Japanese Yen flat lines against USD amid uncertainty over timing of next BoJ rate hike

- The Japanese Yen lacks a firm intraday direction amid mixed fundamental cues.

- Weak real wages data from Japan tempers BoJ rate hike bets and caps the upside.

- Rising September Fed rate cut bets undermine the USD and the USD/JPY pair.

The Japanese Yen (JPY) seesaws between tepid gains/minor losses against its American counterpart through the early European session on Wednesday amid the uncertainty over the likely timing of the next interest rate hike by the Bank of Japan (BoJ). Data released earlier today showed that inflation-adjusted real wages in Japan fell for the sixth straight month in June and fueled concerns about a consumption-led recovery. This comes on top of domestic political uncertainty and could complicate the BoJ's policy normalization path.

Apart from this, a positive tone around the equity markets contributes to capping the safe-haven JPY. However, the BoJ last week left the door open for a further interest rate hike by the end of this year, which, in turn, is holding back the JPY bears from placing aggressive bets. The US Dollar (USD), on the other hand, struggles to attract buyers amid bets that the Federal Reserve (Fed) will resume its rate-cutting cycle in September. This further contributes to capping the USD/JPY pair's recovery move from a nearly two-week low touched on Tuesday.

Japanese Yen traders remain on the sidelines amid BoJ rate hike uncertainty

- Government data released earlier this Wednesday showed that nominal wages in Japan rose 2.5% YoY in June, the fastest pace in four months, though it was below market expectations. Adding to this, inflation-adjusted real wages declined 1.3% from a year earlier, following a revised 2.6% drop in May.

- Meanwhile, the consumer inflation rate the ministry uses to calculate real wages – which includes fresh food prices but not rent costs – rose 3.8% YoY in June, the lowest in seven months. Wage trend and inflation are among the key factors the Bank of Japan monitors to determine the timing of the next rate hike.

- The data, however, highlights broader pressures on consumption. Furthermore, the ruling Liberal Democratic Party’s loss in the July 20 polls raised concerns about Japan's fiscal health amid opposition calls to boost spending and cut taxes. This suggests that prospects for BoJ rate hikes could be delayed further.

- Moreover, BoJ Governor Kazuo Ueda last week signaled continued policy patience. That said, the BoJ has repeatedly said that it will hike interest rates further if growth and inflation continue to advance in line with its estimates. The mixed cues, in turn, do little to provide any impetus to the Japanese Yen.

- The US Dollar attracts some buyers following the previous day's two-way price moves and acts as a tailwind for the USD/JPY pair during the Asian session on Wednesday. The USD bulls, however, lack conviction amid the growing acceptance that the Federal Reserve will cut interest rates in September.

- The bets were reaffirmed by the disappointing US release of the US ISM PMI, which unexpectedly fell to 50.1 in July from 50.8 in the previous month. This comes on top of weaker-than-expected US Nonfarm Payrolls last Friday and fueled worries about the economic health, which could cap the USD.

- Separately, the US Census Bureau and Bureau of Economic Analysis reported that the trade deficit narrowed more than expected, to $60.2 billion in June from $71.7 billion in the previous month. This reflects a dip in imports at the end of the second quarter following a tariff-fueled spike earlier in the year.

- In the absence of any relevant market-moving US macro data, speeches from FOMC members could influence the USD later during the North American session on Wednesday. Apart from this, the broader risk sentiment will drive the safe-haven JPY and provide some impetus to the USD/JPY pair.

