Japan moves forward with $1tn in new coronavirus relief

- Japan has begun finalizing a coronavirus relief package of more than $928 billion.

- The package is equivalent to 20% of national GDP.

- Nikkei will likely be buoyed by such a plan.

The Nikkei has reported that the Japanese government has "begun finalizing a coronavirus relief package of more than 100 trillion yen ($928 billion), aiming to strengthen the corporate safety net and follow up on last month's 117 trillion yen stimulus."

This stimulus package, equivalent to 20% of national GDP, is meant to help families and businesses suffering from the pandemic.

Japan appeared to have the novel coronavirus epidemic well-contained but by March 24, when the 2020 Olympics in Tokyo were called off, the virus was spreading fast, forcing the country to call a state of national emergency.

On Saturday, Tokyo reported two cases, the lowest single-day tally since Japan declared a state of emergency last month. However, Tokyo reported fourteen new coronavirus infections on Sunday, just a day after the capital reported single-digit daily figures for two days in a row, according to public broadcaster NHK. These numbers came a day ahead of a widely expected announcement by the government that it would lift restrictions on the capital and four other prefectures.

Market implications

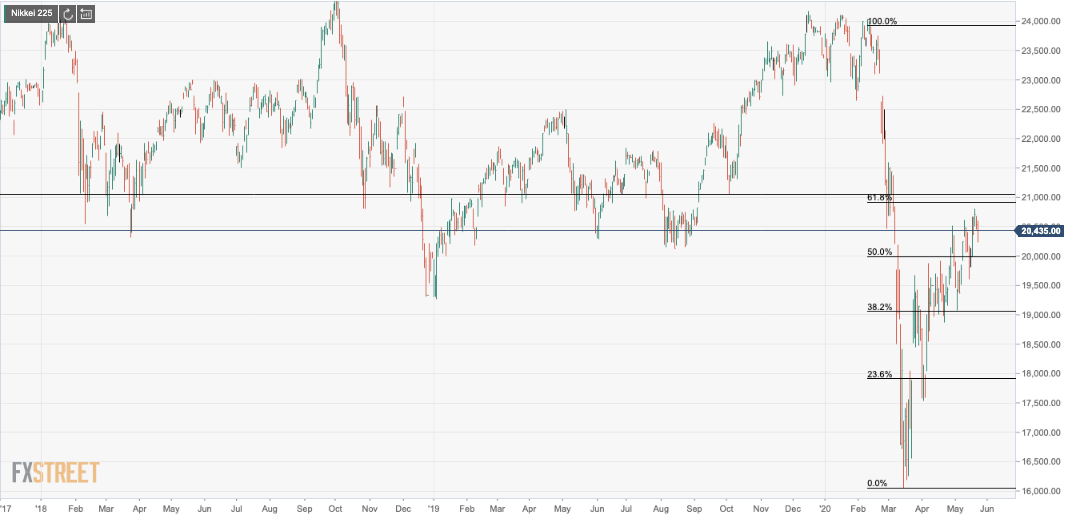

Governments and central banks around the world have released unprecedented monetary and fiscal support for economies knocked down by the pandemic. This, in turn, has enabled global equity markets to continue to recover, rebounding from the crash. Nikkei, Japan's benchmark stock index, will likely be buoyed by such a plan.

Nikkei daily chart shows that there has been a reversal of the crash which is yet to complete a full 61.8% Fibonacci retracement.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.