Intel stock surges over 30% after Nvidia takes $5 billion stake

- Intel stock rises above $32 for the first time in 15 months.

- Nvidia has agreed to take a $5 billion stake in Intel.

- Intel will use Nvidia's NVLink protocol for its data center chips.

- Further partnership will allow both companies to offer high-end chips to PC market.

Intel (INTC) stock is trading at its highest level since July 2024 on Thursday after news broke that the Artificial Intelligence leader Nvidia (NVDA) has taken a shine to the legacy chipmaker.

Nvidia will take a $5 billion stake in Intel, as well as launching a partnership with Intel to co-develop PC and data center chips.

The wider equity is also seeing gains a day after the Federal Reserve (Fed) cut interest rates by 25 basis points and used its dot plot to signal two additional cuts before the year is out.

Intel stock news

The agreement serves as a sign that Intel is hitching its wagon to Nvidia's coattails, a proposition that argues Intel is far from dead after inking a much-mocked deal with the Trump administration to give the federal government a $10 billion stake in order to keep federal funds already allotted by the previous Biden administration.

Intel has agreed to use Nvidia's NVLink, a protocol that allows faster data transfers between CPUs and GPUs. This will mean that Intel's x86 architecture for data center CPUs will now adhere to Nvidia's technology stack.

Intel will then offer Nvidia-based customized x86 CPUs for data centers and produce x86 system-on-chips that integrate into Nvidia's RTX GPUs. These RTX system-on-chips will be aimed at the PC market, which Intel once had a stranglehold on before rival Advanced Micro Devices (AMD) began taking major market share over the past decade. Nvidia stock rose 2.5% at Thursday's open, while AMD stock sank more than 5% on the news.

If regulatory hurdles are met, Nvidia's $5 billion investment in Intel's common stock will come at a price of $23.28 per share. This means that Nvidia will own nearly 215 million shares of Intel or about 5% of the company.

Intel stock forecast

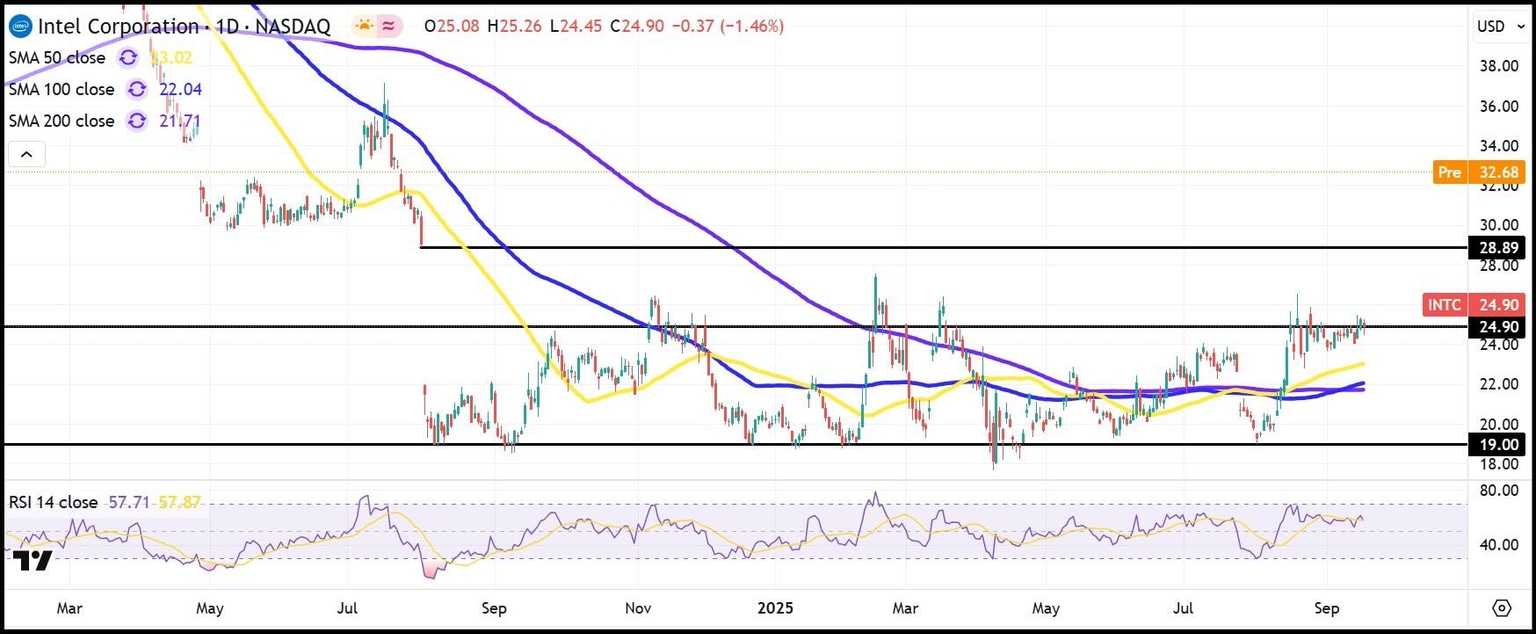

Intel stock closed at $24.90 on Wednesday but has traded as high as $33.43 in the premarket on Thursday. This rally closes the gap created following the August 1, 2024, low of $28.89. My, my, how markets love to fill gaps.

Some traders will surely be tempted to take profits after being stuck in the low $20s for so long. Intel stock has been using the $19.00 level as support over the past year, and certainly some investors are now sitting on 50% or more gains if they scooped up shares at those low levels.

The July 17, 2024, range high at $37.16 is the primary bull target, while the aforementioned $28.89 level is the most prominent nearby support.

INTC daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.