Japanese Yen keeps the red against a broadly recovering USD; downside seems limited

- The Japanese Yen attracts some sellers as Trump raised doubts over a US-Japan deal.

- A positive risk tone also undermines the safe-haven JPY and lends support to USD/JPY.

- The divergent BoJ-Fed expectations favor the JPY bulls and might cap the currency pair.

The Japanese Yen (JPY) sticks to its intraday negative bias heading into the European session on Wednesday in the wake of US President Donald Trump's threat to impose higher tariffs on Japanese imports. Apart from this, a positive risk tone undermines the JPY's safe-haven status, which, along with the emergence of some US Dollar (USD) buying, assists the USD/JPY pair to build on overnight bounce from a nearly one-month low.

Meanwhile, the Bank of Japan's (BoJ) cautious approach to unwinding its ultra-loose policy forced investors to push back their expectations for early interest rate hikes. Investors, however, seem convinced that the BoJ will stay on the path of monetary policy normalization as inflation has exceeded its target for nearly three years. This might hold back the JPY bears from placing aggressive bets and cap the upside for the USD/JPY pair.

Japanese Yen remains on the back foot, though it lacks bearish conviction

- US President Donald Trump had expressed frustration over stalled US-Japan trade negotiations and cast doubt about reaching an agreement with Japan. Moreover, Trump suggested that he could impose a tariff of 30% or 35% on imports from Japan, above the tariff rate of 24% announced on April 2.

- Bank of Japan Governor Kazuo Ueda said on Tuesday that although headline inflation has been above 2% for nearly three years, underlying inflation remains below target. Ueda added that any future rate hikes will depend on the overall inflation dynamic, including wage growth and expectations.

- Moreover, BoJ's new board member Kazuyuki Masu said on Tuesday that the central bank should not rush into raising interest rates given various economic risks. However, concerns about mounting inflationary pressure in Japan keep the door open for a BoJ rate hike in 2025, especially if trade risks stabilize.

- In contrast, Federal Reserve (Fed) Chair Jerome Powell noted that the US central bank would have eased monetary policy by now if not for Trump’s tariff plan. When asked if July would be too soon for markets to expect a rate cut, Powell answered that he can’t say and that it’s going to depend on the data.

- Nevertheless, traders still see a small chance that the next rate reduction by the Fed will come in July and are pricing in over a 75% probability of a rate cut at the September policy meeting. This, in turn, dragged the US Dollar to its lowest level since February 2022 and should cap the USD/JPY pair.

- Meanwhile, the US ISM Manufacturing PMI showed on Tuesday that economic activity in the manufacturing sector contracted for the fourth consecutive month, albeit the rate of contraction slowed in June. In fact, the gauge edged up to 49 from 48.5 in May, above market expectations of 48.8.

- Separately, the US Bureau of Labor Statistics (BLS) reported in the Job Openings and Labor Turnover Survey (JOLTS) that the number of job openings on the last business day of May stood at 7.769 million. This followed 7.395 million openings in April and was above estimates for 7.3 million.

- Traders now look forward to the release of the US ADP report on private-sector employment for some impetus later this Wednesday. The focus, however, remains on the closely-watched US monthly employment details – popularly known as the Nonfarm Payrolls (NFP) report on Thursday.

