Japanese Yen remains confined in a range against USD; looks to US PPI for fresh impetus

- The Japanese Yen struggles for a firm intraday direction amid mixed fundamental cues.

- BoJ rate hike bets support the JPY, though political crisis and positive risk tone cap gains.

- A further USD recovery acts as a tailwind for the USD/JPY pair ahead of US inflation data.

The Japanese Yen (JPY) extends its sideways consolidative price move against a broadly weaker US Dollar (USD) heading into the European session on Wednesday, though the near-term bias seems tilted in favor of bulls. Traders, however, seem reluctant to place aggressive bets and opt to wait for the release of the US Producer Price Index (PPI) due later today. In the meantime, a generally positive tone around the equity markets is seen acting as a headwind for JPY amid expectations that domestic political uncertainty could give the Bank of Japan (BoJ) more reasons to go slow on interest rate hikes.

Nevertheless, investors seem convinced that the BoJ will stick to its policy normalization path amid sticky inflation and the upbeat economic outlook. In contrast, the US Federal Reserve (Fed) is expected to lower borrowing costs next week and deliver three rate cuts by the end of this year. This, in turn, fails to assist the USD to capitalize on the overnight recovery from its lowest level since July 28 and keeps a lid on the USD/JPY pair's goodish rebound from the vicinity of the August monthly swing low. Hence, any move up could be seen as a selling opportunity and is likely to remain capped.

Japanese Yen bulls remain on the sidelines despite supportive fundamental backdrop

- Japan's Prime Minister Shigeru Ishiba announced his decision to resign on Sunday in the wake of the Liberal Democratic Party’s defeat in the July upper house election. This adds a layer of uncertainty and could temporarily hinder the Bank of Japan from normalising policy.

- Wall Street’s three major indices posted record closing highs on Tuesday, and the spillover effect led to a further rise in the Asian equity markets. This, in turn, undermines the safe-haven Japanese Yen, which, along with the ongoing US Dollar recovery, supports the USD/JPY pair.

- The Reuters Tankan poll showed this Wednesday that Japanese manufacturers' sentiment was its best in more than three years in September. This follows an upward revision of Japan's GDP print earlier this week, which showed that the economy grew at an annualised 2.2% rate in Q2 2025.

- Moreover, other upbeat data released recently pointed to a rise in household spending and positive real wages for the first time in seven months. This keeps the door open for an imminent BoJ rate hike by the year-end, which could hold back the JPY bears from placing aggressive bets.

- This marks a significant divergence in comparison to rising bets for a more aggressive policy easing by the US Federal Reserve. A 25-basis-points rate cut at the upcoming FOMC policy meeting next week is all but certain and traders are pricing in a small possibility of a jumbo rate cut.

- The speculations were fueled by Friday's disappointing release of the US Nonfarm Payrolls (NFP) report, which pointed to signs of a softening labor market. This, in turn, might hold back the USD bulls from placing aggressive bets and act as a headwind for the USD/JPY pair.

- Market participants now look to the release of the US Producer Price Index (PPI), due later during the North American session. The focus will then shift to the US Consumer Price Index (CPI) on Thursday, which will play a key role in influencing the near-term USD price dynamics.

