Japanese Yen remains depressed; USD/JPY upside seems limited amid rising BoJ rate hike bets

- The Japanese Yen turns lower against the USD, though the downside seems limited.

- Bets that the BoJ will hike rates again and safe-haven buying could underpin the JPY.

- Dovish Fed expectations might cap any meaningful upside for the USD and USD/JPY.

The Japanese Yen (JPY) maintains its offered tone through the early European session on Thursday, allowing the USD/JPY pair to stick to gains above the 143.00 mark amid a modest US Dollar (USD) uptick. Investors seem convinced that the Bank of Japan (BoJ) will continue raising interest rates amid the broadening inflation in Japan, which led to a fall in Japan's real wages for the fourth consecutive month in April. This, along with persistent trade-related uncertainties and rising geopolitical risk could limit deeper losses for the safe-haven JPY.

Meanwhile, hawkish BoJ expectations mark a big divergence in comparison to bets that the Federal Reserve (Fed) will lower borrowing costs further in 2025, bolstered by Wednesday's weaker US data. This should keep a lid on any meaningful USD appreciation and further lend support to the lower-yielding JPY, warranting caution for the USD/JPY bulls. Traders might also opt to wait for potential talks between US President Donald Trump and his Chinese counterpart Xi Jinping, and the US Nonfarm Payrolls (NFP) report on Friday.

Japanese Yen remains on the defensive despite a combination of supporting factors

- Government data released earlier this Thursday showed that nominal wages increased 2.3% from a year earlier in April, or the fastest pace in four months and up for the 40th consecutive month. However, real wages slumped 1.8% as rising prices continued to outpace pay hikes.

- The consumer inflation rate that is used to calculate real wages eased slightly to the 4.1% YoY rate during the reported month compared to 4.2% in March, though it stayed above 4% for the fifth month in a row. This backs the case for further rate hikes by the Bank of Japan (BoJ).

- In contrast, traders lifted bets that the Federal Reserve could cut interest rates as soon as September in reaction to Wednesday's weaker-than-expected US macro data. In fact, Automatic Data Processing (ADP) reported that private sector employment in the US rose 37K in May.

- This was the lowest monthly job count since March 2023 and was accompanied by a downward revision of April's reading to 60K. Adding to this, the survey from the Institute for Supply Management (ISM) showed the US services sector contracted for the first time since June 2024.

- US President Donald Trump continues to press Fed Chair Jerome Powell to lower interest rates. Moreover, the yields on the rate-sensitive two-year and the benchmark 10-year US government bonds fell to the lowest level since May 9, which weighed heavily on the US Dollar.

- The lack of follow-through USD selling, however, assists the USD/JPY pair in attracting some buyers during the Asian session on Thursday. Nevertheless, the divergent BoJ-Fed policy expectations might hold back traders from placing aggressive bullish bets around the currency pair.

- Traders keenly await the high-stakes call between Trump and Chinese President Xi Jinping amid renewed trade tensions. It, however, remains unclear if such a call had been arranged. In the meantime, Trump said that it was extremely hard to make a deal with the Chinese leader.

- This keeps the risk premium associated with a trade war between the world's two largest economies in play. This, along with rising geopolitical tensions, should contribute to limiting losses for the safe-haven JPY and keep a lid on any meaningful upside for the USD/JPY pair.

- Traders now look forward to the release of the usual Weekly Initial Jobless Claims data from the US. Apart from this, speeches from influential FOMC members could provide some impetus in the run-up to the highly-anticipated US Nonfarm Payrolls (NFP) report on Friday.