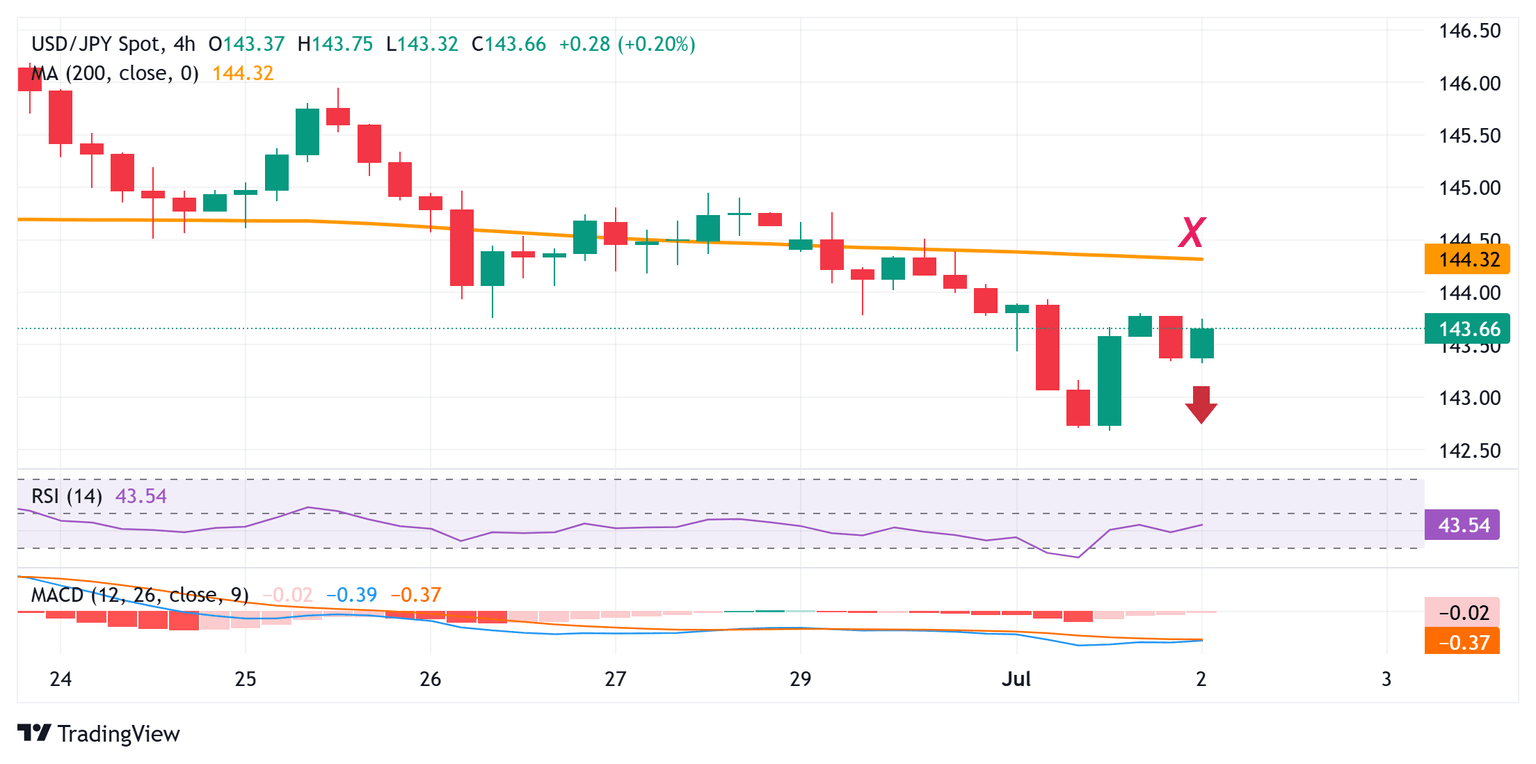

USD/JPY bearish setup backs sellers while below the 144.00 round figure

From a technical perspective, negative oscillators on 4-hour/daily charts suggest that any subsequent move up towards the 144.00 mark could be seen as a selling opportunity. This, in turn, should cap the USD/JPY pair near the 200-period Simple Moving Average (SMA) on the 4-hour chart, currently pegged near the 144.35 region. Some follow-through buying, leading to a subsequent strength beyond the 144.65 horizontal hurdle, should allow spot prices to reclaim the 145.00 psychological mark.

On the flip side, the 143.40-143.35 area could offer some support ahead of the 143.00 round figure and the overnight swing low, around the 142.70-142.65 region. Failure to defend the said support levels will reaffirm the near-term negative bias and make the USD/JPY pair vulnerable to accelerate the fall toward the May monthly swing low, around the 142.15-142.10 region. The downward trajectory could extend further towards testing sub-141.00 levels in the near term.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.15% | 0.08% | 0.22% | 0.04% | 0.03% | 0.00% | 0.11% | |

| EUR | -0.15% | -0.11% | 0.05% | -0.12% | -0.09% | -0.03% | -0.03% | |

| GBP | -0.08% | 0.11% | 0.18% | -0.02% | -0.04% | 0.05% | 0.04% | |

| JPY | -0.22% | -0.05% | -0.18% | -0.18% | -0.20% | -0.17% | -0.12% | |

| CAD | -0.04% | 0.12% | 0.02% | 0.18% | 0.00% | 0.06% | 0.07% | |

| AUD | -0.03% | 0.09% | 0.04% | 0.20% | -0.01% | 0.12% | 0.09% | |

| NZD | -0.00% | 0.03% | -0.05% | 0.17% | -0.06% | -0.12% | -0.01% | |

| CHF | -0.11% | 0.03% | -0.04% | 0.12% | -0.07% | -0.09% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.