Japanese Yen trims a part of intraday losses against a broadly weaker USD

- The Japanese Yen underperforms against a weaker USD amid domestic political uncertainty.

- A positive risk tone further undermines the safe-haven JPY and supports the USD/JPY pair.

- The divergent BoJ-Fed policy expectations might cap any meaningful gains for the major.

The Japanese Yen (JPY) recovers slightly against a broadly weaker US Dollar (USD), though it retains its negative bias through the early European session on Friday amid the Bank of Japan (BoJ) ambiguity. Investors now seem concerned that Japanese Prime Minister Shigeru Ishiba’s successor might put pressure on the central bank to keep interest rates low. However, the incoming macro data from Japan keeps hopes alive for an imminent BoJ rate hike by the end of this year.

Apart from this, the prevalent risk-on environment is seen as another factor behind the safe-haven JPY's underperformance. The USD, on the other hand, languishes near its lowest level since July 24 amid rising bets for a more aggressive policy easing by the Federal Reserve (Fed). This, in turn, is seen offering some support to the lower yielding JPY. Hence, it will be prudent to wait for some follow-through buying before positioning for any further appreciation for the USD/JPY pair.

Japanese Yen traders seem non-committed amid mixed fundamental cues

- Japanese Prime Minister Shigeru Ishiba's resignation adds a layer of uncertainty, which could temporarily hinder the Bank of Japan from normalising policy and continue to act as a headwind for the Japanese Yen.

- Wall Street's three major indices registered record closing highs on Thursday amid the growing acceptance that the US Federal Reserve will cut interest rates next week, which further undermines the safe-haven JPY.

- The optimism over the US-Japan trade deal, an upward revision of Japan's Q2 GDP print, a rise in Producer Price Index, positive real wages, and a rise in household spending back the case for an imminent BoJ rate hike.

- In contrast, traders ramped up their bets for three interest rate cuts by the Federal Reserve (Fed) this year after data on Thursday showed the US Weekly Initial Jobless Claims rose to the highest level since October 2021.

- This comes on top of a weak US Nonfarm Payrolls report last Friday and provides further evidence of the softening labor market, which, in turn, overshadowed a higher-than-expected US consumer inflation reading.

- The US Bureau of Labor Statistics (BLS) reported that the headline Consumer Price Index (CPI rose by a seasonally adjusted 0.4% in August, pushing the annual inflation rate to 2.9% compared to 2.7% recorded in July.

- Meanwhile, the core CPI inflation, which excludes volatile food and energy prices, increased 0.3% for the month and 3.1% on a yearly basis in August, matching the previous month's print and consensus estimate.

- According to the CME Group’s FedWatch Tool, traders have fully priced in a 25-basis-point rate cut at the FOMC meeting next week and see a greater chance of two more rate cuts, in October and in December.

- The dovish outlook dragged the yield on the benchmark 10-year US government bond to a five-month low and the US Dollar to its lowest level since July 24, which could act as a headwind for the USD/JPY pair.

- Traders now look to the release of the Preliminary University of Michigan US Consumer Sentiment and Inflation Expectations, which could influence the USD demand and provide some impetus to the currency pair.

