Is this a healthy pullback or the prelude to a market crash? This analogue reveals clues [Video]

![Is this a healthy pullback or the prelude to a market crash? This analogue reveals clues [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse2-637299021353183737_XtraLarge.jpg)

Watch the video extracted from the WLGC live session before market open on 24 Oct 2023 below to find out the following:

-

How to use an analogue comparison to judge the current market trend?

-

The existing red flag that traders and investors need to be very cautious

-

The bearish case that the bull must watch out for

-

The key level the S&P 500 needs to commit to kick-start a relief rally

-

And a lot more

The bullish vs. bearish setup is 39 to 567 from the screenshot of my stock screener below pointing to a negative market environment.

Despite the long-term market breadth signals a red flag while the short-term market breadth approaches the deeply oversold level, it is critical to monitor the S&P 500 as discussed in the video to get the confirmation.

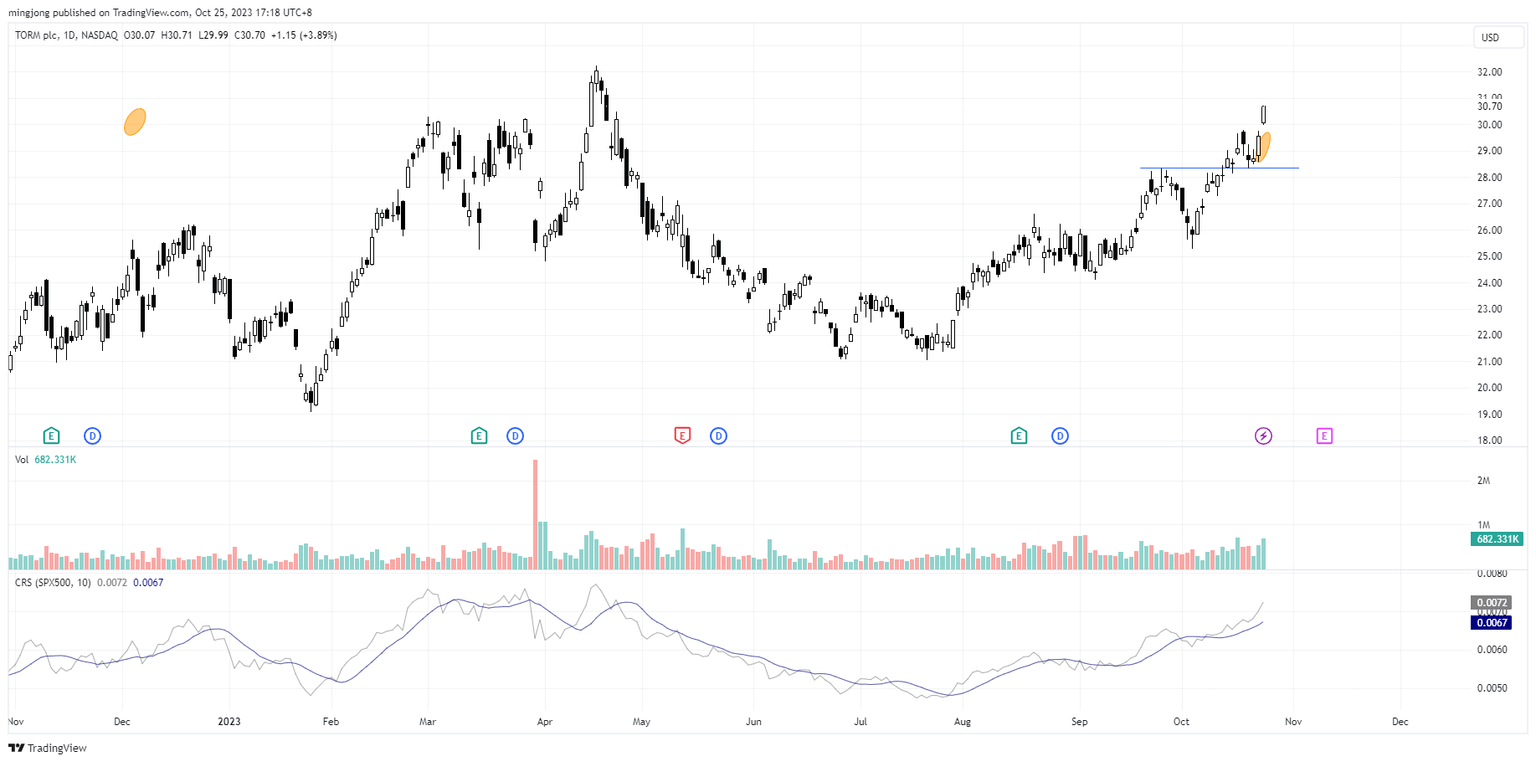

