Japanese Yen hangs near multi-month low against USD ahead of Japan election on Sunday

- The Japanese Yen continues to be undermined by reduced BoJ rate hike bets.

- Japan’s National CPI report does little to provide any meaningful impetus.

- Traders might opt to wait for Japan’s upper house elections over the weekend.

The Japanese Yen (JPY) drifts lower against its American counterpart for the second straight day on Friday and remains within striking distance of an over three-month low touched earlier this week. Investors now seem convinced that the Bank of Japan (BoJ) would forgo raising interest rates this year amid worries about the economic fallout from higher US tariffs. Apart from this, the prevalent risk-on environment is seen as another factor undermining the safe-haven JPY.

Traders, however, might refrain from placing aggressive bearish bets around the JPY and opt to move to the sidelines ahead of Japan's upper house elections on Sunday. The US Dollar (USD), on the other hand, is weighed down by dovish comments from Federal Reserve (Fed) Governor Christopher Waller. However, bets that the Fed will delay cutting interest rates act as a tailwind for the Greenback and the USD/JPY pair, which remains on track to post its second straight weekly gains.

Japanese Yen remains on the back foot as traders brace for Japan's upper house election

- House of Councillors elections are scheduled to be held in Japan this Sunday, on July 20. This is seen as a critical mid‑term test for Prime Minister Shigeru Ishiba’s embattled coalition of the Liberal Democratic Party (LDP) and Komeito.

- Recent media polls suggest that the shaky minority government will likely lose its majority, heightening the risk of political instability and stoking fears of an increase in debt, amid calls from the opposition to boost spending and cut taxes.

- This comes at a time when Japan is struggling to strike a trade deal with the US and might complicate the Bank of Japan's (BoJ) policy normalization path, which continues to undermine the Japanese Yen amid the upbeat market mood.

- Meanwhile, the latest data released by the Japan Statistics Bureau this Friday showed that the National Consumer Price Index (CPI) rose by 3.3% YoY in June and the gauge excluding fresh food prices arrived at 3.3%, down from 3.7% prior.

- Furthermore, CPI ex Fresh Food and Energy rose 3.4% during the reported month compared to the reading of 3.3% in May. The data offers some relief to the BoJ, which is set to update its inflation projections at the July policy meeting.

- Meanwhile, traders have been scaling back their expectations for an immediate interest rate cut by the Federal Reserve amid the evidence that the Trump administration's increasing import taxes are passing through to consumer prices.

- Fed governor Adriana Kugler said on Thursday that the still-restrictive policy stance is important to keep longer-run inflation expectations anchored, and it will be appropriate to hold the policy rate at the current level for some time.

- Atlanta Fed President Raphael Bostic, in an interview with the Wall Street Journal, noted that rate cuts might be difficult in the short run and that the economic outlook remains highly uncertain as tariff adjustments could take months.

- San Francisco Fed President Mary Daly said that despite the overall progress on inflation, the central bank still has some work to do on inflation. Whether the rate cut happens in July or September isn't most relevant, Daly added further.

- Separately, Fed Governor Christopher Waller said that rising risks to the economy favour easing the policy rate and the central bank should cut its interest rate target in July amid evidence that the labour market is growing weaker.

- This, in turn, drags the US Dollar away from a fresh monthly high, touched on Thursday following the release of upbeat US macro data, and keeps the USD/JPY pair below its highest level in more than three months.

- Traders now look to the release of Preliminary Michigan US Consumer Sentiment and Inflation Expectations, and the US housing market data – Building Permits and Housing Starts – for some impetus later this Friday.

