Is the stock market on the brink of a meltdown? Here's what you need to know [Video]

![Is the stock market on the brink of a meltdown? Here's what you need to know [Video]](https://editorial.fxstreet.com/images/Markets/Equities/display-panel-of-daily-stock-market-59908972_XtraLarge.jpg)

Watch the video extracted from the live session on 27 Sep 2023 below to find out the following:

-

The deeply oversold level S&P 500 could hit before a technical rally.

-

How to spot outperforming stocks during the correction.

-

How a shakeout or capitulation scenario could occur.

-

The key level for a trend reversal.

-

And a lot more.

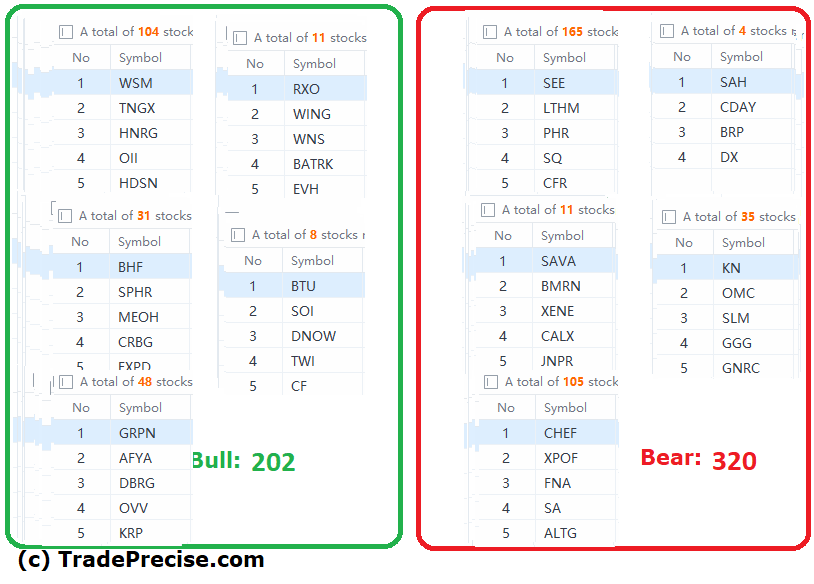

The bullish vs. bearish setup is 202 to 320 from the screenshot of my stock screener below pointing to a negative market environment.

The long-term market breadth also points to a negative environment while the short-term market breadth approaches a deeply oversold level, which could be a meaningful condition for a technical rally.

7 “low hanging fruits” (DELL, ET, etc…) trade entries setup + 13 others (TDW, FTI, etc…) plus 23 “wait and hold” candidates have been discussed during the live session.

If there are stocks bucking the trend (or even consolidating) while the index is going down, they show a lot of relative strength. Those are the stocks that will outperform when the index undergoes a relief rally rebound.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.