Japanese Yen buying interest remains unabated, hits fresh two-week high against a broadly weaker USD

- The Japanese Yen prolongs its uptrend against the USD amid the divergent BoJ-Fed expectations.

- Hopes for an eventual US-Japan trade deal further benefit the JPY and contribute to the move up.

- The fundamental backdrop favors the JPY bulls and backs prospects for a further USD/JPY slide.

The Japanese Yen (JPY) sticks to strong intraday gains, which, along with a broadly weaker US Dollar (USD), drags the USD/JPY pair closer to mid-143.00s, or a fresh two-week low during the early European session on Wednesday. The Bank of Japan (BoJ) Deputy Governor Shinichi Uchida's hawkish comments earlier this week left the door open for further policy tightening by the central bank amid fears of broader and more entrenched price increases in Japan. Apart from this, renewed US-China trade tensions revive safe-haven demand and provide an additional boost to the JPY.

Meanwhile, the optimism over a potential US-Japan trade deal ahead of a third round of negotiations later this week turns out to be another factor driving flows towards the JPY. The USD, on the other hand, continues to lose ground on the back of US fiscal concerns, which led to a surprise downgrade of the US government's credit rating last Friday. Furthermore, bets that the Federal Reserve (Fed) will lower borrowing costs further mark a big divergence in comparison to hawkish BoJ expectations and suggest that the path of least resistance for the lower-yielding JPY remains to the upside.

Japanese Yen bulls retain control amid BoJ rate hike bets and reviving safe-haven demand

- Government data released earlier this Wednesday showed that Japan’s trade balance unexpectedly shrank to a deficit of ¥115.8 billion in April compared to a surplus of ¥559.4 billion in the prior month. Japanese imports shrank at a slower-than-expected pace as a bumper springtime hike in wages boosted private consumption, while export growth slowed sharply on the back of softer US demand following US President Donald Trump's higher import tariffs.

- Japanese and US government officials are set to hold a third round of high-level trade talks in Washington this week. Japan's trade minister Ryosei Akazawa is expected to attend the ministerial-level talks with US Trade Representative Jamieson Greer. US Treasury Secretary Scott Bessent is also expected to take part in the negotiations. US officials are reportedly pressing Japan for an early conclusion to the talks, suggesting that a deal could be reached sooner.

- Bank of Japan Deputy Governor Shinichi Uchida told parliament earlier this week that Japan's underlying inflation is likely to re-accelerate after a period of slowdown and will stay around the 2% target. The BoJ will continue to raise interest rates if the economy and prices improve as projected, Uchida added further. Moreover, the BoJ's Summary of Opinions revealed last week that policymakers haven't given up on hiking interest rates further.

- In contrast, traders ramped up their bets for further rate cuts by the Federal Reserve (Fed) in 2025 following last week's softer-than-expected release of the US Consumer Price Index (CPI) and the Producer Price Index (PPI). Moreover, the disappointing US monthly Retail Sales data increased the likelihood of several quarters of sluggish growth and should allow the Fed to stick to its policy easing bias, which, in turn, drags the US Dollar to a nearly two-week low.

- Fed officials took the opportunity to express concern about the current state of the US economy during a panel discussion on Tuesday. San Francisco Fed President Mary Daly noted that the net impact of the Trump administration's trade, immigration, and other policies is unknown. Adding to this, the Cleveland Fed Bank President said that the sentiment about the economy is concerning, and it will take longer to observe how business decisions are impacted by trade policy.

- China on Monday accused the US of undermining the preliminary trade agreement after the latter issued an industry warning against using Chinese chips that singled out Huawei. Adding to this, China’s Commerce Ministry said this Wednesday that US measures on advanced chips are ‘typical of unilateral bullying and protectionism.’ Furthermore, US chip measures seriously undermine the stability of the global semiconductor industry chain and supply chain.

