Japanese Yen refreshes multi-month low against USD; seems vulnerable post-BoJ

- The Japanese Yen reverses modest intraday gains after the BoJ monetary policy update.

- The BoJ upgraded its inflation forecast, leaving the door open for rate hikes later this year.

- A modest USD pullback from a multi-month top contributes to capping the USD/JPY pair.

The Japanese Yen (JPY) attracts fresh sellers following an intraday uptick led by the upbeat macro data and the Bank of Japan's (BoJ) decision to maintain the status quo. The BoJ's unwillingness to pre-commit to interest rate hikes turns out to be a key factor undermining the JPY. Furthermore, signs of cooling inflation in Japan and domestic political uncertainty might complicate the BoJ's policy normalization path. This, along with the underlying US Dollar (USD) bullish sentiment, lifts the USD/JPY pair to a fresh high since early April during the early part of the European session on Wednesday.

Meanwhile, the recent US-Japan trade deal has removed economic uncertainty. Furthermore, an upward revision of the BoJ's inflation forecast keeps the door open for an imminent interest rate hike before the end of this year. This, in turn, holds back the JPY bears from placing aggressive bets. The USD, on the other hand, edges lower following the previous day's hawkish Federal Reserve (Fed)-inspired rally to a two-month peak and contributes to capping the USD/JPY pair. Traders also seem reluctant and opt to wait for the release of the US inflation figures before placing directional bets.

Japanese Yen bears look to regain control after the BoJ policy update

- A preliminary government report showed this Thursday that Industrial Production in Japan rose 1.7% from the previous month in June, beating consensus estimates and signaling resilience among manufacturers despite headwinds from US trade tariffs.

- A separate report revealed that Retail Sales in Japan grew for the 39th consecutive month, by 2.0% year-on-year in June. This marked a slight uptick from the previous month's downwardly revised 1.9% growth and also exceeded market expectations.

- The latter signaled that Japanese private consumption remained strong despite headwinds from sticky inflation and economic uncertainty. This, along with the US-Japan trade deal, keeps hopes alive for the Bank of Japan rate hike later this year.

- As was widely anticipated, the BoJ decided to maintain the status quo at the end of the July meeting. The central bank revised its Core CPI forecast to +2.7% for the fiscal year 2025 vs the previous +2.2%. Moreover, the BoJ reiterated that it will continue to raise the policy rate if the economy and prices move in line with the forecast.

- In the post-meeting press conference, BoJ Governor Kazuo Ueda said that Japan's economy is recovering moderately and that the US-Japan trade deal reduces uncertainty over economic outlook. Ueda added that the BoJ will look at the data to come out without any preconception and will make appropriate decision at each meeting.

- The ruling Liberal Democratic Party’s loss in the July 20 polls fueled concerns about Japan's fiscal health amid calls from the opposition to boost spending and cut taxes. This suggests that prospects for BoJ rate hikes could be delayed for a bit longer.

- Meanwhile, the US Federal Reserve kept interest rates unchanged on Wednesday in a split decision that saw two governors dissenting for the first time since 1993. Furthermore, Fed Chair Jerome Powell tempered hopes for a rate cut in September.

- Addressing reporters during the post-meeting press conference, Powell said it was too soon to say whether the Fed would cut rates at its next meeting and that the current modestly restrictive monetary policy has not been holding back the economy.

- This adds to the early optimism driven by the upbeat US macro data and pushes the US Dollar to its highest level since late May. The ADP report showed that private-sector payrolls surged by 104K in July, reversing June’s 33K decline and beating estimates.

- Furthermore, the Advance US Gross Domestic Product (GDP) report published by the US Commerce Department showed that the economy expanded at a 3.0% annualized pace during the second quarter, following a 0.5% contraction in the first quarter.

- Thursday's US economic docket features the release of the Personal Consumption Expenditure (PCE) Price Index, which will influence the USD price dynamics and provide some impetus to the USD/JPY pair later during the North American session.