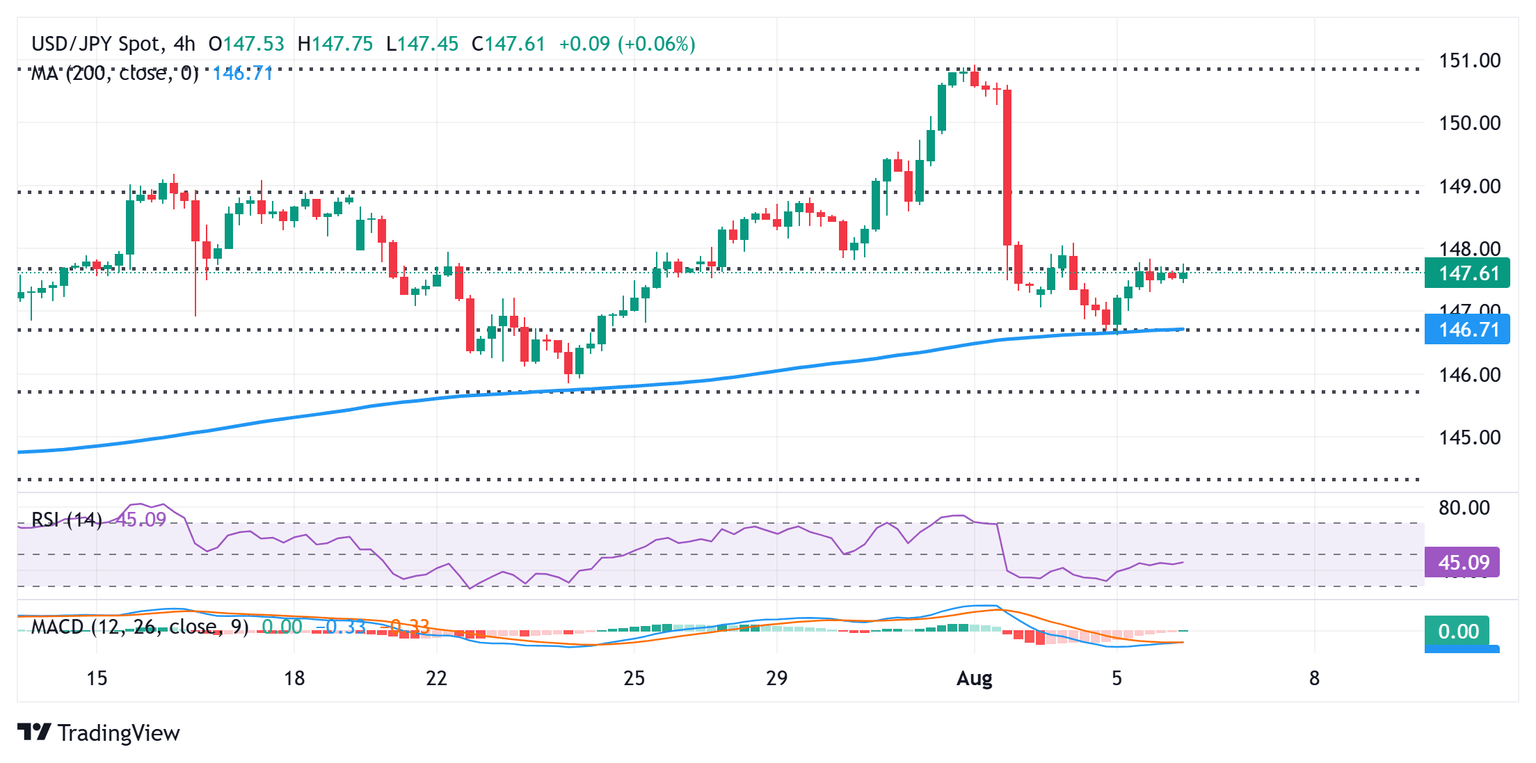

USD/JPY needs to surpass the 38.2% Fibo. hurdle for bulls to seize intraday control

The overnight resilience below the 50% retracement level of the rally from the July swing low and the subsequent recovery favors the USD/JPY bulls. Moreover, oscillators on the daily chart have again started gaining positive traction and back the case for additional gains. That said, any further move up beyond the 147.75 area, or the 38.2% Fibonacci retracement level, might confront some hurdle near the 148.00 round figure. A sustained move beyond the latter will suggest that spot prices have formed a near-term bottom and pave the way for further strength towards the 148.45-148.50 intermediate hurdle en route to the 149.00 neighborhood, or the 23.6% Fibo. retracement level.

On the flip side, the Asian session low, around the 147.45 region, now seems to act as an immediate support for the USD/JPY pair. Any further downfall could be seen as a buying opportunity near the 147.00 round figure. However, some follow-through selling below the 50% retracement level, around the 146.85 area, which coincides with the 200-period Simple Moving Average (SMA) on the 4-hour chart, could make spot prices vulnerable to accelerate the fall towards the 146.00 round figure. The downward trajectory could extend further and eventually drag spot prices to the 61.8% Fibo. retracement level, around the 145.85 area, en route to the 145.00 psychological mark.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.