Japanese Yen remains on the front foot against USD; bulls lack conviction ahead of US NFP

- The Japanese Yen regains positive traction on Friday in reaction to upbeat domestic data.

- Furthermore, trade optimism overshadows the risk-on mood and further supports the JPY.

- Fed rate cut bets undermine the USD and also weigh on USD/JPY ahead of the US NFP.

The Japanese Yen (JPY) struggles to capitalize on its modest intraday gains against a broadly weaker US Dollar (USD) as traders opt to move to the sidelines ahead of the release of the US Nonfarm Payrolls (NFP) report. The crucial jobs data will play a key role in influencing market expectations about the Federal Reserve's (Fed) rate-cut path, which, in turn, will drive the USD and provide some meaningful impetus to the USD/JPY pair.

In the meantime, a generally positive risk tone and domestic political uncertainty seem to act as a headwind for the safe-haven JPY. However, the growing acceptance that the Bank of Japan (BoJ) will stick to its policy normalization path, bolstered by the upbeat wage growth data from Japan, favors the JPY bulls. This suggests that the path of least resistance for the USD/JPY pair is to the downside and backs the case for further losses.

Japanese Yen bulls turn cautious amid positive risk tone, political uncertainty, ahead of US NFP

- Data published by the Labour Ministry earlier this Friday showed that Japan’s nominal wages rose 4.1% year-on-year in July 2025, the fastest pace in seven months and above expectations for a 3% increase. Moreover, inflation-adjusted real wages, a key gauge of household purchasing power, turned positive for the first time since December and climbed 0.5% in July.

- Meanwhile, the consumer inflation rate the ministry uses to calculate real wages, which includes fresh food prices but not rent costs, rose 3.6% year-on-year in July. This was the slowest pace since November last year, though it far exceeded the Bank of Japan's 2% inflation target and reaffirmed market bets for an imminent interest rate hike by the end of this year.

- A separate government report showed that Japan's household spending in July rose 1.4% from a year earlier, falling short of the median market forecast for a 2.3% rise. On a seasonally adjusted, month-on-month basis, spending increased 1.7%, versus an estimated 1.3% rise. Adding to this, the trade optimism provides a modest lift to the Japanese Yen during the Asian session.

- US President Donald Trump signed an executive order on Thursday formalizing the lower tariffs on Japanese automobile imports, from the current 27.5% to 15%, and other products that were announced in July. The changes will take effect in seven days of being published in the Federal Register and removes a major uncertainty, which, in turn, boosts investors' confidence.

- The US Dollar continues with its struggle to attract any meaningful buyers amid the growing acceptance that the US Federal Reserve will lower borrowing costs later this month. Moreover, traders are pricing in a greater chance of at least two 25-basis-point rate cuts by the end of this year. This turns out to be another factor exerting pressure on the USD/JPY pair.

- Investors now look forward to the release of the closely-watched US monthly employment details, due later during the North American session. The popularly known Nonfarm Payrolls report will play a key role in influencing expectations about the Fed's rate-cut path, which, in turn, will drive the USD and determine the near-term trajectory for the USD/JPY pair.