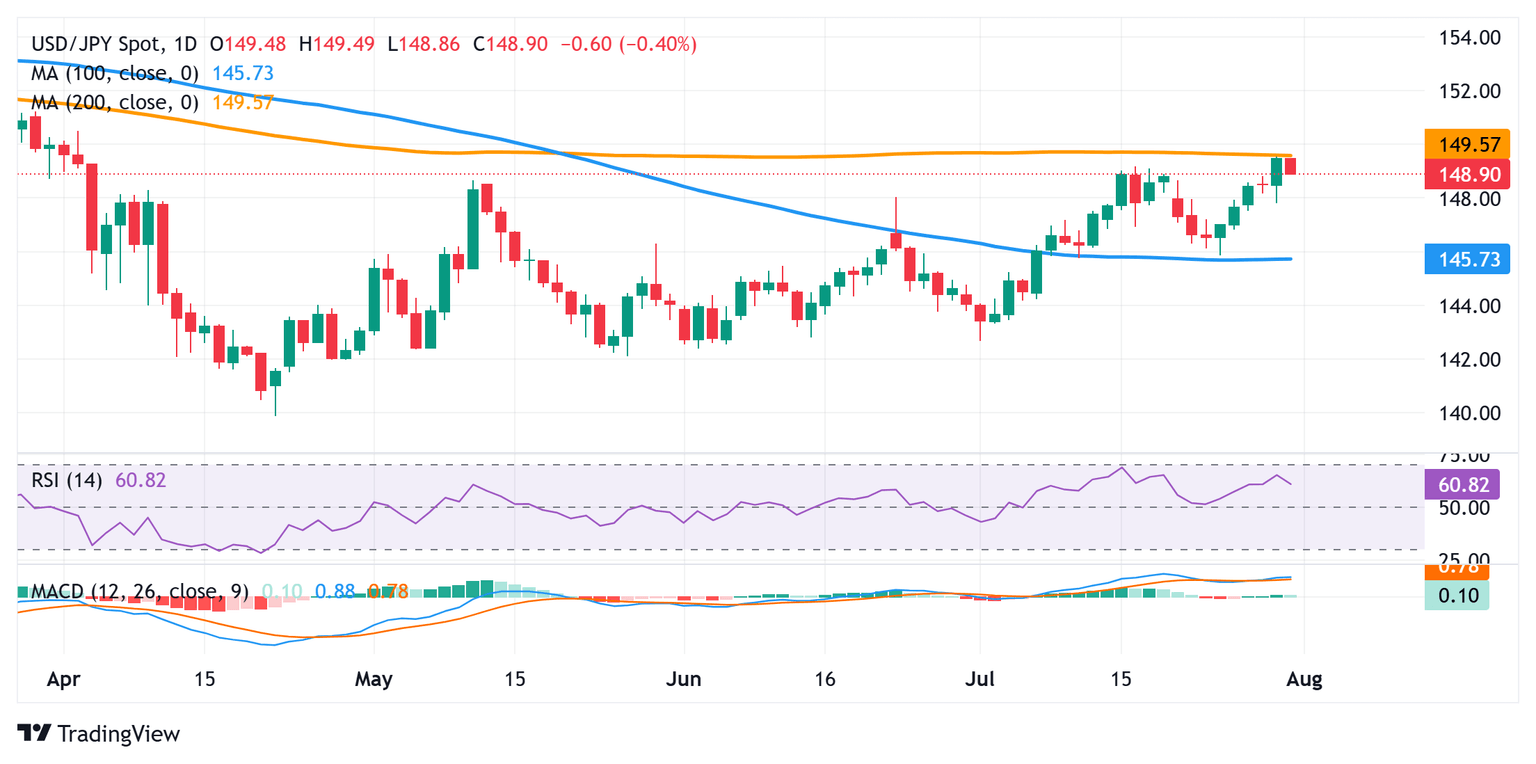

USD/JPY needs to find acceptance above the 200-day SMA to back the case for further gains

From a technical perspective, the USD/JPY pair stalls the post-Fed move higher near the 200-day Simple Moving Average (SMA). The said barrier is pegged near the 149.55 region and should now act as an immediate hurdle. Given that oscillators on the daily chart have been gaining positive traction, sustained strength beyond should pave the way for a move towards reclaiming the 150.00 psychological mark. The momentum could extend further towards the next relevant hurdle near the 150.40 area before spot prices eventually climb to the 151.00 round figure.

On the flip side, any further corrective slide could find decent support near the 148.55 region, below which the USD/JPY pair could slide to the 148.00 mark and the overnight swing low, around the 147.80 area. Failure to defend the said support levels might then drag spot prices to the 147.00 mark en route to the 100-day SMA support, currently pegged near the 146.70 region. The latter coincides with last week's swing low, which, if broken, might shift the near-term bias in favor of bearish traders and pave the way for a slide towards testing sub-146.00 levels.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.