Japanese Yen bounces off weekly low, flat lines against USD amid Trump-Xi trade talk chatter

- The Japanese Yen seesaws between tepid gains/minor losses against its American counterpart.

- An upward revision of Japan’s Services PMI lifts BoJ rate hike bets and favors the JPY bulls.

- Safe-haven buying could further benefit the JPY amid the divergent BoJ-Fed expectations.

The Japanese Yen (JPY) recovers slightly from a fresh weekly low touched against its American counterpart this Wednesday and drags the USD/JPY pair back below the 144.00 mark heading into the European session. An upward revision of Japan's Services PMI, along with expectations that higher wages will boost inflation, backs the case for more interest rate hikes by the Bank of Japan (BoJ). Adding to this, persistent geopolitical risks and trade-related uncertainties act as a tailwind for the JPY.

Meanwhile, BoJ Governor Kazuo Ueda's cautious remarks on Tuesday fueled speculations that the next interest rate hike won't come soon. This, along with calls for the BoJ to slow tapering beyond 2026 and a generally positive risk tone, holds back traders from placing aggressive bullish bets around the safe-haven JPY and should limit the downside for the USD/JPY pair. Traders now look forward to the US macro data and speeches by influential FOMC members for short-term opportunities.

Japanese Yen traders seem non-committed as receding safe-haven demand offsets hawkish BoJ expectations

- A private sector survey showed on Wednesday that growth in Japan’s service-sector activity slowed less than estimated in May. The final au Jibun Bank Japan Services Purchasing Managers’ Index (PMI) was revised from a 50.8 flash reading to 51.0. This was below the previous month's final print of 52.4, though it signaled a second consecutive expansion in services activity.

- The data keeps hopes for another interest rate hike by the Bank of Japan (BoJ) during the second half of the year and provides a modest lift to the Japanese Yen during the Asian session. Meanwhile, BoJ Governor Kazuo Ueda sounded cautious on Tuesday and said in the parliament that uncertainties over overseas trade policies, economic and price situations remain extremely high.

- Ueda added that there is no preset plan for rate hikes and that he won't push for higher interest rates unless the economy is strong enough to take it. Moreover, reports that Japan's Prime Minister Shigeru Ishiba may dissolve parliament for a snap general election if the main opposition party submits a no-confidence motion, might cap any further gains for the JPY.

- The US Dollar struggles to capitalize on the previous day's recovery from the lowest level since April 22 amid the growing acceptance that the Federal Reserve (Fed) will lower borrowing costs further by the end of this year. Adding to this concerns about the worsening US fiscal situation and the economic fallout from trade tariffs keep the USD bulls on the defensive.

- The increase in steel and aluminum import tariffs from 25% to 50% will be effective from Wednesday. Meanwhile, several White House officials said in recent days that US President Donald Trump and Chinese President Xi Jinping will hold a call this week, likely on Friday, which could help to revitalize trade negotiations between the world's two largest economies.

- On the economic data front, the US Bureau of Labor Statistics (BLS) reported in the Job Openings and Labor Turnover Survey (JOLTS) on Tuesday that showed that the number of job openings on the last business day of April stood at 7.39 million. This reading followed the 7.2 million openings recorded in March and came in above the market expectation of 7.1 million.

- Traders now look forward to the release of the ADP report on US private-sector employment for some impetus in the run-up to the crucial US Nonfarm Payrolls (NFP) report on Friday. Wednesday's US economic docket also features the release of the ISM Services PMI, which should influence the USD price dynamics and provide short-term impetus to the USD/JPY pair.