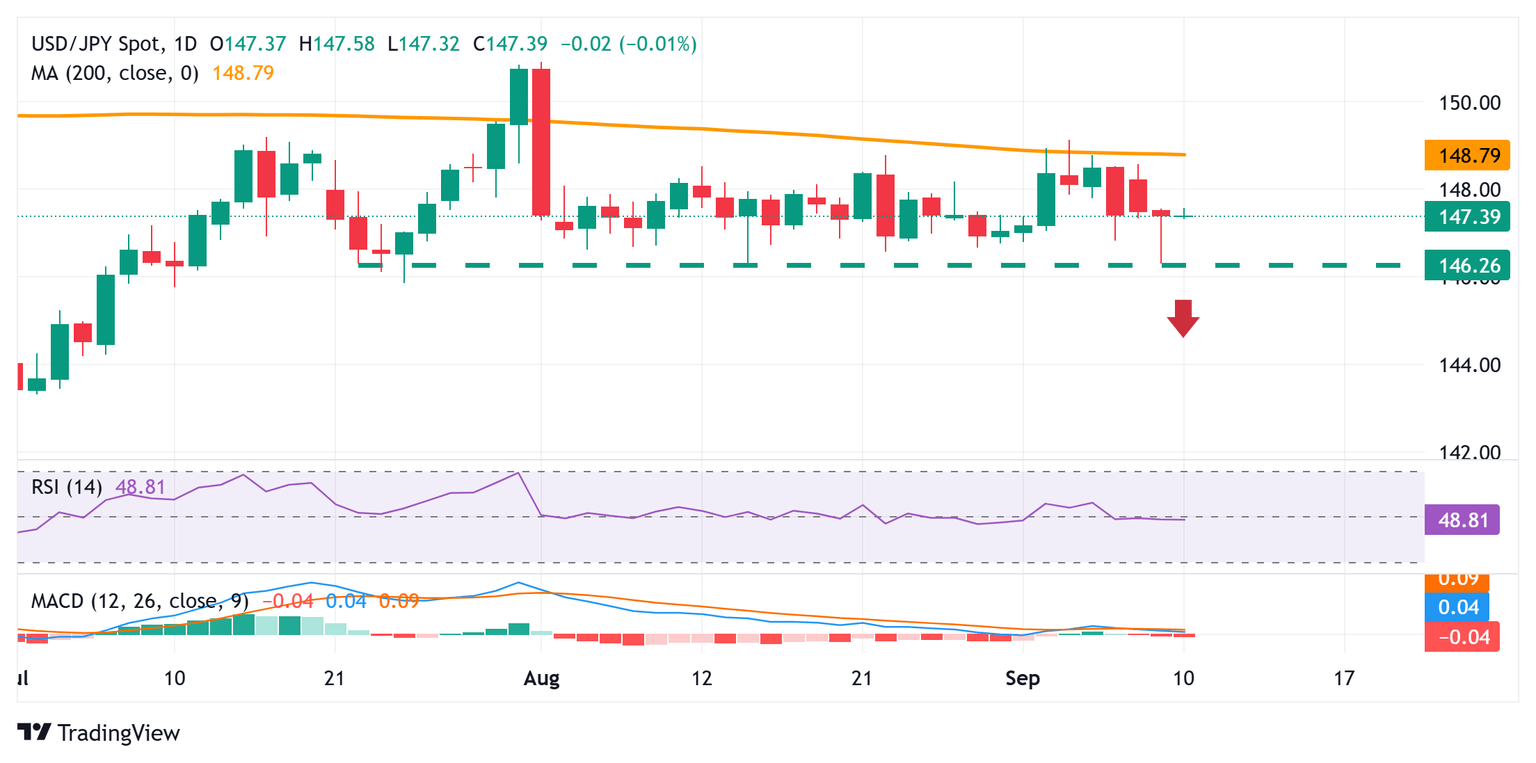

USD/JPY seems vulnerable to retest overnight swing low, break below 147.00 awaited

The overnight bounce from the 146.30 area, or the vicinity of the August monthly swing low, warrants some caution for the USD/JPY bears. That said, the lack of follow-through buying and negative oscillators on the daily chart suggest that the path of least resistance for spot prices remains to the downside. Hence, any further move up is more likely to attract fresh sellers near the 147.75-147.80 region, which, in turn, should cap the pair near the 148.00 round figure. A sustained strength beyond the latter might trigger a short-covering rally and pave the way for a move towards challenging the very important 200-day Simple Moving Average (SMA), currently pegged near the 148.75 zone.

On the flip side, the 147.00 round figure now seems to protect the immediate downside, below which the USD/JPY pair could slide back to the 146.30-146.20 strong horizontal support. Some follow-through selling, leading to a subsequent breakdown through the 146.00 mark, will be seen as a fresh trigger for bearish traders and drag spot prices to the 145.35 intermediate support en route to the 145.00 psychological mark.

Economic Indicator

Producer Price Index (YoY)

The Producer Price Index released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Changes in the PPI are widely followed as an indicator of commodity inflation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Next release: Wed Sep 10, 2025 12:30

Frequency: Monthly

Consensus: 3.3%

Previous: 3.3%

Source: US Bureau of Labor Statistics

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.