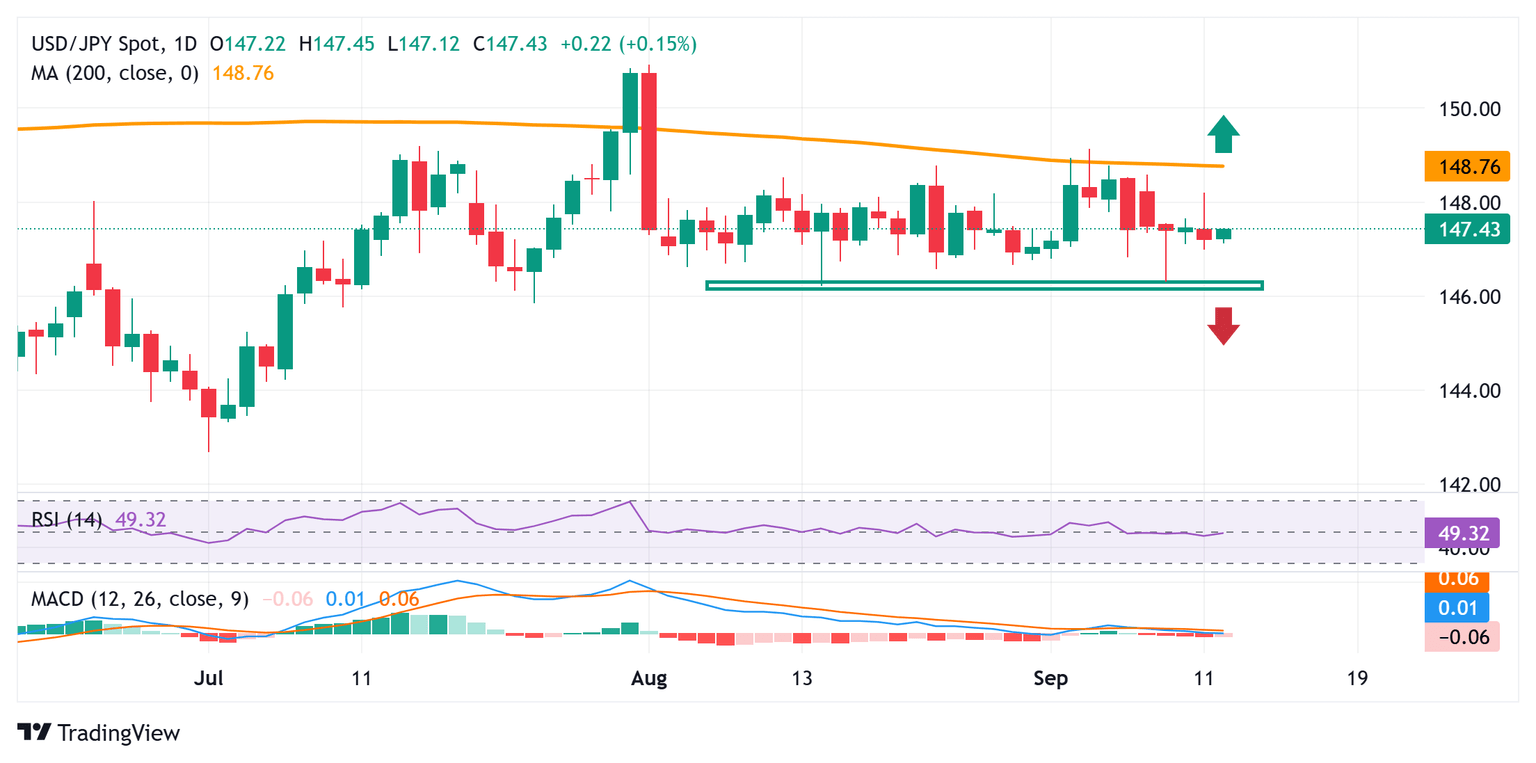

USD/JPY needs to find acceptance above 148.00 to back the case for any further gains

The overnight resilience below the 147.00 mark and the subsequent bounce favor the USD/JPY bulls, though neutral technical indicators on the daily chart warrant some caution. Hence, any further move up is more likely to confront a stiff resistance near the 148.15-148.20 region, or the overnight swing high. A sustained strength beyond, however, should pave the way for a move toward challenging the very important 200-day Simple Moving Average (SMA), currently pegged near the 148.75 zone. This is closely followed by the 149.00 mark and the monthly swing high, around the 149.15 region, which, if cleared decisively, will be seen as a fresh trigger for bulls.

On the flip side, acceptance below the 147.00 round figure would expose the 146.30-146.20 pivotal support. A convincing break below, leading to a subsequent breakdown through the 146.00 mark, could make the USD/JPY pair vulnerable to accelerate the fall to the 145.35 intermediate support en route to the 145.00 psychological mark.

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Sep 12, 2025 14:00 (Prel)

Frequency: Monthly

Consensus: 58

Previous: 58.2

Source: University of Michigan

Consumer exuberance can translate into greater spending and faster economic growth, implying a stronger labor market and a potential pick-up in inflation, helping turn the Fed hawkish. This survey’s popularity among analysts (mentioned more frequently than CB Consumer Confidence) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but foremost because it gauges consumer attitudes on financial and income situations. Actual figures beating consensus tend to be USD bullish.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.