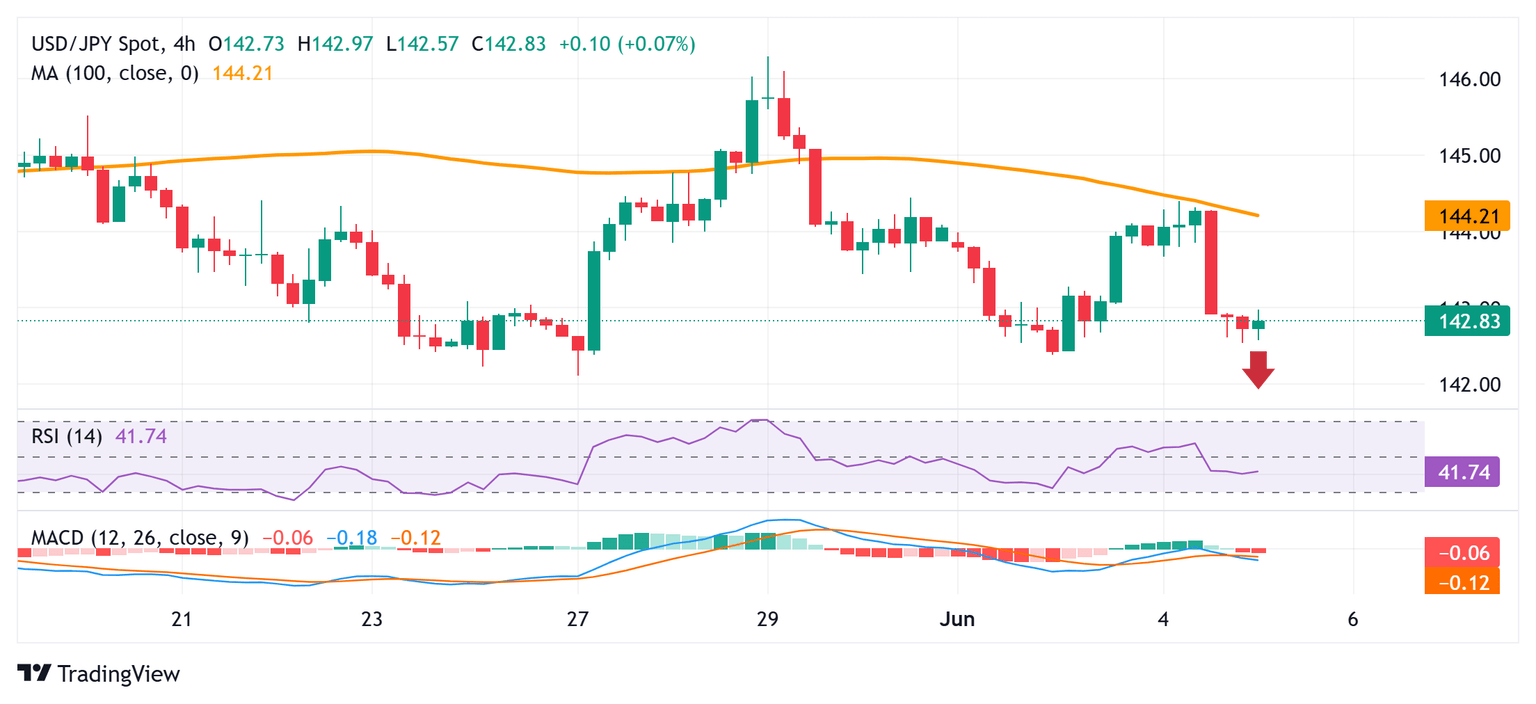

USD/JPY might struggle to build on positive move beyond the 143.70 immediate hurdle

From a technical perspective, the overnight failure near the 100-period Simple Moving Average (SMA) on the 4-hour chart and the subsequent fall favors the USD/JPY bears. Moreover, technical indicators on hourly/daily charts are holding in negative territory, suggesting that the path of least resistance for spot prices is to the downside. Hence, any further move up could be seen as a selling opportunity near the 143.70 region and is likely to remain capped near the 144.00 mark. This is followed by the 144.25-144.30 region (100-period SMA on H4). Some follow-through buying beyond the overnight swing high could trigger an intraday short-covering move and allow bulls to reclaim the 145.00 psychological mark.

On the flip side, the weekly trough, around the 142.40-142.35 area, could offer some support to the USD/JPY pair ahead of the 142.10 region, or last week's swing low. A convincing break below the latter could make spot prices vulnerable to resume the recent downward trajectory from the May swing high and slide further to the next relevant support near the 141.60 area en route to sub-141.00 levels.

(This title of the story was corrected on June 5 at 07:27 GMT to say that the upside for "USD/JPY" seems limited amid rising BoJ rate hike bets.)

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.