.15% | -0.10% | 0.10% | 0.10% | 0.31% | -0.07% | |

| CAD | -0.10% | -0.21% | -0.21% | -0.10% | 0.00% | 0.13% | -0.28% | |

| AUD | -0.10% | -0.21% | -0.20% | -0.10% | -0.00% | 0.13% | -0.27% | |

| NZD | -0.28% | -0.34% | -0.33% | -0.31% | -0.13% | -0.13% | -0.39% | |

| CHF | 0.17% | 0.06% | 0.07% | 0.07% | 0.28% | 0.27% | 0.39% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.