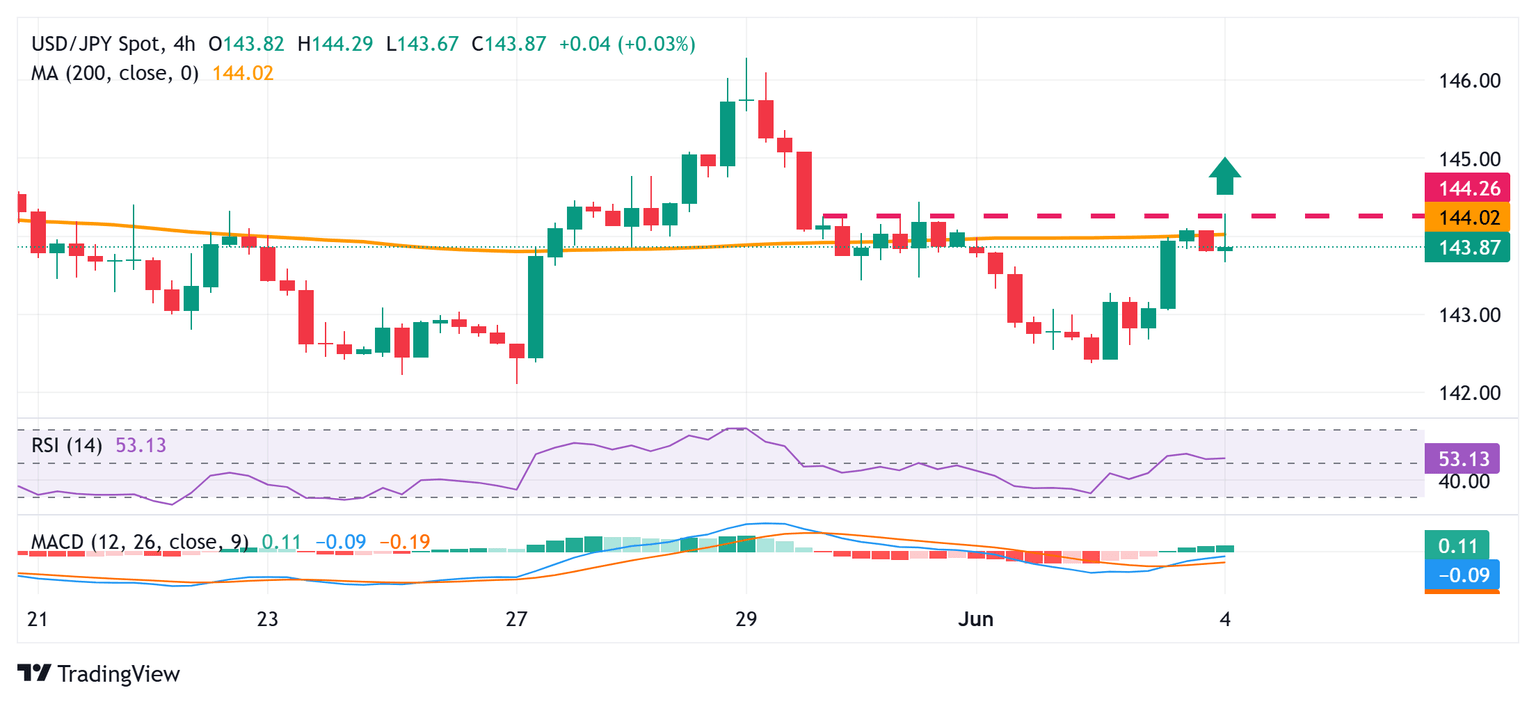

USD/JPY could climb further while above the 200-period SMA on the 4-hour chart

Technical indicators on the daily chart have been recovering and have just started gaining positive traction on the 4-hour chart. This, in turn, favors the USD/JPY bulls, though an intraday failure to find acceptance above the 200-period Simple Moving Average (SMA) warrants some caution. Hence, it will be prudent to wait for some follow-through buying beyond the Asian session peak, around the 144.30 area before positioning for any further appreciating move. Spot prices might then aim to reclaim the 145.00 psychological mark, with some intermediate hurdle near the 144.75-144.80 region.

On the flip side, the 143.50-143.45 area now seems to act as immediate support, below which the USD/JPY pair could slide to the 143.00 round figure. Follow-through selling would drag spot prices to the 142.40-142.35 region, or the weekly trough set on Tuesday, en route to the 142.10 area, or the May monthly swing low touched last week.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.