IONQ expects choppiness in double correction

IONQ Inc., (IONQ) engages in the development of general-purpose quantum computing systems in the US. It sells the access to quantum computers of various qubit capacities. The company makes access to its quantum computers through cloud platforms, such as Amazon web services, Amazon Braket, Microsoft’s Azure Quantum & Google’s cloud marketplace. It is based in US, comes under Technology sector & trades as “IONQ” ticker.

As mentioned in previous article, it reacted lower in corrective sequence in II, which ended ((W)) at $9.23 low. It favors bounce in ((X)) in 3 or 7 swings before turning lower in ((Y)) of II as double correction.

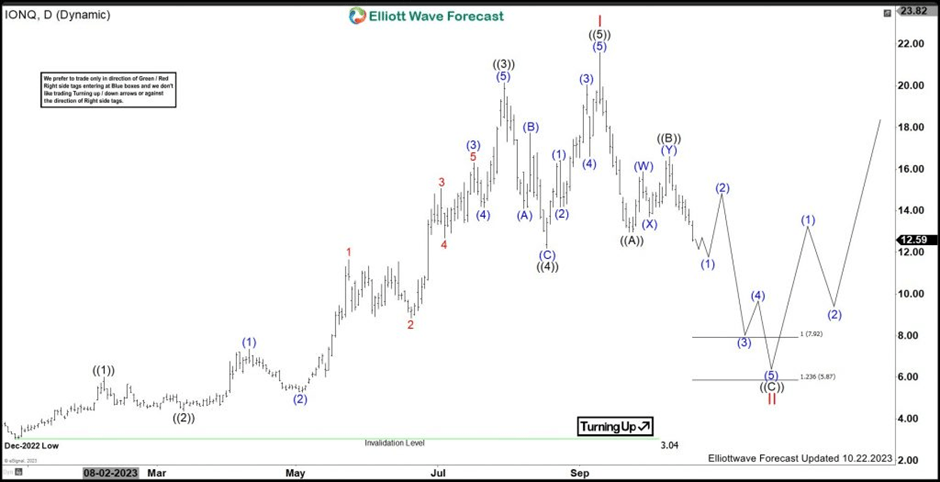

IONQ – Elliott Wave daily view from 10.22.2023

In daily, it finished ((1)) of I at $6.00 high & retraced in ((2)) at $4.38 low as 0.5 Fibonacci retracement. Above there, it extended higher as third wave extension as ((3)), which ended at $20.14 high. Within ((3)), it placed (1) at $7.35 high, (2) at $5.29 low, (3) at $16.30 high, (4) at 14.15 low & (5) at $20.14 high. It was corrected in ((4)) in zigzag sequence at $12.19 low. Finally, it ended ((5)) at $21.60 high as wave I impulse.

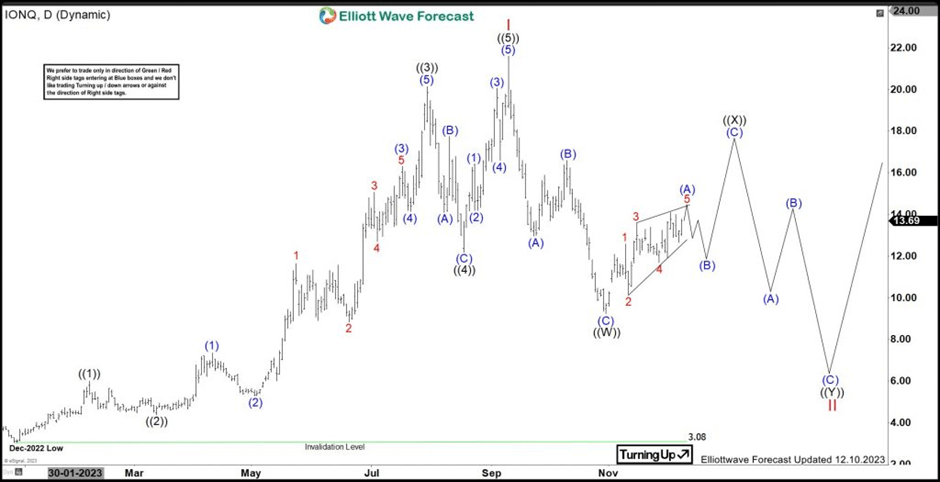

IONQ – Elliott Wave latest daily view

Below I high, it ended ((W)) at $9.23 low as the part of double correction in II & failed to reach the extreme areas. Within ((W)) sequence, it ended (A) at $12.96 low, (B) at $16.60 high & (C) at $9.23 low as ((W)). Currently, it favors higher in 5 of (A) of ((X)) connector. It placed 1 at $12.58 high, 2 at $10.15 low, 3 at $13.58 high & 4 of (A) at $11.69 low. It expects one more push higher to finish 5 of (A) before correcting in (B). (B) expects to remain above $9.23 low to bounce in (C) of ((X)). As long as the bounce fail below I high, it can do double correction before upside resumes in III. So, it expects ((X)) to fail in 3, 7 or 11 swings below I high to turn lower in ((Y)) of II.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com