Japanese Yen weakens as traders brace for Fed’s Powell speech

- The Japanese Yen loses ground amid the stronger USD in Wednesday’s early European session.

- Growing expectations of the BoJ rate hike in December and safe-haven flows might help limit the JPY’s losses.

- Investors brace for the US economic data and Fed’s Powell speech on Wednesday.

The Japanese Yen (JPY) trades in negative territory on Wednesday. The upbeat US Manufacturing PMI data and job openings data this week indicated that the US economy remains robust, lifting the Greenback. However, traders are increasingly confident that the Bank of Japan (BOJ) may hike interest rates this month. This, in turn, might support the JPY in the near term.

Furthermore, the ongoing political uncertainty in France, the political tension in South Korea and escalating geopolitical risks in the Middle East could boost the safe-haven flows, benefitting the JPY against the USD. Investors will keep an eye on the US ADP Employment Change report, final S&P Global Services PMI, ISM Services PMI and the Fed’s Beige Book, which are due later on Wednesday. The Federal Reserve’s (Fed) Chair Jerome Powell is scheduled to speak later in the same day.

Japanese Yen drifts lower amid the firmer US Dollar broadly

- Japan's Nikkei 225 futures opened up 0.15% and the South Korean Kospi opened down -1.97% after martial law was proposed then rejected by parliamentary action.

- The final reading of Japan’s Jibun Bank Services PMI improved to 50.5 in November versus 50.2 prior. This reading came in stronger than the 50.2 expected.

- The BoJ Governor Kazuo Ueda said on Saturday that the central bank will adjust the degree of monetary easing at the appropriate time if it becomes confident that the underlying inflation rises toward 2%.

- The US JOLTS Job Openings rose to 7.74 million in October, compared to 7.37 million openings in September, according to the US Bureau of Labor Statistics (BLS) on Tuesday. This reading came in higher than the market expectation of 7.48 million.

- Fed Governor Adriana Kugler said the labor market remains solid, and inflation appears to be on a sustainable path to the Fed's 2% target. However, Kugler underscored that the central bank’s policy decisions are not on a preset course.

- San Francisco Fed President Mary Daly stated that an interest rate cut in the December meeting isn’t certain but remains on the table for policymakers.

- Chicago Fed President Austan Goolsbee noted he expects interest rates will “come down a fair amount from where they are now” over the next year, per Bloomberg.

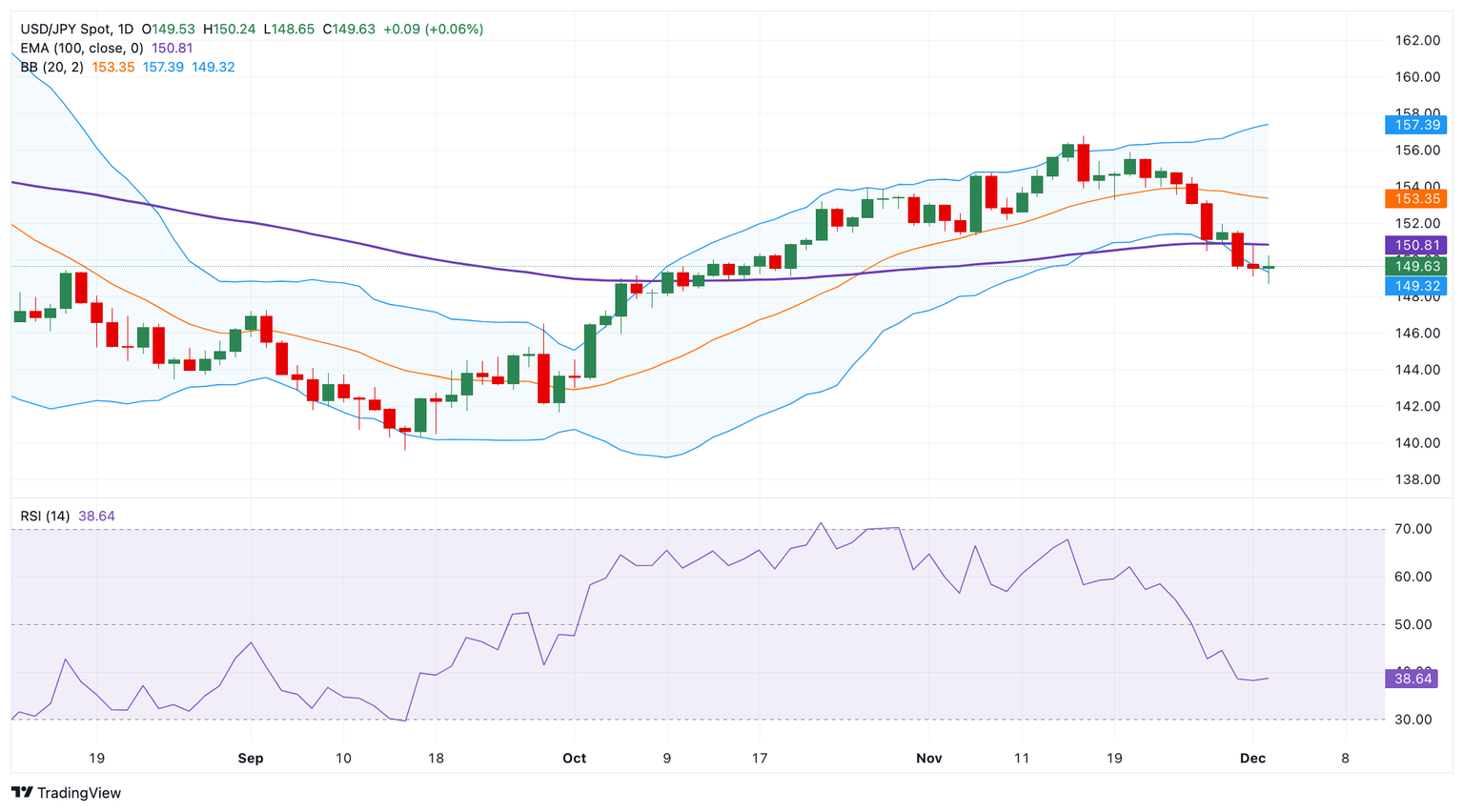

USD/JPY turns bearish in the longer term

A break below the lower Bollinger Band of 149.33 could set off an even steeper slide for the pair to 147.18, the high of September 2. Further south, the next support level is seen at 143.62, the low of August 6.

On the brighter side, the crucial resistance level emerges at the 150.00 psychological mark. Sustained upside momentum could even take it all the way to the next hurdle at 154.70, the high of November 6. A decisive break above the mentioned level could attract enough bullish energy to lift USD/JPY back up to 155.89, the high of November 20.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.