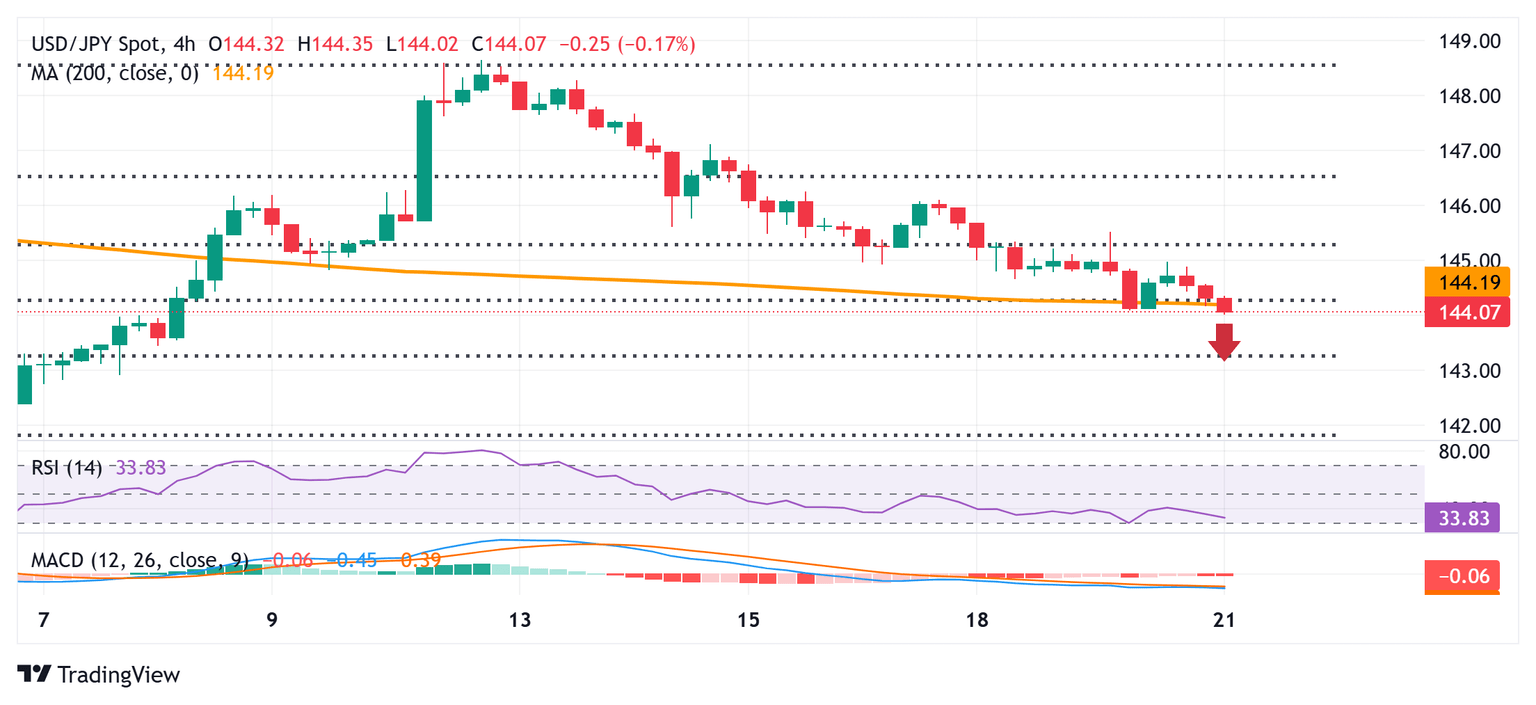

USD/JPY bears have the upper hand while below the 144.30-144.20 confluence breakpoint

From a technical perspective, the intraday slide drags the USD/JPY pair below the 144.30-144.20 confluence – comprising the 50% retracement level of the April-May rally and the 200-period Simple Moving Average (SMA) on the 4-hour chart. Moreover, oscillators on the daily chart have just started gaining negative traction and underpin a further near-term depreciating move. Acceptance below the 144.00 mark reaffirms the bearish outlook and a subsequent slide through the 143.65-143.60 horizontal support might expose the 143.25 region, or the 61.8% Fibonacci (Fibo.) retracement level.

On the flip side, the Asian session peak, around the 144.55 zone, now seems to act as an immediate hurdle, above which the USD/JPY pair could aim to reclaim the 145.00 psychological mark. Any subsequent move up, however, might still be seen as a selling opportunity and remain capped near the 145.35-145.40 region, or the 38.2% Fibo. retracement level. The latter should act as a pivotal point, and a sustained move beyond might shift the near-term bias in favor of bullish traders.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.