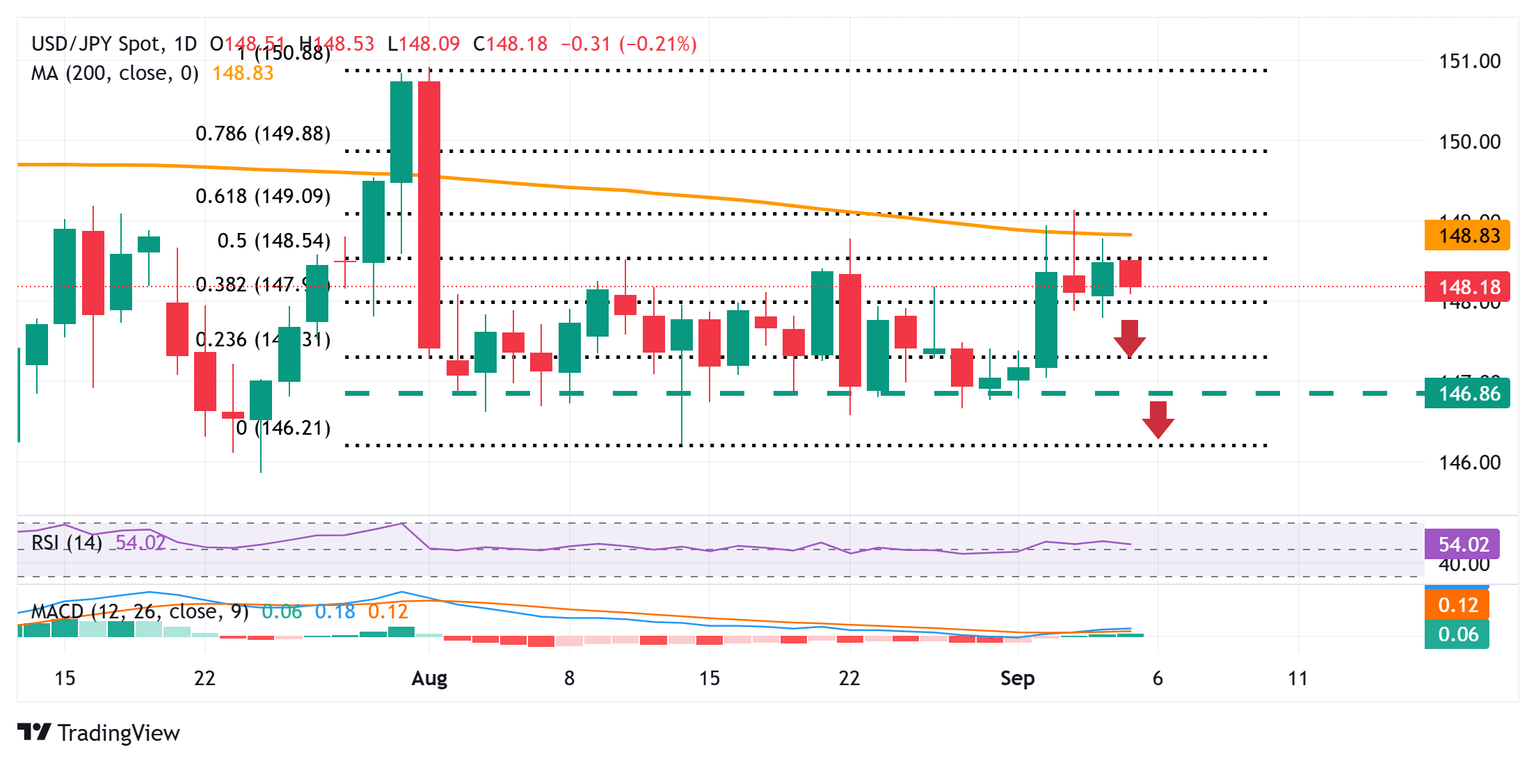

USD/JPY needs to find acceptance below 148.00 to back the case for further depreciating move

From a technical perspective, the back to back failures near the 200-day Simple Moving Average (SMA) over the past two days and the subsequent slide favor the USD/JPY bears. However, slightly positive oscillators on the daily chart make it prudent to wait for some follow-through selling and acceptance below the 148.00 mark before positioning for further losses. Spot prices might then accelerate the fall to the 147.40 intermediate support en route to the 147.00 mark and the 146.70 horizontal zone. A convincing break below the latter would expose the August swing low, around the 146.20 region, before spot prices eventually drop to the 146.00 mark.

On the flip side, the 200-day SMA, currently pegged near the 148.75-148.80 region, might continue to act as an immediate hurdle ahead of the 1.4900 mark and the 149.20 area, or a one-month high touched earlier this week. The latter represents the 61.8% Fibonacci retracement level of the downfall from the August monthly swing high, which, if cleared decisively, would shift the bias in favor of bullish traders. The USD/JPY pair might then aim to reclaim the 150.00 psychological mark and extend the momentum further towards challenging the August monthly swing high, around the 151.00 neighborhood.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Sep 05, 2025 12:30

Frequency: Monthly

Consensus: 75K

Previous: 73K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.