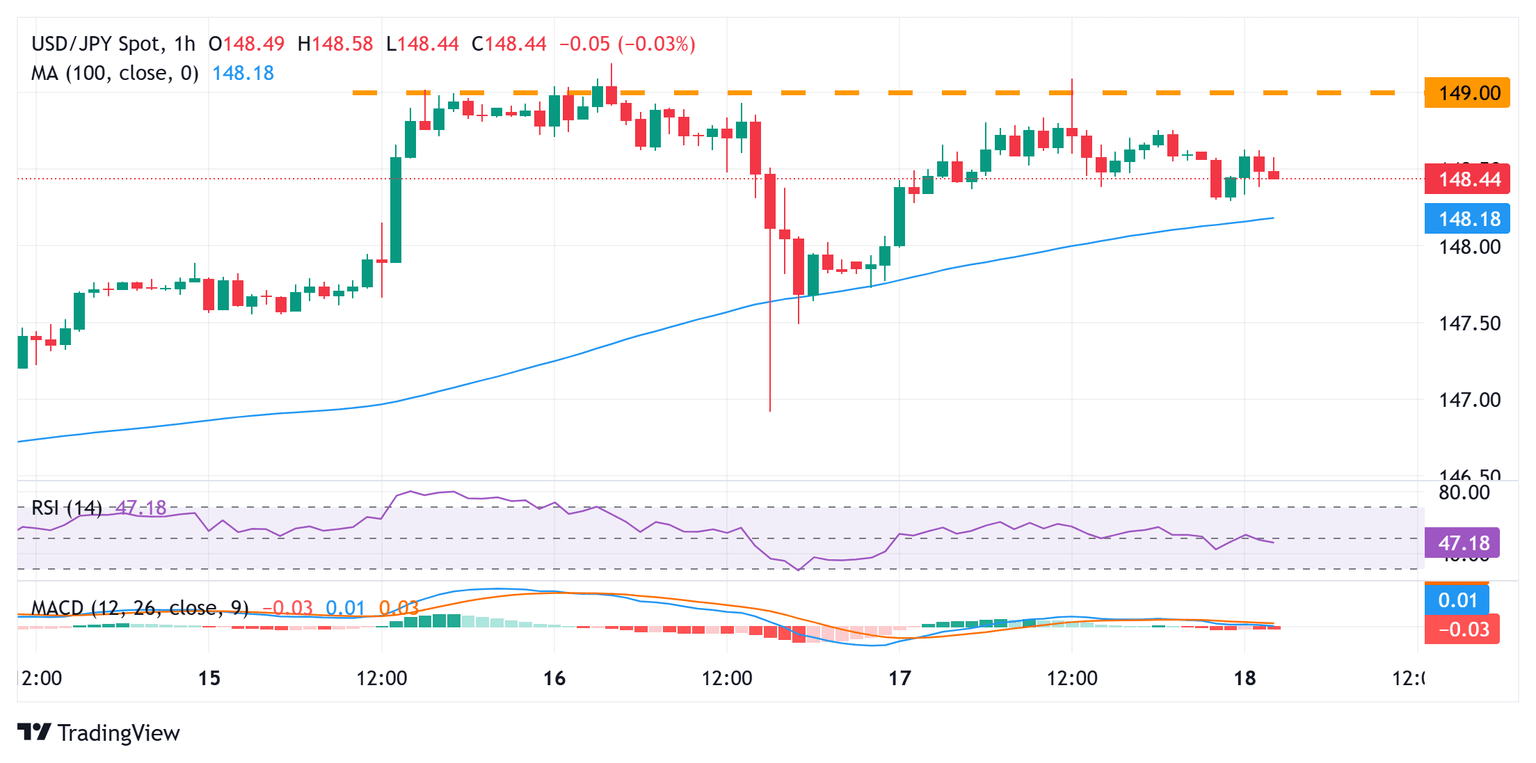

USD/JPY bulls might await sustained move beyond 149.00 before placing fresh bets

From a technical perspective, the USD/JPY pair showed some resilience below the 100-hour Simple Moving Average (SMA) earlier this week, and the subsequent move up favors bullish traders. Moreover, oscillators are holding comfortably in positive territory and are still away from being in the overbought zone. However, the overnight failure to build on the momentum beyond the 149.00 mark warrants some caution. Hence, it will be prudent to wait for some follow-through buying beyond the 149.15-149.20 region, or a multi-month peak, before positioning for a move towards reclaiming the 150.00 psychological mark.

On the flip side, the 148.20-148.25 region, or the 100-hour SMA, could offer immediate support ahead of the 148.00 mark. Some follow-through selling, leading to a slide below the 147.70 area, could make the USD/JPY pair vulnerable to accelerate the fall towards testing sub-147.00 levels. Acceptance below the latter might shift the bias in favor of bearish trades and drag spot prices to the 146.60 intermediate support en route to the 146.20 area, the 146.00 mark, and the 100-day SMA, currently pegged near the 145.80 region.

Japanese Yen PRICE This month

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies this month. Japanese Yen was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 1.44% | 2.24% | 3.23% | 0.95% | 1.05% | 2.26% | 1.32% | |

| EUR | -1.44% | 0.80% | 1.68% | -0.48% | -0.30% | 0.80% | -0.10% | |

| GBP | -2.24% | -0.80% | 0.98% | -1.24% | -1.08% | 0.00% | -0.88% | |

| JPY | -3.23% | -1.68% | -0.98% | -2.16% | -2.13% | -0.96% | -1.85% | |

| CAD | -0.95% | 0.48% | 1.24% | 2.16% | 0.08% | 1.26% | 0.35% | |

| AUD | -1.05% | 0.30% | 1.08% | 2.13% | -0.08% | 1.11% | 0.23% | |

| NZD | -2.26% | -0.80% | -0.01% | 0.96% | -1.26% | -1.11% | -0.90% | |

| CHF | -1.32% | 0.10% | 0.88% | 1.85% | -0.35% | -0.23% | 0.90% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.