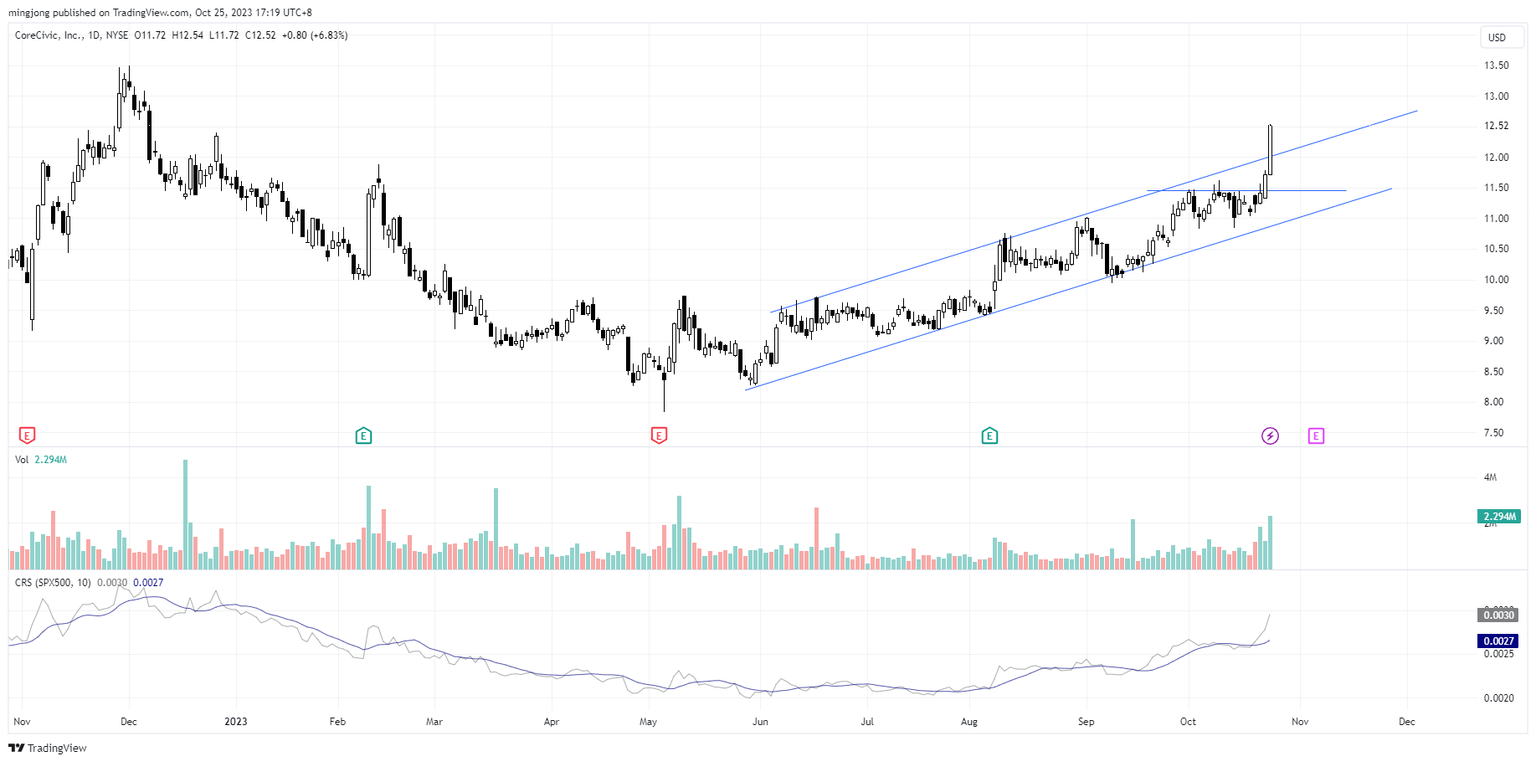

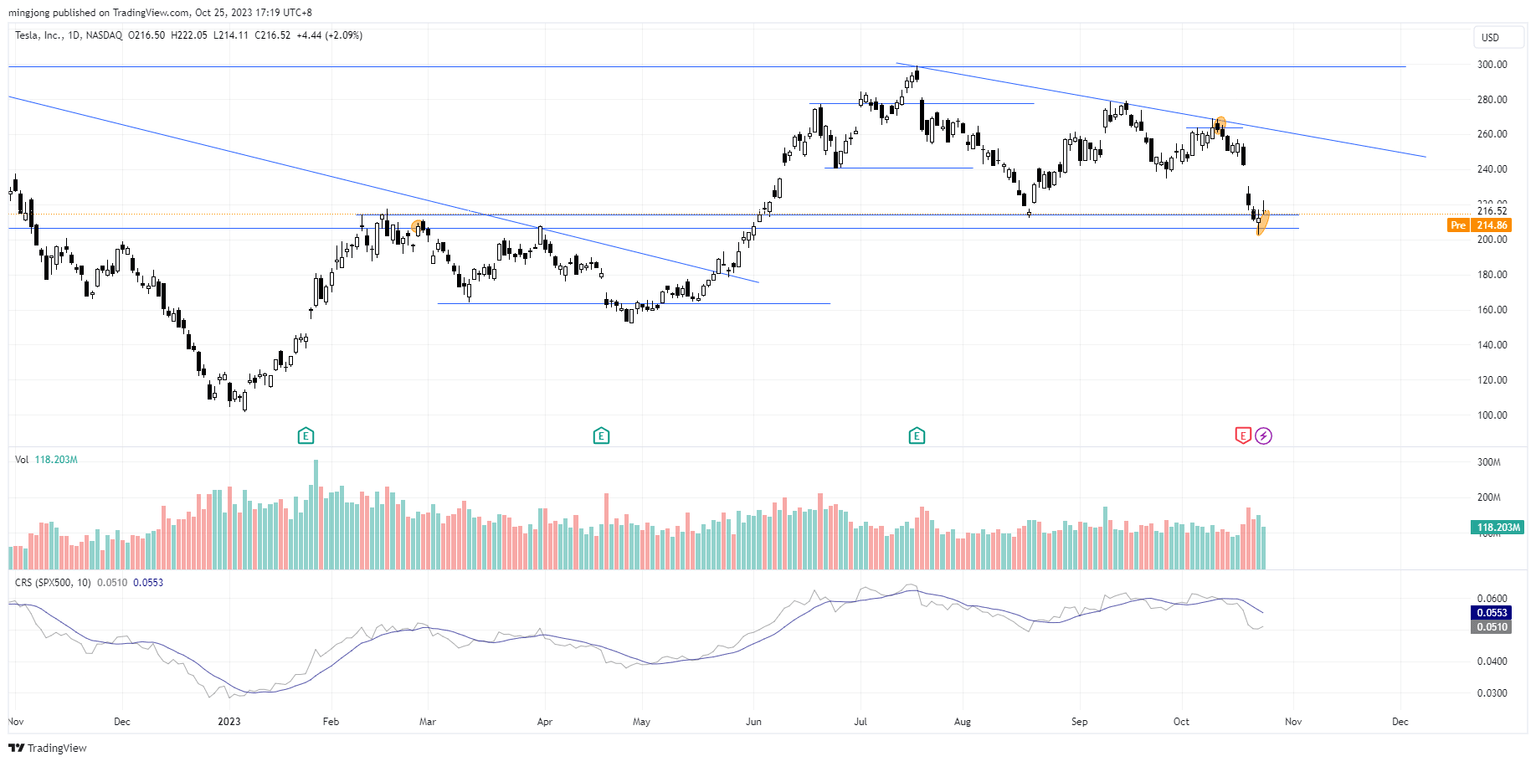

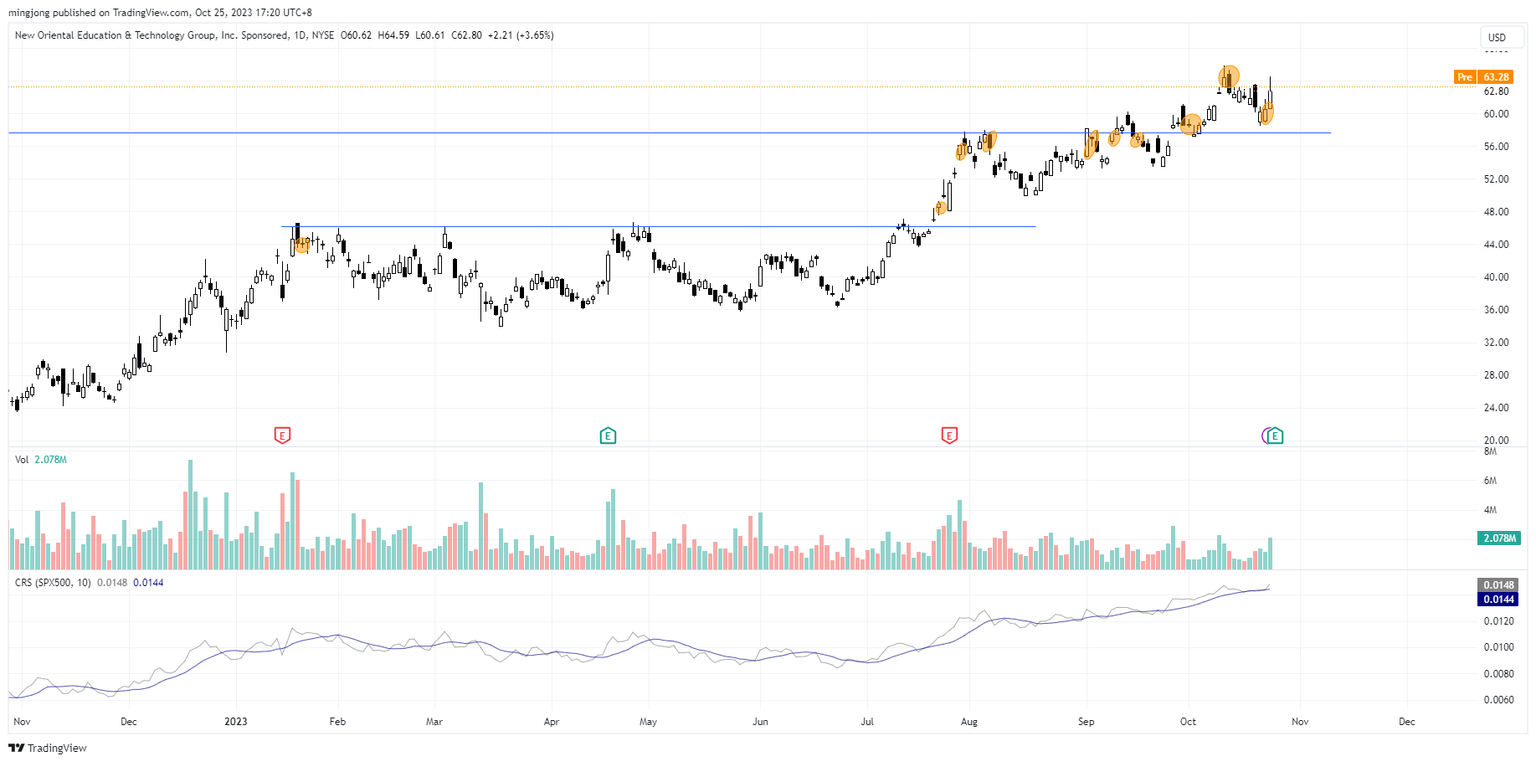

4 “low hanging fruits” (TRMD, CXW, etc…) trade entries setup + 7 others (TSLA, EDU, etc…) plus 25 “wait and hold” candidates are discussed in the video (32:43) accessed by subscribing members below.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.